Roy Morgan Business Confidence virtually unchanged at 101.7 after the RBA leaves interest rates at 3.6%

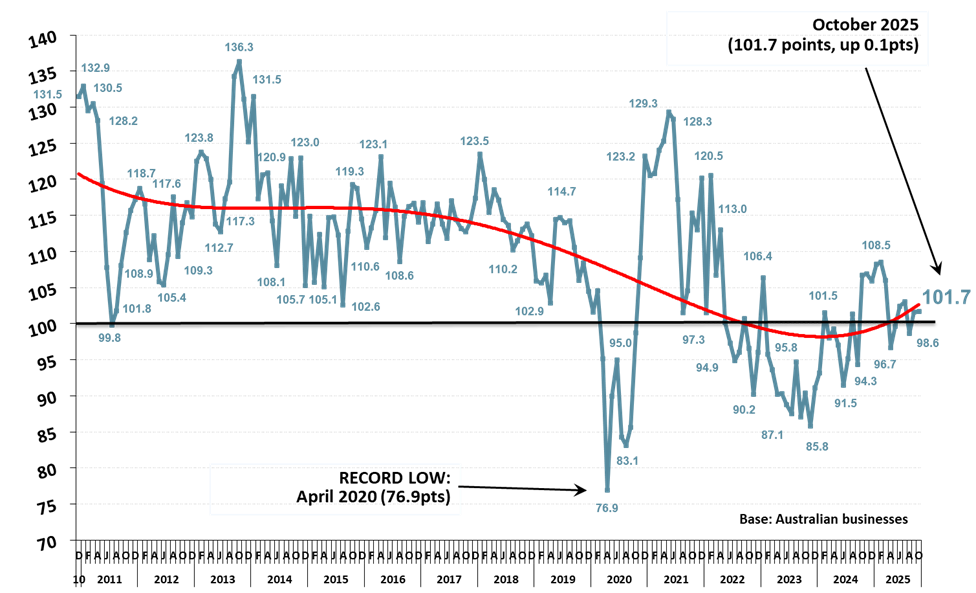

In October 2025 Roy Morgan Business Confidence was virtually unchanged at 101.7. The result followed the Reserve Bank’s decision to leave interest rates unchanged in late September at 3.6%.

A look at the component questions of the index showed a strengthening in the questions related to the Australian economy’s performance was offset by weakness in the investing views of businesses.

In October, an increasing majority of businesses, 58.2% (up 2.9% points), say they expect ‘good times’ for the Australian economy over the next year and nearly a third, 31.1% (up 3.2% points), expect ‘good times’ for the economy over the longer-term over the next five years.

However, there was a softening in sentiment in terms of investing in growing the business with only 37.4% (down 1.9% points) saying the next 12 months is a ‘good time to invest’ in growing the business compared to a rising 34.9% (up 5.4% points) that say the next 12 months is a ‘bad time to invest’.

Business Confidence is 8.2pts below the long-term average of 109.9, but a large 18.2pts higher than the latest ANZ-Roy Morgan Consumer Confidence of 83.5 on November 3-9, 2025.

Roy Morgan Monthly Business Confidence -- Australia

Source: Roy Morgan Business Single Source, Dec 2010-Oct 2025. Average monthly sample over the last 12 months = 1,381.

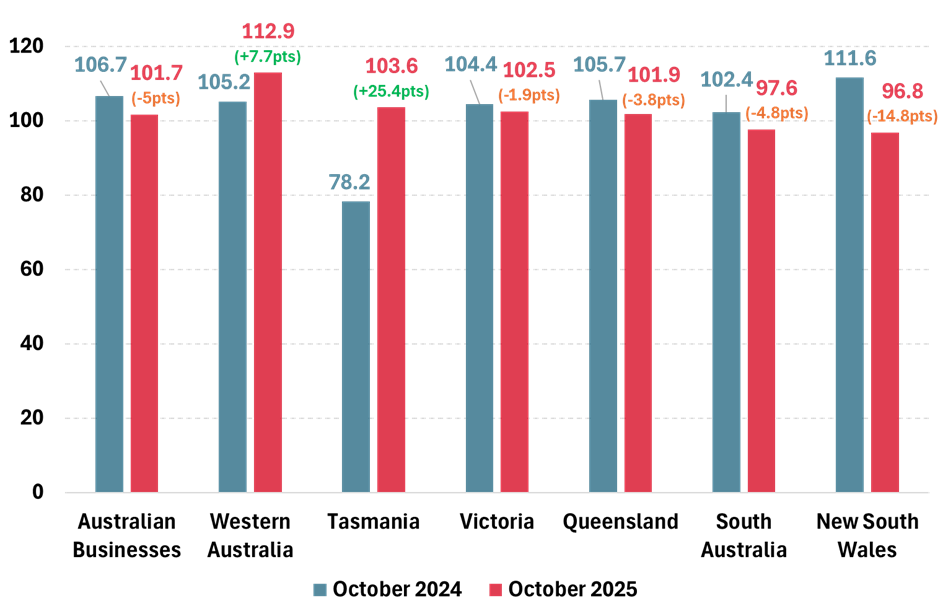

Business Confidence is down from a year ago driven by falls in the three largest States

In October, Business Confidence was virtually unchanged at 101.7, but down 5pts from October 2024. There were decreases from a year ago in the three largest States of New South Wales, Victoria, and Queensland that drove the annual decline.

Business Confidence dropped by 14.8pts to 96.8 in New South Wales, the largest decline of any State and now with the lowest level of Business Confidence of any State. Business Confidence was also low, and below the neutral level of 100, in South Australia, down 4.8pts to only 97.6.

There were also marginal declines in Victoria, down 1.9pts to 102.5, and in Queensland, down 3.8pts to 101.9. Business Confidence in these two States remains in positive territory above 100 and marginally above the national average of 101.7.

In contrast, Business Confidence has increased in two States compared to a year ago – Western Australia and Tasmania. In Western Australia, Business Confidence was up 7.7pts from a year ago to 112.9, and is now clearly the highest of any State over 10% above the national average of 101.7.

There was also a large increase in Tasmania, up 25.4pts to 103.6, following the confirmation of the re-election of the Liberal Premier Jeremy Rockliff’s Government in mid-August. The boost to Business Confidence came after Rockliff’s Government easily survived a no confidence motion in mid-August launched by former Labor Leader Dean Winter. Winter subsequently resigned the leadership of the Tasmanian Labor Party and was replaced by new leader Josh Willie in late August.

Business Confidence by State in October 2024 vs October 2025

Source: Roy Morgan Business Single Source, October 2024, n=1,884, October 2025, n=1,411. Base: Australian businesses. *Tasmanian Business Confidence is measured over two months: Sept. & Oct. 2024 cf. Sept & Oct. 2025.

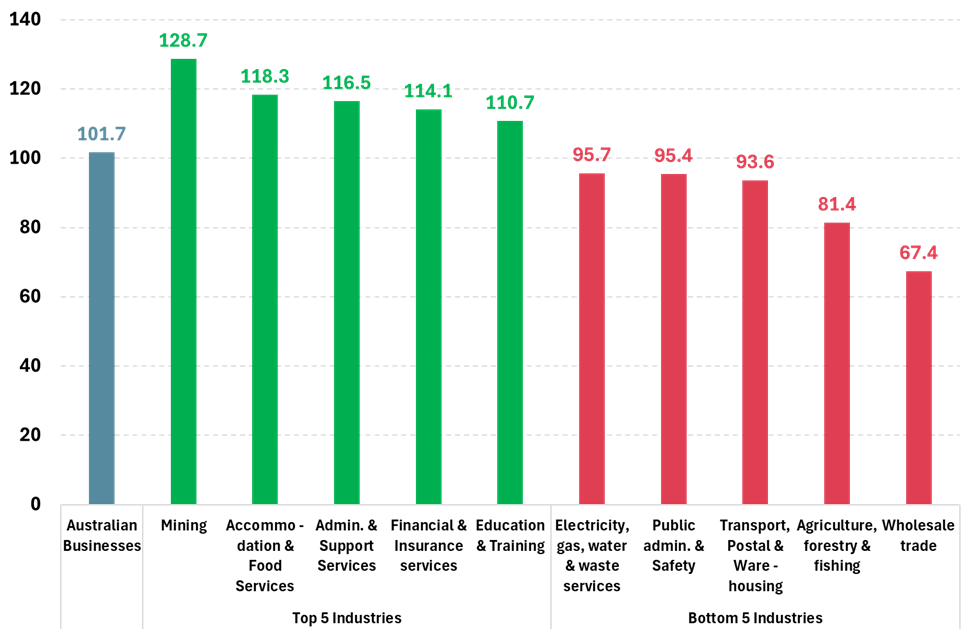

Mining, Accommodation & Food Services, Administration & Support Services and Financial & Insurance Services are the four most confident industries during September & October 2025

Over the last two months there were 12 industries with Business Confidence in positive territory above 100 led by Mining, Accommodation & Food Services, Administration & Support Services, Financial & Insurance Services, Education & Training, Professional, Scientific & Technical Services, Rental, Hiring & Real Estate Services, Construction, Information Media & Telecommunications and Construction.

There were four industries with confidence over 10pts above the average in September & October 2025 led by the Mining industry on 128.7, up a large 50.4pts on a year ago. The increased confidence in the Mining industry comes as Prime Minister Anthony Albanese signed a multi-billion dollar deal with US President Donald Trump regarding Australia’s critical mineral and rare earth supplies in early October.

There was also a large spike in confidence in the Accommodation & Food Services industry, up 21.8pts on a year ago to 118.3. Followed closely by Administration & Support Services on 116.5, up 10.5pts on a year ago, and Financial & Insurance Services on 114.1.

There were only two industries with Business Confidence deeply in negative territory below 90 during the last two months and the least confident industry is Wholesale Trade on only 67.4.

Only slightly higher is Agriculture, Forestry & Fishing on just 81.4. Business Confidence in this industry has been at low levels for a significant period of time and has averaged only 81.0 over the last three years – clearly the lowest of any industry.

Business Confidence for Top 5 and Bottom 5 Industries in September & October 2025

Source: Roy Morgan Business Single Source, September & October 2025, n=2,609. Base: Australian businesses.

Note: In the chart above, green bars represent Business Confidence in positive territory above the national average, red bars represent Business Confidence well below the national average and below the neutral level of 100 while the dark blue bar represents Business Confidence above the neutral level of 100 but still below the national average.

Business Confidence unchanged at 101.7 as businesses grow more positive about the Australian economy going forward but fewer want to invest in growing the business:

- In October, under a third of businesses, 30.6% (down 2.8ppts), said their business is ‘better off’ financially than a year ago, while over a third, 34.1% (down 0.5ppts), said the business is ‘worse off’;

- Businesses’ net views on their prospects for the next year were little changed in October with 42.2% (up 2.6ppts) expecting the business will be ‘better off’ financially this time next year, while over a fifth, 22.3% (up 2.3ppts), expect the business will be ‘worse off’;

- However, confidence regarding the performance of the Australian economy over the next year increased in October with 58.2% (up 2.9ppts) expecting ‘good times’ while 39.4% (down 2.6ppts) expect ‘bad times’;

- Businesses’ views on the long-term future of the Australian economy over the next five years also improved marginally in October with 31.1% (up 3.2ppts) expecting ‘good times’ over the next five years compared to 60.4% (down 0.8ppts) expecting ‘bad times’;

- Net sentiment on whether now is a ‘good or bad time to invest in growing the business’dropped in October with 37.4% (down 1.9ppts) saying the next 12 months will be a ‘good time to invest’ in growing the business while 34.9% (up 5.4ppts) say the next 12 months will be a ‘bad time to invest’.

Michele Levine, CEO of Roy Morgan, says Business Confidence was unchanged at 101.7 in October, following a Reserve Bank decision to leave interest rates unchanged at 3.6% in late September:

“Roy Morgan Business Confidence was unchanged at 101.7 in October as more optimism about Australia’s economic performance was cancelled out by a decline in businesses saying the next 12 months is a ‘good time to invest’ in growing the business.

“Now a rising majority of 58.2% (up 2.9% points) of businesses expect ‘good times’ for the Australian economy over the next 12 months and nearly a third, 31.1% (up 3.2% points), expect ‘good times’ over the longer-term of the next five years.

“In contrast, now 37.4% (down 1.9% points) of businesses say the next 12 months is a ‘good time to invest in growing the business’ compared to nearly as many, 34.9% (up 5.4% points), that say it is a ‘bad time to invest’ – a net negative move of 7.3% points in October.

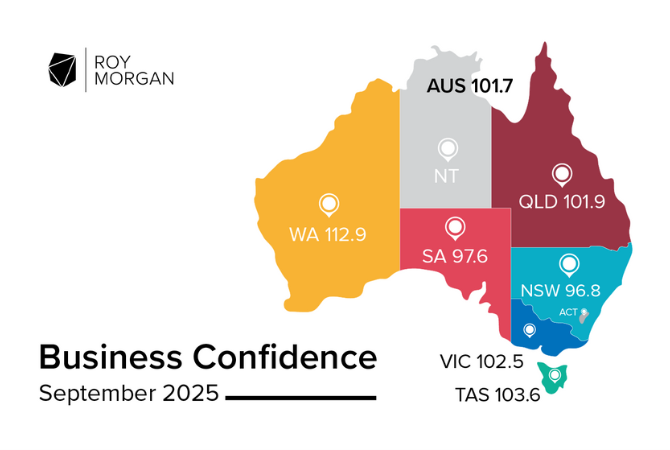

“On a State-by-State basis Business Confidence was highest in Western Australia (112.9) for a fourth straight month ahead of Tasmania (103.6) following the re-appointment of Liberal Premier Jeremy Rockliff’s Liberal Government in late August after a close election that led to little overall change.

“Business Confidence is marginally in positive territory in both Victoria (102.5) and Queensland (101.9), but well below the neutral level of 100 in South Australia (97.6) and lowest of all in Australia’s largest State of New South Wales at only 96.8.

“At an industry level, the most confident industry is the Mining industry on 128.7 – over 25pts above the national average. The Mining industry was significantly boosted in October when Prime Minister Anthony Albanese signed a multi-billion-dollar deal with US President Donald Trump covering access to and development of Australia’s large critical minerals and rare earth resources.

“Other confident industries include Accommodation & Food Services on 118.3 and Administration & Support Services on 116.5 and Financial & Insurance Services on 114.1, all over 10pts higher than the national average.

“At the other end of the scale are Wholesale Trade on only 67.4 and Agriculture, Forestry & Fishing on just 81.4 and the lowest average Business Confidence over a sustained period of the last three years of only 81.0 – clearly the lowest average of any of the 18 industries over this extended period.”

The latest Roy Morgan Business Confidence results for August are based on 1,198 detailed interviews with a cross-section of Australian businesses from each State and Territory. Detailed findings are available to purchase on a monthly or annual subscription as part of the Roy Morgan Business Confidence Report.

For comments or more information please contact:

Michele Levine

CEO, Roy Morgan

Office: +61 (3) 9224 5215

Mobile: 0411 129 093

To learn more about Roy Morgan’s Business Confidence, Consumer Confidence and Inflation Expectations data call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |