Australians now distrust many more corporations, exposing corporate ‘moral blindness’

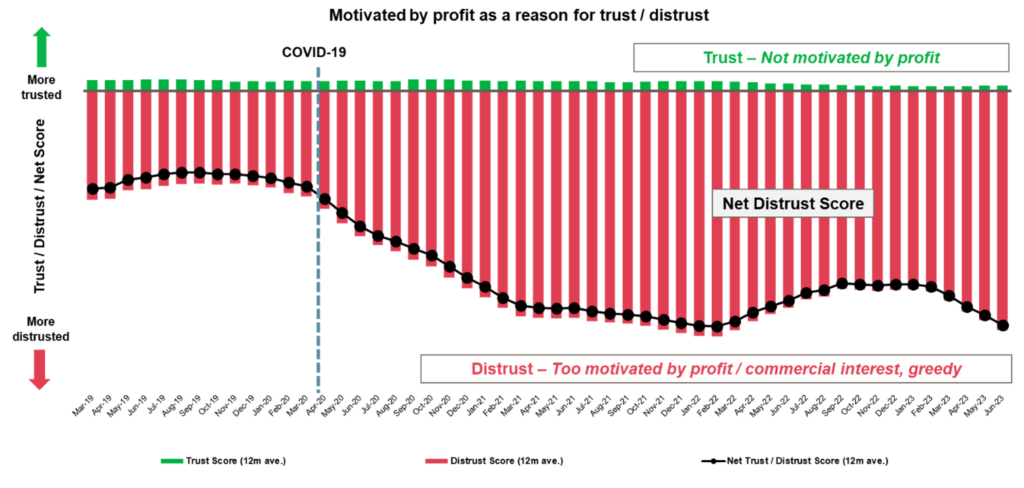

Australians have never been more distrusting of corporate Australia since Roy Morgan began measuring trust and distrust in late 2017. Since 2020, the poor behaviour of corporate Australia under the ‘cover of COVID’ has led to dramatically soaring distrust, not only for individual brands but for corporate Australia.

In 2023 corporate distrust deteriorated even further as consumers faced economic uncertainty and grappled with successive data breaches and corporate scandals.

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12 month average to June 2023.

Base: Australians 14+, Latest 12 month average n=25,662.

The PwC tax scandal and the data breaches at Optus and Medibank are among recent events accelerating distrust. The Harvey Norman’s JobKeeper scandal, Rio Tinto’s destruction of the Juukan Gorge, Qantas’ refusal to pay back any of the $2.7 billion in COVID government handouts – even after announcing an annual profit of $2.5 billion and the class action by hundreds of thousands of customers fueled by the airline’s unwillingness to refund $2 billion in cancelled flights, are all having an impact on distrust.

The poor behaviour of many of Australia’s corporate leaders reveals a Moral Blindness to what is ethical and in the community’s interest rather than solely in the shareholders’ interest.

Australians say:

“All the reasons are currently emblazoned across our newspapers. Excessive greed and arrogance and seeming absence of professional integrity.”

“Corrupt; too much access to power has gone to their collective head; seem to have no mechanisms for maintaining integrity.”

“The CEO is a disgusting greedy individual, who is a poor employer, makes use of people, governments and society for his own personal aggrandisement.”

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12 month average to June 2023.

Base: Australians 14+, Latest 12 month average n=25,662. Profit motivations n=5,658.

Mentions of professional services firm, PwC as a distrusted brand have increased dramatically since the April 2023 revelations of confidential tax office information being misused for commercial gain. Mentions of PwC for either trust or distrust were generally low prior to this scandal.

In the year to June 2023, for the first time, Facebook/Meta is not Australia’s most distrusted brand – replaced by telecommunications giant Optus. This change in ranking follows the widely publicised Optus data breach in September 2022. Distrust in Optus increased sharply following the data breach and has remained at high levels ever since. Although far more Australians continue to distrust than trust Facebook, the change in ranking also reflects a slight improvement in its distrust score.

More than three years after the destruction of the 46,000-year-old sacred Indigenous site, Juukan Gorge, Australians continue to nominate Rio Tinto as a company they distrust.

Roy Morgan CEO Michele Levine says that this alarming increase in distrust following major scandals shows the dire consequences of moral blindness and reinforces the importance of ethics in business.

“From the onset of COVID corporate leaders had to respond with agility, often sidestepping the checks and balances. This got many of them through the pandemic recession.

“But once the crisis had passed, they found the new freedoms they had enjoyed under the cover of COVID hard to relinquish, and a kind of Moral Blindness became endemic.

“The pandemic made it easier for leaders to look the other way, to avoid facing the ethical repercussions of their behaviour.

“Fundamentally, we need to arrest this trend and embrace a decency principle while at the same time ensuring company directors put distrust on their boards’ risk registers.”

View Australia's Most Trusted & Distrusted Brands Moral Blindness August 2023 Webinar here. The Risk Report with rankings of over 200 brands and analysis by industry is available for purchase here. Trust and Distrust Webinar Reports with insights into trust and distrust across various industries are available here.

Subscribe to Roy Morgan’s YouTube channel to ensure you don’t miss our next webinar on trust and distrust: https://www.youtube.com/c/roymorganaus.

The Roy Morgan Risk Monitor surveys approximately 2,000 Australians every month (around 25,000 per year) to measure levels of trust and distrust of around 1,000 brands across 26 industries. Respondents are asked which brands they trust, and why, and which brands they distrust, and why. The survey is designed to be open-ended, context-free, and unprompted. Roy Morgan Risk Monitor data is available in a variety of formats, from snapshot overviews to detailed tracking of individual brands and competitors. Industry Trust and Distrust Deepdive Surveys are also conducted (eg. Telco, Utilities, Insurance, Life Insurance, Banking, Agribusiness, Media, Retail, Real Estate, etc.) for deep insights into brand health, perceptions of, and customer experience (CX) with brands.

To learn more call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |