Telecommunications industry is Australia’s second most distrusted and Optus is the most distrusted brand

A special Roy Morgan webinar released yesterday took a deep dive into views on Australia’s telecommunications industry, and the most trusted and distrusted brands in the industry.

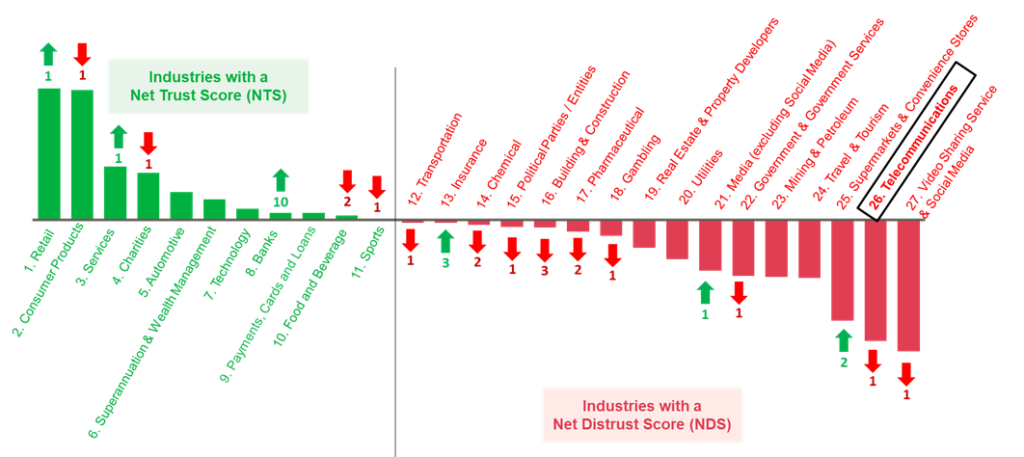

The chart below ranks all 27 industries by Net Trust/Distrust Scores and shows how uneven the trust landscape has become. Only a handful of industries (11) sit in positive territory, while most (16) fall into net distrust. Overall, it’s a structurally imbalanced environment, one where industries must work harder simply to stay out of the distrust zone.

In fact, in the single month of October 2025, Optus was Australia’s most distrusted brand of all. According to the Roy Morgan Risk Monitor, Optus’s reputation deteriorated sharply following the triple-zero outage in September – the number one monthly ranking is a clear warning sign for the next quarter’s results.

The poor result for Optus led to the Telecommunications industry overall being the nation’s most distrusted industry for the single month of October. For the full 12 months to September 2025 the industry is the second most distrusted, a position likely to worsen in our next quarterly update – due out early next year.

View the special Australia’s Most Trusted and Distrusted Telcos Deep Dive Webinar.

Net Trust/Distrust Score Rankings by Industry – Telecommunications is 26th out of 27 industries

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to September 2025. Base: Australians 14+, Latest 12-month average n= 19,779. Arrows and numbers represent ranking moves since June 2025.

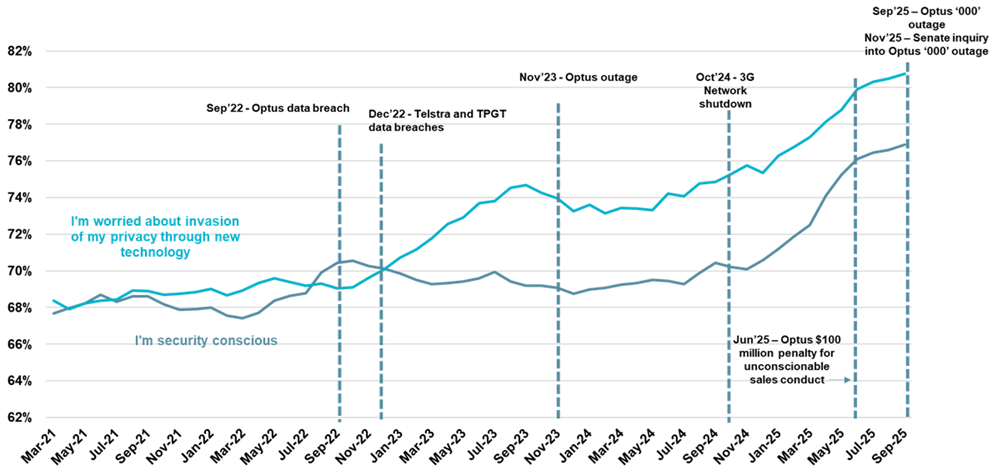

Concerns about privacy & security increased dramatically after Optus data breach and remain high

The Telecommunications industry has long been entrenched in net distrust territory, stretching back well over seven years, but the past few years have seen that pattern intensify. The Optus data breach in September 2022, the Telstra and TPG Telecom breaches, and the nationwide outage in 2023 all deepened distrust across the entire sector.

We saw some recovery through 2024, with distrust easing slightly. But the Optus September 2025 fatal triple-zero outage is likely to reverse those gains.

In telecommunications, every major incident resets the clock, and the fallout rarely stays confined to a single brand. The challenge now isn’t just mitigating distrust – it’s breaking a cycle where one crisis continually undermines the whole industry.

Concerns about privacy and security among Australians with mobile phones rose sharply after the Optus data breach – and since then, worry about privacy risks from new technology has become the dominant concern, overtaking general security consciousness.

Concerns of privacy and security among Australians with a mobile phone

Source: Roy Morgan Single Source 6MMA, April 2025 – September 2025. Base: Australians with a mobile phone.

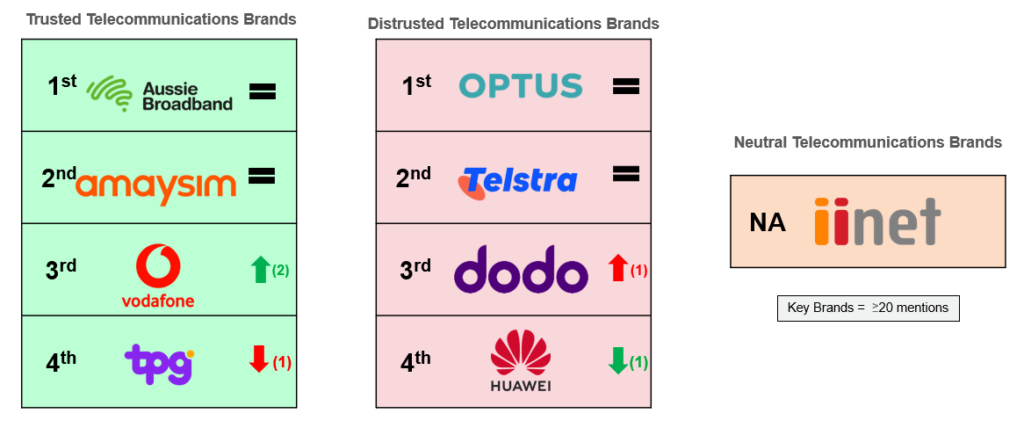

Optus is the most distrusted telecommunications brand – and has been since late 2022

Over the past year, the telecommunications brand ladder has barely moved – but the story beneath it has. Aussie Broadband and Amaysim continue to dominate trust, with Vodafone the only brand making a meaningful gain. TPG has slipped, driven by a softening in trust.

On the distrust side, Optus and Telstra remain firmly entrenched at the top, while Dodo and Huawei swap places. iiNet’s move into neutral territory signals a weakening of its traditional trust advantage.

The standout insight is Amaysim: despite being owned by Optus, it remains untouched by the fallout from Optus’s scandals. Consumers clearly don’t associate the two brands.

Optus’s distrust surged after the September 2022 data breach, and it has remained the most distrusted telco ever since. Even as Telstra’s distrust fluctuated – notably dipping during 2023 before climbing again – Optus has not significantly reclaimed lost ground.

The gaps between Optus and Telstra reflect two different dynamics: Optus is still carrying long-tail reputational damage from repeated failures, while Telstra’s movements are driven more by short-term pricing and service issues. The industry’s relative positions are stable, but the underlying trajectories suggest that once formed, distrust is far harder to unwind for deeply distrusted brands than for others.

Telecommunications Brand Rankings – 12-month average to September 2025

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to September 2025. Base: Australians 14+, Latest 12-month average n=19,779. Arrows and numbers represent ranking moves since June 2025.

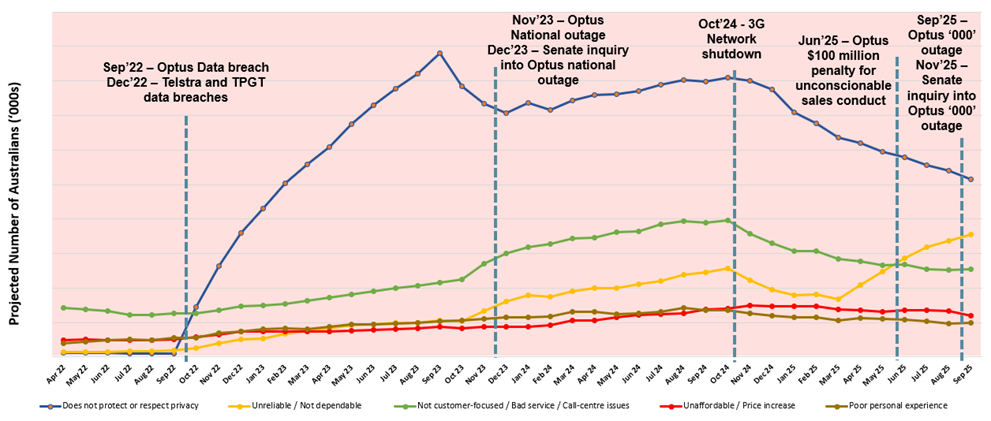

Optus has been Australia’s most distrusted telco brand since late 2022 – what is driving this?

In the year ending June 2023, Optus became Australia’s most distrusted brand of all, a position it held for over a year until Woolworths replaced Optus in September 2024.

More than three years after the data breach, Optus remains deeply distrusted and has continued to be the most distrusted telecommunications brand since late 2022, despite a partial recovery.

The single-month October 2025 results show that once again Optus was the most distrusted brand in Australia following the triple-zero outage in September - another clear warning sign for the brand.

Reasons Australians distrust Optus – unreliable and does not protect or respect privacy

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to Sep 2025.

Base: Australians 14+, Latest 12-month average n=19,779. Latest 12-month average Distrust Optus n=899.

Optus is now operating inside what neuroscience calls a reactivation loop.

Once a brand becomes associated with distrust, the memory network reorganises around that idea. So when a new ‘Optus event’ occurs – a penalty, an outage, a headline – it doesn’t land in isolation. One node lights up, and the whole network fires: “breach,” “unreliable,” “unsafe,” “chaotic,” “poor service.”

That’s why the fatal triple-zero outage instantly reignited deep-seated distrust. Consumers aren’t judging each incident separately anymore – they’re experiencing a single, coherent emotional response, and until that neural network is rewired, any new misstep will trigger the same cascade.

What’s striking is how the shape of distrust has shifted for Optus. Privacy (the blue line in the chart) was the dominant driver in the aftermath of the September 2022 breach – but over the past year, that intensity has eased. Not because the issue is “fixed,” but because people have adjusted; the shock has worn off.

What hasn’t eased is frustration with reliability. The yellow line in the chart has surged again in recent months, showing that Australians are no longer responding to Optus through a single-issue lens. They’re reacting to day-to-day performance – outages, failures, and service instability.

This is where Optus is most vulnerable: reliability taps straight into the reactivation loop. Every new disruption triggers the entire memory, making distrust both broader and harder to reverse.

Optus’ distrust is even more pronounced among the all-important business community, with distrust currently 23% higher among business decision makers than the general population.

Roy Morgan CEO Michele Levine says the telco industry is Australia’s second most distrusted in the 12 months to September 2025 – and heading deeper into distrust – as the latest triple-zero outage drove Optus to be the country’s most distrusted brand of all in the single month of October:

“The Telecommunications industry has dropped further in recent months to be Australia’s second most distrusted industry over the 12 months to September 2025 – just behind the currently ‘in the news’ ‘Video Sharing and Social Media Services’ industry in last place.

“The latest decline in trust in the industry has largely been driven by Optus – the most distrusted telecommunications brand for over three years since late 2022. The recent triple zero outage in September 2025 that was caused by issues with the Optus network – has seen the telco plunge further into distrust; in the single month of October Optus was the most distrusted brand in the country.

“Just over a year ago it looked like Optus had hit rock bottom in terms of distrust and finally started to turn the corner and recover lost ground on its rivals. After spending over a year as Australia’s most distrusted brand from June 2023 until September 2024, Optus moved out of bottom spot as distrust began to soften and over the last year Optus has ranked as Australia’s fourth most distrusted brand.

“However, the latest setback has clearly triggered memories of the telco’s other failures in recent years in what neuroscientists call a ‘reactivation loop’. Once a brand becomes associated with distrust, the memory network reorganises around that idea.

“So, when a new ‘Optus event’ occurs – a penalty, outage, headline – it doesn’t land in isolation. One node lights up, and the whole network fires: “breach,” “unreliable,” “unsafe,” “chaotic,” “poor service.”

“The risks for Optus remain acute, but they’re not the only telco brand dealing with concerns driving distrust. Rival Telstra also faces a significant level of distrust, although this distrust tends to be driven by short-term pricing and service issues and the nation’s largest telco ranks as Australia’s eighth most distrusted brand overall – an unwanted top ten.

“The high levels of distrust that are faced by two of Australia’s most important telecommunications companies, and the industry more broadly, also bring into question the role of regulators such as ACMA (Australian Communications & Media Authority).

“Does ACMA have sufficient power to properly regulate an industry that is dealing with high levels of distrust? Does ACMA have sufficient insights into the sentiments of the community to equip them in upholding consumer protection and strengthening their enforcement powers?

“This special deep dive into Australia’s telecommunications industry provides a valuable insight into how everyday Australians view the performance of our most important telcos and what more they can do to win the public’s trust, and in the case of some – win back the public’s trust.

“Although a heavy degree of distrust in the industry does linger, it should be recognised that there are bright spots. Aussie Broadband is Australia’s most trusted telecommunications brand – and was recently recognised as the 2025 Roy Morgan Most Trusted Brand Awards – while Amaysim, Vodafone, and TPG Telecom are all comfortably ensconced in net trust territory.

View the special Australia’s Most Trusted and Distrusted Telcos Deep Dive Webinar.

Telecommunications Brands tracked in the Roy Morgan Risk Monitor:

Activ8me, Amaysim, Aussie Broadband, Belong, Boost Mobile, Dodo, Exetel, Huawei, iPrimus, iiNet, Internode, Lebara, MATE, Moose Mobile, Motorola, NBN Co, Nokia, Oppo, Optus, Southern Phones, SpinTel, Starlink, Tangerine, Telstra, TPG and Vodafone.

The nine brands bolded above have large enough sample sizes to feature in the main Risk Report.

Subscribe to Roy Morgan’s YouTube channel to ensure you don’t miss our next webinar on trust and distrust: https://www.youtube.com/c/roymorganaus.

Comprehensive Trust and Distrust Insights Reports are available in Roy Morgan’s online store, including the Telco Providers Trust and Distrust Insights Report here. The Risk Report June 2025 with rankings of over 230 brands and analysis by industry is now available for purchase here. The latest Trust and Distrust Webinar Report with insights into trust and distrust across various industries is available here. Roy Morgan provides research and consulting services to actively minimize distrust and associated risks, to fast-track recovery from reputation crises, and to build trust.

The Roy Morgan Risk Monitor surveys approximately 1,500-2,000 Australians every month (over 20,000 per year) to measure levels of trust and distrust of around 1,000 brands across 27 industries. Respondents are asked which brands they trust, and why, and which brands they distrust, and why. The survey is designed to be open-ended, context-free, and unprompted. Roy Morgan Risk Monitor data is available in a variety of formats, from snapshot overviews to detailed tracking of individual brands and competitors. Industry Trust and Brand Health Surveys are also conducted (e.g. Private Health Insurance, Agribusiness, Banking, Travel and Tourism, Telco, Utilities, Insurance, etc.) for deep insights into brand health, perceptions of, and customer experience (CX) with brands.

To learn more call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is the source of the most comprehensive data on Australians’ behaviour and attitudes, surveying over 1,000 people weekly in a continuous cycle that has been running for two decades. The company has more than 80 years’ experience collecting objective, independent information.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |