Libra tops the tampon market

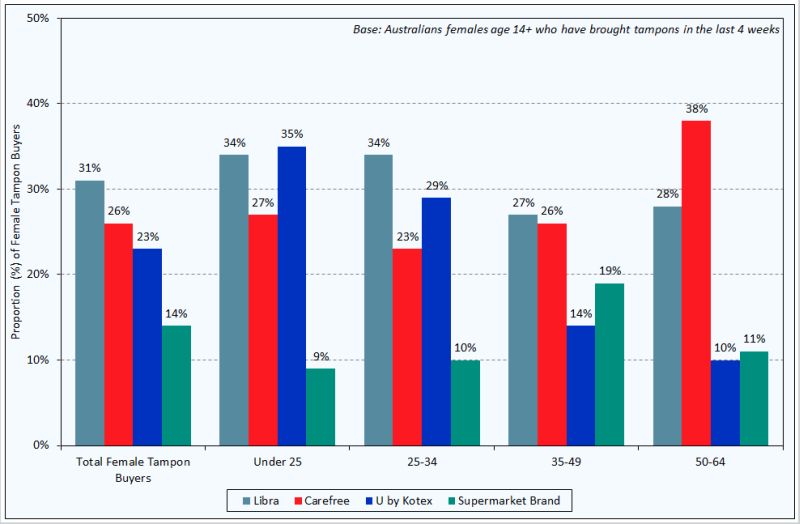

Last year, 21% of Australian women bought tampons in any given four-week period. Libra is the most popular brand by far, being purchased by 31% of tampon-buyers in an average four weeks, well ahead of Carefree and U by Kotex.

Recent findings by Roy Morgan Research show that while Libra tops the list, there are some differences in brand preference by age. U by Kotex is slightly more popular among tampon-buyers aged under 25, with 35% buying the brand in any given four weeks compared to 34% who buy Libra.

Carefree is the second-most purchased brand among women who buy tampons (particularly those aged between 50 and 64), but trails behind U by Kotex among under-25s. Marketed squarely at young teenage girls, U by Kotex is clearly resonating with the younger market. Nearly a quarter of women who bought tampons in an average four weeks chose Kotex.

In contrast, women aged 35-49 and 50-64 are more likely to buy supermarket-brand tampons than Kotex.

Top 4 best-selling tampons among Australian women

Source: Roy Morgan Single Source (Australia), April 2014 – September 2014 (n=715).

Angela Smith, Group Account Director, Roy Morgan Research, says:

“Libra’s dominance of the tampon market is well established, but among the other brands, some interesting trends emerge. While a woman’s choice of tampon appears to be heavily influenced by her age, the latest Roy Morgan data reveals that the brand she buys may also be coloured by subtle differences in attitudes and habits.

“For example, women who buy supermarket brand tampons are far more likely than the average Australian woman to agree with the statement ‘I buy more store’s-own products than well-known brands’. In contrast, women who buy Moxie are more likely than other tampon buyers to agree that ‘I will buy a product because of the label’ and ‘I try to buy Australian-made products as often as possible.’

“A niche Aussie brand bringing a touch of pizzazz to this most unglamorous of FMCG categories, Moxie currently accounts for just 6% of total tampon buyers in an average four weeks, but is one to watch.

“Moxie buyers tend to be extroverts who wear clothes that will get them noticed, identify as intellectual, place a high value on freedom and regularly attend their church or place of worship.

“Let’s face it: tampons are a boring necessity for many women, but this doesn’t mean brands can’t differentiate themselves and target specific kinds of shoppers. But to do this requires the kind of in-depth insights into Australian consumers that only Roy Morgan data can provide…”

For comments or more information please contact:

Roy Morgan - Enquiries

Office: +61 (03) 9224 5309

askroymorgan@roymorgan.com

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |