Bunnings is Australia’s most trusted brand – while the big four banks (CBA, NAB, ANZ and Westpac) surge up the rankings

Bunnings is the most trusted brand in the 12 months to June 2025 – a seventh consecutive quarterly victory for the ubiquitous hardware retailer stretching back to late 2023. Bunnings was also recognised last week as Australia’s ‘Best of the Best’ Most Trusted Brand for 2025.

For the third straight quarter the top five places remain unchanged with budget supermarket Aldi in second place, discount department store Kmart.in third, technology and consumer products giant Apple in fourth and leading car manufacturer Toyota in fifth place.

Big four banks and discount department stores improve their trust rankings

There were two notable trends in the latest trust rankings with all four major banks improving their rankings, and two prominent discount department stores rising to more closely challenge market leader Kmart.

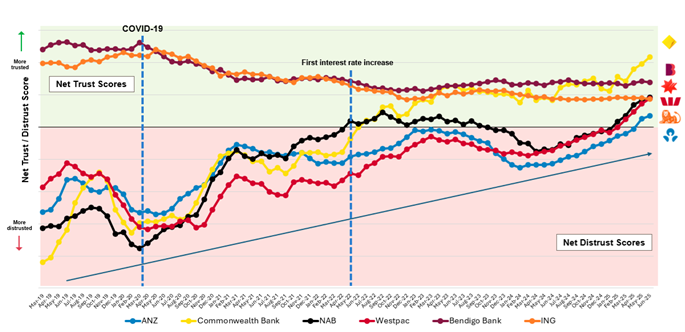

All four major banks improved their rankings led by banking giant Commonwealth Bank improving an impressive five spots on the back of increasing levels of trust to enter the top ten for the first time in 7th place and number one in the bank rankings – moving clearly ahead of Bendigo Bank.

NAB had a good quarter with a rising level of trust as well as decreasing levels of distrust powering a rise of 29 places to enter the top 20 for the first time in 19th position. This is a second straight quarterly surge for the Melbourne-based bank after a massive increase of 112 spots in the previous quarter.

Westpac increased by an exceptional 53 places to be move into 21st place, and ANZ jumped an extraordinary 104 places to 51st overall. However, it’s important to note the rapid increases for ANZ were before corporate regulator ASIC imposed a record fine of $240 million against the bank earlier this week for widespread misconduct. In contrast to the its larger peers, ING fell out of the top 20 for the first time.

For the discount department stores, Big W (owned by Woolworths) was up for a second straight quarter by one spot to 6th, and rival Target (owned by Wesfarmers) improved three spots to 13th

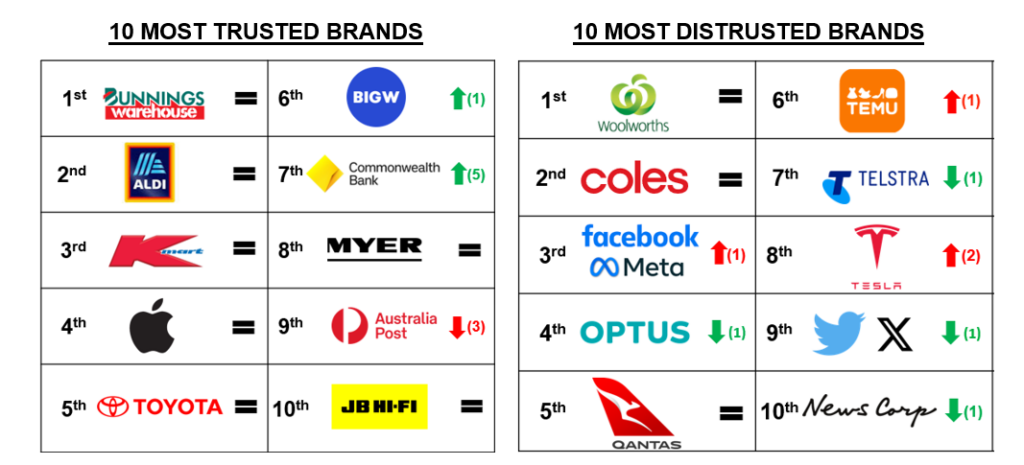

Figure 1: Australia’s 10 most trusted and 10 most distrusted brands in June 2025. Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to June 2025. Base: Australians 14+, n=21,787. Arrows with numbers show ranking change since March 2025.

According to Roy Morgan CEO Michele Levine:

“Bunnings continues its reign as Australia’s most trusted brand in mid-2025 – now on top for a seventh straight quarter and collecting a well-deserved second consecutive ‘Best of the Best’ Most Trusted Award at Roy Morgan’s Annual Trust Awards in mid-September.

“The most notable movements in the index were below the unchanged top five of Bunnings, ALDI, Kmart, Apple and Toyota with the big four banks enjoying a surge in trust during 2025 so far.

“The improvements for the major banks so far this year are impressive with all four surging upwards in recent quarters. In the June quarter 2025, Commonwealth Bank increased five places to enter the top 10 in 7th place and clearly the number one in the banking rankings ahead of Bendigo Bank (now in 14th overall).

“There were also significant improvements for NAB which jumped 29 spots to enter the top 20 in 19th place and Westpac surged 53 places to be just outside the top 20 in 21st position. Both NAB and Westpac are forecast to overtake Bendigo Bank later this year.

“However, the largest spike in the rankings was for ANZ which rocketed up the rankings by 104 spots to 51st place – although the ASIC fine last week for widespread misconduct – admitted to by the bank – may well put a halt to this rapid improvement.

“All four of the big banks have improved their rankings in both quarters of 2025 so far – a period which included the first cuts to official interest rates for nearly five years after a sustained period of interest rate increases. The RBA cut interest rates in February 2025 (-0.25%) and May 2025 (-0.25%) and has subsequently cut interest rates again in August 2025 by 0.25% to 3.6%.”

Net Trust/Distrust Score Trends – Big 4 Banks + Bendigo Bank and ING (12m avg.)

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to June 2025.

Base: Australians 14+, Latest 12-month average n=21,787.

Trusted Brands – Bunnings, ALDI, Kmart, Apple and Toyota are again the top five

Bunnings (1st) has retained top spot as the most trusted brand in the June quarter, the popular hardware chain’s seventh straight quarterly victory atop the rankings. Filling out the top five places were ALDI (2nd), Kmart (3rd), Apple (4th) and Toyota (5th) for the third straight quarter.

There were two improvers in the top 10 most trusted brands with Big W up one spot to 6th and the Commonwealth Bank improving their ranking by five spots to 7th – both brands have now increased in the rankings for a second consecutive quarter.

As well as the aforementioned improvements for the big four banks, there was an impressive increase for discount department store Target, up by three spots to 13th overall.

Distrusted Brands – Woolworths and Coles are the most distrusted and Tesla’s slide continues

The supermarket giants Woolworths and Coles are again Australia’s two most distrusted brands for a third straight quarter.

Behind the two supermarkets there were several prominent brands to increase their distrust in the last quarter including Facebook/Meta which deteriorated one spot to be Australia’s third most distrusted brand, Temu, deteriorating one place to sixth most distrusted and Tesla, which continued its descent, deteriorating two places to eighth.

However, the biggest sliders in the top 20 most distrusted brands were all ranked between 12th to 20th most distrusted including two technology centred firms: Chinese discount online retailer, Shein, deteriorating three spots to 12th most distrusted brand, and Google, deteriorating three spots to 17th most distrusted brand.

Also deteriorating in distrust rankings were Harvey Norman, down three places to 14th, and discount airline Jetstar which lost three ranking places to be the country’s 20th most distrusted brand.

There were several distrusted companies to improve their rankings including Optus which improved one spot to 4th – although this was before the latest network outage problems for the telco last week, Telstra, improving one place to 7th, Twitter/X, improving one place to 9th, News Corp, improving one place to 10th, TikTok which landed in 13th, an improvement of one ranking spot, Nestle, improving two spots to 15th, Rio Tinto, improving two places to 16th and the biggest increase was for oil major BP, improving three places to 19th.

According to Roy Morgan CEO Michele Levine some of Australia’s most high profile – and most distrusted – brands are beginning to turn the corner – but there is a long way to go:

“Woolworths, Coles and Qantas – four of Australia’s biggest brands – have all experienced reputational crises in recent years, but there are positive signs for all of them in the latest trust data.

“Underneath the surface, and despite continuing high levels of distrust, it’s worth mentioning Qantas has continued to improve their trust significantly, and even the two most distrusted – Coles and Woolworths – are showing green shoots of recovery, albeit with a very long way to go.

“The evolving trust rankings of these four major brands provide valuable insights into the shifting dynamics of consumer trust and distrust for which Roy Morgan’s Benchmark Recovery Rate enables clients to track progress against a reliable recovery benchmark.

“Looking closely at the major online retailers, shows Shein and Temu have continued to dramatically deteriorate. As more Australians buy from Chinese brands, they become more concerned about the quality of the products and the ethics surrounding their business practices.

“In contrast, Amazon’s reputation, which declined during the COVID-19 pandemic and reached its lowest point in April 2022, has begun to bounce back, but still has a long way to go.”/

Subscribe to Roy Morgan’s YouTube channel to ensure you don’t miss our next webinar on trust and distrust: https://www.youtube.com/c/roymorganaus.

For the latest rankings of key brands, comparison to rankings from a year ago, and examples of reasons Australians trust and distrust key brands view the latest edition of the Roy Morgan Risk Report.

For further topline insights into the Most Trusted Award winners, and an overview of trust and distrust trends and insights for each of the categories view the latest edition of the Roy Morgan Trusted Brands Report.

The Roy Morgan Risk Monitor surveys approximately 1,500-2,000 Australians every month (over 20,000 per year) to measure levels of trust and distrust of around 1,000 brands across 27 industries. Respondents are asked which brands they trust, and why, and which brands they distrust, and why. The survey is designed to be open-ended, context-free, and unprompted. Roy Morgan Risk Monitor data is available in a variety of formats, from snapshot overviews to detailed tracking of individual brands and competitors. Industry Trust and Brand Health Surveys are also conducted (e.g. Private Health Insurance, Agribusiness, Banking, Travel and Tourism, Telco, Utilities, Insurance, etc.) for deep insights into brand health, perceptions of, and customer experience (CX) with brands.

To learn more call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is the source of the most comprehensive data on Australians’ behaviour and attitudes, surveying over 1,000 people weekly in a continuous cycle that has been running for two decades. The company has more than 80 years’ experience collecting objective, independent information.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |