Apple Pay set to overtake Afterpay in usage in 2023

The latest Roy Morgan Digital Payments Report shows Apple Pay has rapidly increased its penetration of the Australian market over the last year and is set to overtake Afterpay in usage among Australians in the next few months.

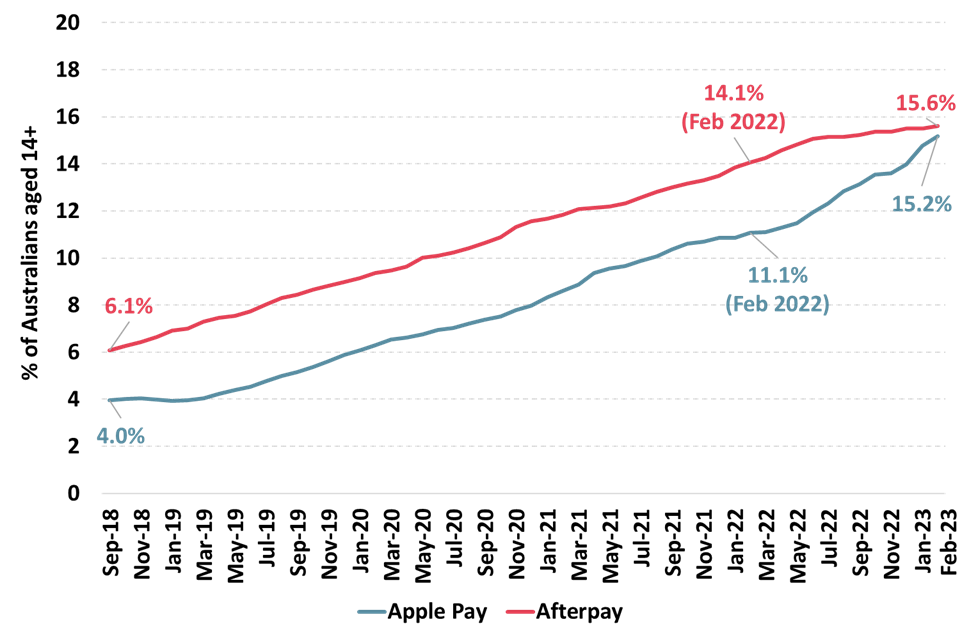

Afterpay is now used by over 3.3 million Australians (15.6% of the population) to be just ahead of Apple Pay used by over 3.2 million people (15.2%). However, current trends show that Apple Pay is poised to overtake Afterpay during the next few months.

Apple Pay has increased its usage in the Australian marketplace significantly from a year ago, up from 11.1% of Australians in February 2022 to 15.2% in February 2023 – an increase of 4.1% points in a year. In contrast, usage of Afterpay has increased from 14.1% of Australians a year ago up to 15.6% in February 2023 – an increase of 1.5% points in a year.

Afterpay launched in the Australian marketplace in late 2014, just over a year before Apple Pay entered the Australian market late in 2015.

The rapid growth in usage of both Apple Pay and Afterpay is in contrast to the position of digital payment service market leaders PayPal and BPAY which are used by far more Australians but haven’t experienced such rapid growth in recent years.

Usage in an average 12 months of digital payment services Apple Pay & Afterpay (2018-2023)

Source: Roy Morgan Single Source, October 2018 – February 2023, 12 month moving average; n = 54,428. Base: Australians 14+.

Roy Morgan CEO Michele Levine says the wide variety of digital payment services available today appeal to very different consumers and the rapid growth of new entrants Apple Pay and Afterpay is providing an increasing challenge to traditional services such as PayPal and BPAY:

“Roy Morgan’s latest Digital Payments Report reveals Apple Pay is set to overtake Afterpay in usage amongst Australians in the next few months.

“The growth in usage of Apple Pay has been rapid over the last year with over 3.2 million Australians (15.2% of the population) using the service in the year to February 2023, up significantly from a year ago.

“Apple Pay is closing in fast on ‘buy-now-pay-later’ leader Afterpay which was used by around 3.3 million Australians (15.6% of the population) in the year to February 2023. The two newer digital payment services are clearly the standouts from amongst the newer players in the market.

“Apple Pay launched in Australia in late 2015 just over a year after Afterpay and both have grown their market share rapidly over the last decade.

“The digital payment services market is a competitive one as we have seen recently with both Latitude Pay and openpay exiting the ‘buy-now-pay-later’ market in recent months as interest rates increased and competition in the market intensified. Latitude Pay was taken off-line just this week.

“Overall awareness of ‘buy-now-pay-later’ services such as Afterpay, Zip and Klarna is high with the sector the most well-known type of digital payment service – now 18 million Australians (84%) say they are aware of these services. However, only 4.3 million Australians (19.9%) have used a ‘buy-now-pay-later’ service in the year to February 2023.

“The usage of ‘buy-now-pay-later’ services still trails well behind more traditional digital payment services such as ‘online payment platforms’ PayPal, Visa Checkout and Masterpass. Nearly half of Australians, 10.2 million (47.5%), used an online payment platform in the year to February 2023 – despite lower overall awareness.

“A large factor in the huge difference in the usage of the three services can be put down to time in the market. Both PayPal and BPAY launched in the late 1990s, over 20 years ago, while Afterpay, Apple Pay and other newer rivals have only been in the market for under a decade.

“To learn more about Australia’s fast-changing and increasingly crowded digital payments eco-system Roy Morgan’s latest Digital Payments Report provides a wealth of detail on the awareness and usage trends for over 20 digital payment services including some well-known, some well used and some well-loved – we measure them all.

“The digital payment services Roy Morgan measures include PayPal, BPAY, Afterpay, Humm, Apple Pay, Zip, Google Pay, Post billpay, Visa Checkout, masterpass, Western Union, Kharna, fitbit pay, Garmin Pay, paywear, Samsung Pay, Commbank Tap & Pay, ANZ, NAB Pay, Bankwest Halo and Cryptocurrencies such as Bitcoin, Ethereum, Tether, Ripple and Cardano.”

These new digital payment findings are from Roy Morgan Single Source, Australia’s leading consumer survey, derived from in-depth interviews with around 60,000 Australians annually.

For comments or more information about Roy Morgan’s digital payment data please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |