Roy Morgan Business Confidence drops 2.5pts to 106.0 in March despite interest rate cut in February

In March 2025, Roy Morgan Business Confidence was down 2.5pts to 106.0 despite the Reserve Bank cutting interest rates for the first time in over four years in mid-February by +0.25% to 4.1%.

The biggest domestic news in March revolved around the impact of Cyclone Alfred which hit the Queensland and New South Wales coasts in early March – causing extensive flooding – and delaying the Federal Election for nearly a month until early May.

Despite the decline during March, Roy Morgan Business Confidence has now had a positive rating above 105 for six months in a row – the first time this has happened since July 2021.

Businesses are confident about the year ahead with a majority of 60.7% expecting ‘good times’ for the Australian economy over the year ahead compared to just over a third, 34.3%, that expect ‘bad times’.

Confidence about the economy translates across to prospects for businesses themselves with 44.8% expecting their own business to be ‘better off’ financially this time next year compared to fewer than a fifth, 17.3%, expecting to be ‘worse off’. Businesses also want to invest with 43.4% that say the next 12 months is a ‘good time to invest’ compared to 34.4% that say the next 12 months is a ‘bad time to invest’.

Business Confidence is 4.3pts below the long-term average of 110.3, but a large 19.2pts higher than the latest ANZ-Roy Morgan Consumer Confidence of 86.8 for March 31 – April 4, 2025.

Roy Morgan Monthly Business Confidence -- Australia

Source: Roy Morgan Business Single Source, Dec 2010-March 2025. Average monthly sample over the last 12 months = 1,571.

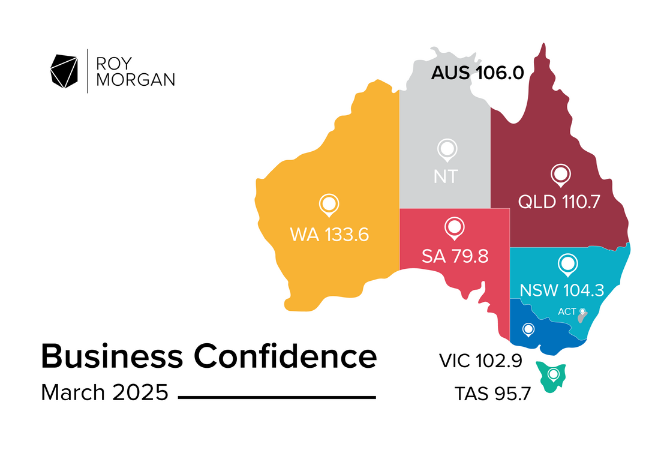

Business Confidence is up from a year ago driven by Western Australia and Queensland

Business Confidence for the month of March dropped by 2.5pts from a month ago, but up by 7pts from March 2024. The increase in Business Confidence has been driven by increases in Western Australia, Queensland, New South Wales, and Victoria.

The most significant increase was in Western Australia, with Business Confidence increasing by a stunning 27.3pts from a year ago to 133.6 and the highest of any State. At the Western Australian State Election in March the ALP Government led by Premier Roger Cook was re-elected winning 46 seats out of 59 with a large two-party preferred lead of ALP 57.1% cf. L-NP 42.9%.

There were also strong increases in Queensland, up 17.4pts to 110.7, in New South Wales, up 7.9pts to 104.3 and in Victoria, up 8.2pts to 102.9.

However, there were declines in the two smallest States with Business Confidence down 11.5pts to 95.7, and a significant fall of 29.5pts to 79.8 in Tasmania – and now clearly the lowest of any State.

Business Confidence by State in March 2024 vs March 2025

Source: Roy Morgan Business Single Source, March 2024, n=1,605, March 2025, n=1,484. Base: Australian businesses. *Tasmanian Business Confidence is measured over two months: February and March 2024 cf. February and March 2025.

Electricity, Gas, Water & Waste Services, Financial & Insurance Services and Professional, Scientific & Technical Services are the three most confident industries during February and March 2025

Over the last two months there were 16 industries with Business Confidence in positive territory above the neutral level of 100 led by Electricity, Gas, Water & Waste Services, Financial & Insurance Services, Professional, Scientific & Technical Services, Education & Training, Rental, Hiring & Real Estate Services, Mining and Accommodation & Food Services filling out the top seven industries.

There were two industries with confidence over 25pts above the average in February and March 2025 led by Electricity, Gas, Water & Waste Services on 143.8, up a large 45.6pts on a year ago and Financial & Insurance Services on 135.3, and up a significant 17.7pts on a year ago.

Filling out the top four are Professional, Scientific & Technical Services on 115.9, up 3.2pts on a year ago and Education & Training on 115.5, but down 13.1pts on a year ago. Education & Training has now been amongst the top five most confident industries for nearly three years since June 2022.

There were only two industries with Business Confidence in negative territory below 100 during the last two months and the least confident industry is again Wholesale trade on only 79.6, and down 11.9pts from a year ago, just below Agriculture, Forestry & Fishing on 81.4, and also the industry with the lowest average Business Confidence over the last two years of only 81.1.

Business Confidence for Top 5 and Bottom 5 Industries in February & March 2025

Source: Roy Morgan Business Single Source, February & March 2025, n=2,965. Base: Australian businesses.

Note: In the chart above, green bars represent Business Confidence in positive territory above the national average, red bars represent Business Confidence well below the national average and below the neutral level of 100 while the dark blue bar represents Business Confidence above the neutral level of 100 but still below the national average.

Business Confidence dropped to 106 in March driven by rising concerns about the Australian economy in the long-term and a comparison of business prospects to a year ago:

- In March, under a third of businesses, 30.9% (unchanged), said their business is ‘better off’ financially than this time a year ago, while 37.9% (up 6ppts), said the business is ‘worse off’;

- Businesses’ views on their prospects for the next year were virtually unchanged in March with 44.8% (unchanged) expecting the business will be ‘better off’ financially this time next year, while only 17.3% (up 0.9ppts), expect the business will be ‘worse off’;

- Confidence regarding the performance of the Australian economy over the next year was virtually unchanged with a clear majority of 60.7% (down 1.1ppts), expecting ‘good times’ while only 34.3% (down 0.8ppts) expect ‘bad times’ (the lowest figure for this indicator for three years since February 2022);

- Businesses’ views on the long-term future of the Australian economy over the next five years dropped in March with 30.1% (down 3.9ppts) expecting ‘good times’ over the next five years compared to an increasing majority of 55.9% (up 1.2ppts) expecting ‘bad times’;

- Net sentiment on whether now is a ‘good or bad time to invest in growing the business’was unchanged with 43.4% (down 0.3ppts) saying the next 12 months will be a ‘good time to invest’ in growing the business and 34.4% (down 0.3ppts) who say the next 12 months will be a ‘bad time to invest’ (the lowest figure for this indicator for nearly four years since June 2021).

Michele Levine, CEO of Roy Morgan, says Business Confidence dropped 2.5pts to 106 in March, a sixth straight month well into positive territory above 105, but still a decline despite the Reserve Bank cutting interest rates in mid-February for the first time in four years:

“Roy Morgan Business Confidence dropped 2.5pts to 106 in March, its largest drop for six months since September 2024. Despite the fall, Business Confidence has remained in positive territory with all three forward looking indicators which look at the next 12 months clearly in positive territory.

““Businesses are confident about the next 12 months with a majority of 60.7% expecting ‘good times’ for the Australian economy over the next year, a plurality of 44.8% expecting to be ‘better off’ financially this time next year, and a plurality of 43.4% that say now is a ‘good time to invest’ in growing the business.

“Although the Reserve Bank decided to cut interest rates in late February by +0.25% to 4.1%, the cut has not provided a boost to Business Confidence as the Bank’s statement expressed caution about further interest rate cuts due to the uncertain nature of the global, and local, economies.

“Since March ended, there has been further uncertainty introduced when US President Donald Trump announced on what he called ‘Liberation Day’ (Wednesday April 2, 2025) that the United States would levy tariffs on almost all countries around the world of at least 10%. Luckily, for Australia, the tariff Trump imposed on Australian exports was at the minimum level of 10%.

“The imposition of these new tariffs has had a swift reaction on global stock-exchanges, including in Australia, which have fallen sharply. However, it is early days, and a lot could change over the next few weeks, so the exact impact of these new policies on the Australian economy and Australian businesses will take time to assess over the next few weeks and months.

“On a State-by-State basis Business Confidence is in positive territory in four States led by Western Australia at 133.6 in the month the ALP Government led by Premier Roger Cook was re-elected for a third term in a landslide winning 46 out of 59 seats in the WA Legislative Assembly.

“The three largest States also have positive Business Confidence in March including in Queensland (110.7), New South Wales (104.3) and Victoria (102.9). In contrast, Business Confidence is now lowest in the two smallest States of Tasmania (95.7) and well below 100 in South Australia (79.8).

“At an industry level, it is Electricity, Gas, Water & Waste Services on 143.8 and Financial & Insurance Services on 135.3 which are clearly the two most confident industries well over 25 points higher than the national average. Other confident industries include Professional, Scientific and Technical Services on 115.9 and Education & Training on 115.5. Education & Training has now been amongst the top five most confident industries for nearly three years since June 2022.

“At the other end of the scale is Wholesale Trade on only 79.6 just below Agriculture, Forestry & Fishing on 81.4 and the lowest average Business Confidence over the last two years of only 81.1. These are the only two industries with Business Confidence in negative territory below the neutral level of 100.”

The latest Roy Morgan Business Confidence results for December are based on 1,481 detailed interviews with a cross-section of Australian businesses from each State and Territory. Detailed findings are available to purchase on a monthly or annual subscription as part of the Roy Morgan Business Confidence Report.

For comments or more information please contact:

Michele Levine

CEO, Roy Morgan

Office: +61 (3) 9224 5215

Mobile: 0411 129 093

To learn more about Roy Morgan’s Business Confidence, Consumer Confidence and Inflation Expectations data call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |