Over 620,000 ‘Problem Gamblers’ in Australia – and the majority are aged under 35

Amidst debate about gambling reformers lashing out at pokies trials and mandatory loss limits, Roy Morgan reports some 2.9% of the Australian adult population, an estimated 622,000 people, have serious gambling problems.

How does gambling behaviour fit into the Australian population. Amongst all Australians aged 18+:

- 8.6% say they ‘have bet more than they could really afford to lose’;

- 8.0% say they ‘have felt guilty about the way they gamble or what happens when they gamble’;

- 7.9% say they ‘go back on another day to try to win back the money they lost’;

- 6.9% say they’ve ‘needed to gamble with larger amounts of money to get the same feeling of excitement’;

- 5.9% say they ‘feel they might have a problem with gambling’;

- 4.9% say ‘gambling has caused them health problems, including stress or anxiety’;

- 4.4% say ‘people criticised their betting or have told them that they had a gambling problem, regardless of whether or not they thought it was true’;

- 3.6% say that their ‘gambling has caused financial problems for them or their household’;

- 3.4% say they ‘have borrowed money or sold something to get money to gamble’.

The Problem Gambling Severity Index (PGSI), brings together the responses to these key questions and identifies: problem gamblers, moderate and low risk gamblers, non-problem gamblers and non-gamblers and shows 3,492,000 Australians (16.2%) are either problem gamblers or at-risk gamblers.

Although more Australians are non-gamblers, the incidence of ‘problem gamblers’ has increased year-on-year for the last two years – from 1.9% in 2022-23, to 2.4% in 2023-24, and 2.9% in 2024-25.

Year-on-Year PGSI Distribution among Australians 18+; July 2022 to June 2025

| Incidence of Gambling segment | July 2022 – June 2023 | July 2023 – June 2024 | July 2024 – June 2025 | Change (Jun23 – Jun25) |

| Problem Gamblers | 1.9% | 2.4% | 2.9% | +1.0% |

| Moderate Risk Gamblers | 5.3% | 6.0% | 5.8% | +0.5% |

| Low Risk Gamblers | 8.8% | 8.3% | 7.5% | -1.3% |

| Total Problem Gamblers and At-Risk Gamblers | 16.0% | 16.7% | 16.2% | +0.2% |

| Non-Problem Gamblers | 49.6% | 48.6% | 46.7% | -2.7% |

| Total Gamblers | 65.6% | 65.3% | 62.9% | -2.5% |

| Non-Gamblers | 35.4% | 34.7% | 37.1% | +1.8% |

Source: Roy Morgan Single Source, July 2022 – June 2023 n=14,629; July 2023 – June 2024 n=16,441; July 2024 – June 2025, n=16,939. Base: All Australians 18+.

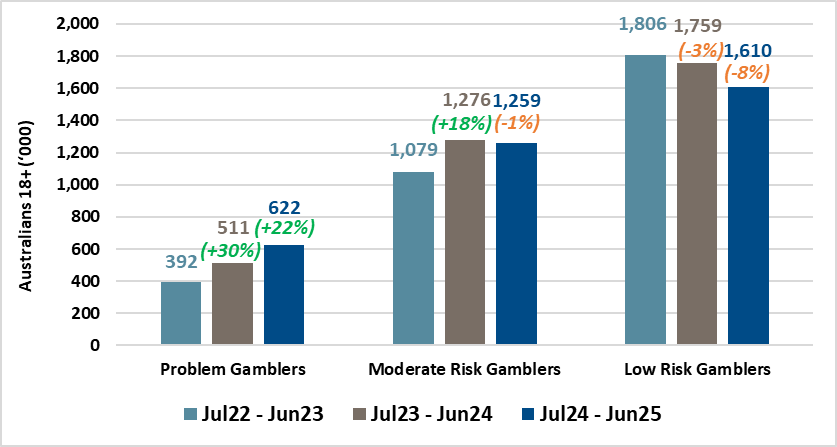

Problem gamblers are on the rise, but low risk gamblers down on two years ago

A detailed look at Australian gamblers shows the rate, and number, of problem gamblers has grown in each of the last two years while those classified as ‘low risk gamblers’ has decreased. There are now more ‘moderate risk gamblers’ than there were two years ago.

There are now 622,000 Australians that fit the profile as ‘problem gamblers’, up a significant 111,000 (+22%) from a year ago, and up 230,000 from two years ago.

Although a larger cohort, the 1,610,000 Australians classified as ‘low risk gamblers’ is down 149,000 (-8%) on a year ago, and down 196,000 on two years ago.

In between each are Australians considered to be ‘moderate risk gamblers’ which are down slightly by 17,000 (-1%) on a year ago, but up significantly, by 180,000, compared to two years ago.

It’s worth remembering most Australian adults, more than five-in-six (83.9%), are considered either ‘non-problem gamblers’ (46.8%) or don’t gamble at all (37.1%).

This detailed research into gambling in Australia is conducted on an ongoing basis around the nation and is based on interviews with 16,000+ Australian adults every year (1,300+ each month).

Year-on-Year PGSI (Problem gamblers, Moderate risk gamblers and Low risk gamblers) Population and growth among Australians 18+; July 2022 to June 2025

Source: Roy Morgan Single Source, July 2022 – June 2023 n=14,629; July 2023 – June 2024 n=16,441; July 2024 – June 2025, n=16,939. Base: All Australians 18+.

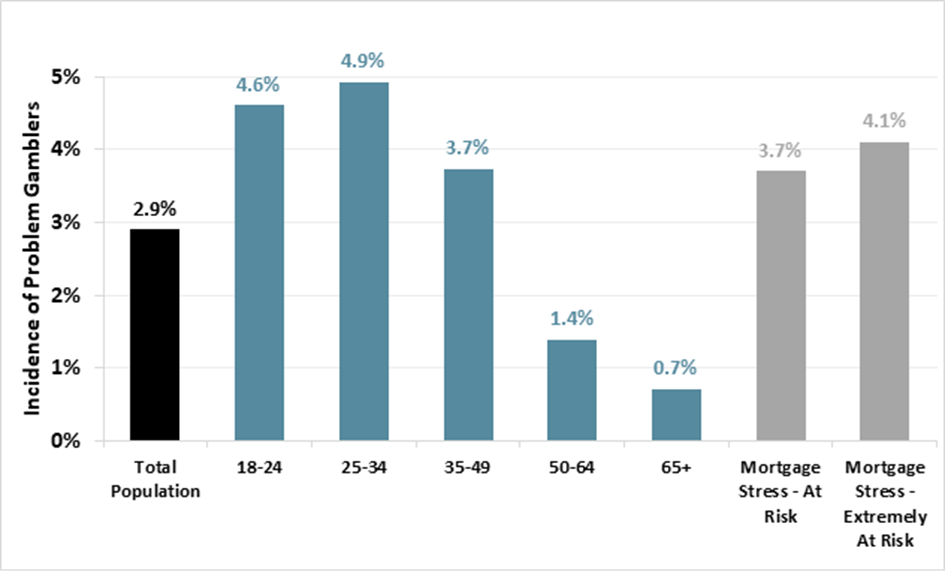

People aged 18-49 are more than twice as likely to be ‘problem gamblers’ than those aged 50+

Analysing problem gamblers by age shows Australians aged under 50 are more than twice as likely to be considered ‘problem gamblers’ than those aged 50+, and Australians aged under 35 are more than three times as likely as those aged 50+.

Those most likely to be considered ‘problem gamblers’ are aged 25-34 (4.9%), just ahead of people aged 18-24 (4.6%). In addition, well above the national rate of 2.9% are people aged 35-49 (3.7%).

The rate of problem gambling drops off significantly for Australians aged 50+, down to only 1.4% for people aged 50-64, and just 0.7% for people aged 65+ - both well below the national rate of 2.9%.

A look at how these rates of problem gambling break down in the numbers shows a slim majority of problem gamblers are aged under 35 (316,000, 51%) compared to a minority aged 35+ (306,000, 49%).

Problem gambling incidence by Age groups and Mortgage Stress – July 2024 to June 2025

Source: Roy Morgan Single Source, July 2024 – June 2025, Total Population n=16,939; 18-24 n=1,608; 25-34 n=2,657; 35-49 n=4,003; 50-64 n=4,115; 65+ n=4,556; At Risk n=1,475; Extremely At Risk n= 948. Base: Australians 18+

Problem gambling is more prevalent among Australians under mortgage stress

Importantly, Australians facing mortgage stress are more likely to be considered ‘problem gamblers’ than regular Australians.

For Australians considered ‘At Risk [1]’ of Mortgage Stress, 3.7% are rated as ‘problem gamblers’ while for Australians considered to be ‘Extremely At Risk [2]’ of Mortgage Stress, an even higher 4.1% are rated as ‘problem gamblers’.

An in-depth explanation of what constitutes being ‘At Risk’ or ‘Extremely At Risk’ of Mortgage Stress is provided below.

Michele Levine, CEO of Roy Morgan says:

“A special Roy Morgan analysis of gambling data reveals over 620,000 Australians are considered to be ‘problem gamblers’ and another, far larger group of almost 2.9 million Australians, are considered to be ‘at risk gamblers’. In total this group of ‘problem gamblers’ and ‘at risk gamblers’ numbers almost 3.5 million and comprises almost one-in-six Australians (16.2%).

“Most concerningly, the number of ‘problem gamblers’ has increased rapidly, up 230,000 (+58.7%) compared to two years ago. The number of ‘moderate risk gamblers’ has also increased, up 180,000 (+16.7%) on two year ago, while those considered ‘low risk gamblers’ are down.

“A look at who the ‘problem gamblers’ are shows a concentration among younger Australians aged under 50, and especially those aged 18-34 who comprise 51% of this group. ’Problem gamblers’ are also likely to face other challenges with over a third (34.1%) ‘At Risk’ of mortgage stress and almost a quarter (24.5%) ‘Extremely At Risk’ of mortgage stress.

“Broadening the discussion out to the entire Australian population, we can see that:

- 8.6% say they have bet more than they could really afford to lose;

- 8.0% say they have felt guilty about the way they gamble or what happens when they gamble;

- 7.9% say they go back on another day to try to win back the money they lost;

- 6.9% say they need to gamble with larger amounts of money to get the same feeling of excitement;

- 5.9% say they feel they might have a problem with gambling;

- 4.9% say gambling has caused them health problems, including stress or anxiety;

“The responses to these, and other, statements related to gambling help researchers determine which Australians can be considered as ‘problem gamblers’ and also which Australians are regarded as ‘moderate risk gamblers’ or ‘low risk gamblers’.

“To learn more about Roy Morgan’s extensive research into gambling, including attitudes, behaviours, and broader gambling habits, contact Roy Morgan today.”

For comments or more information please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

[1] "At Risk" is based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

[2] “Extremely at Risk" is also based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the Standard Variable Rate set by the RBA and the amount now outstanding on their home loan.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |