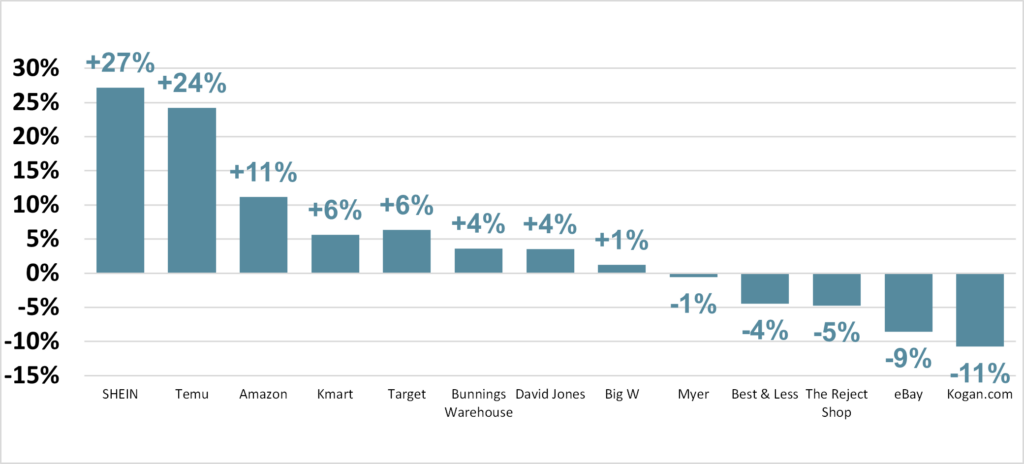

Temu and Amazon have each gained close to a million shoppers in the last year, Shein has also gained over half a million shoppers

New data from Roy Morgan capturing the annual shopper base of key retailers in Australia reveals the staggering growth in the numbers of buyers for online players Amazon, Temu and Shein.

- 8.8 million Australians are buying at least once from Amazon over 12 months (up by 900,000 year-on-year, +11% growth);

- 4.7 million are buying from Temu (up by 900,000 year-on-year, +24% growth); and

- 2.6 million are buying from Shein (up by 600,000 year-on-year, +27% growth).

The rapid rise of these 3 online disruptors is reshaping Australia’s retail landscape. Several major retailers - including eBay, Kogan, The Reject Shop, and Best & Less – have experienced significant year-on-year declines in customer numbers, while others such as Millers, Rivers, Noni B, Katies, Autograph, Crossroads, Rockmans, and Wittner have exited the market entirely in the past year.

Year-on-Year Growth in the number of 12-monthly shoppers

Source: Roy Morgan Single Source, Jul’23 to Jun’25. Base: Australians 14+, n=67,653

Question: ‘In the last 12 months have you bought from...?’

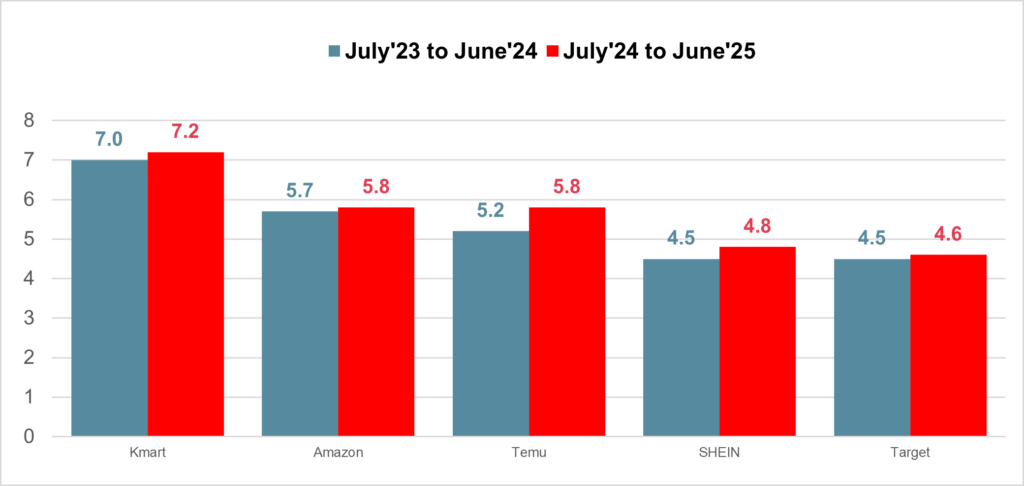

Australians are not only shopping in vast numbers at Amazon, Temu and Shein, they are shopping there more frequently

Average number of times shoppers have bought from the retailer in the last 12 months period

(Year-over-Year comparison)

Source: Roy MorganSingle Source, Jul’23 to Jun’25. Base: Last 12 monthsShoppers 14+. Kmart n=41,140; Amazon n=25,314; Temu n=14,117; SHEIN n=6,738; Target n=23,718.

Question: In the last 12 months how many times did you buy from...? (Online and in-store).

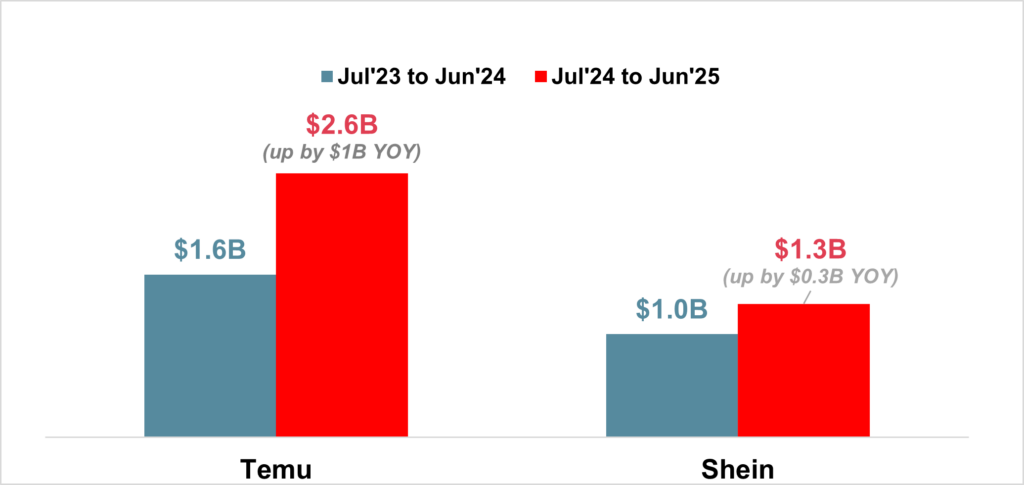

Roy Morgan estimates Temu and Shein together had close to additional $1.3 billion in annual sales year on year - $1B additional sales for Temu and $0.3B additional sales for Shein

Temu has close to an estimated $2.6 billion in annual sales in the 12 months to June 2025 (compared to an estimated $1.6 billion a year ago) and Shein has close to an estimated $1.3 billion in annual sales (compared to an estimated $1 billion a year ago).

Estimated Annual Revenue for the current year: July 2024-June 2025 vs. July 2023-June 2024

Source: Roy Morgan Single Source, Jul’23 to Jun’25. Base: L4W Shoppers 14+. Temu n=6,402; Shein n=3,290.

Catherine Jolley, Roy Morgan’s Head of Retail and Consumer Products:

“The growth in shopper numbers at this scale and speed is unprecedented and it’s redefining the market before our eyes.

“As discount platforms reset consumer expectations, the challenge for established retailers, particularly those that have relied on a low-cost position, is to understand the impact on their position in the ‘new retail order’.”

To learn more about Roy Morgan’s online and shopping data, call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com. Please click on this link to the Roy Morgan Online Store.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |