Interest rate increases set to hit mortgage holders in Victoria, Queensland, and Tasmania the hardest

New research from Roy Morgan shows mortgage holders in Victoria, Queensland, and Tasmania, are set to be hit hardest by the Reserve Bank’s decision to raise interest rates by 0.25% to 3.85%.

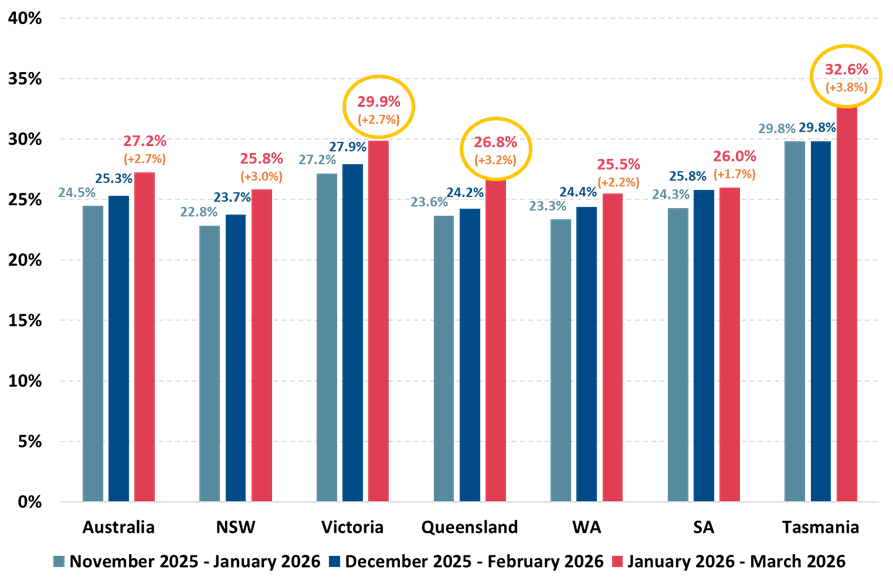

The latest Roy Morgan data on mortgage stress (January 28, 2026: Risk of mortgage stress drops to lowest for three years, but rising inflation poses a risk of interest rates heading up in 2026) shows 24.5% of mortgage holders are now ‘At Risk’ of mortgage stress, the recent interest rate rise is expected to increase this to 25.3%, and an interest rate increase in March by +0.25% to 4.1% would increase this to 27.2% (up 2.7% points from now) – 1,322,000 mortgage holders.

Mortgage Stress is highest in Victoria & Tasmania, lowest in New South Wales

A deep dive into Roy Morgan’s data on mortgage stress by State shows the situation is worst in Tasmania with 29.8% of mortgage holders classified as ‘At Risk’, and this will increase 3.8% points to 32.6% if the Reserve Bank (RBA) increases interest rates again in March by +0.25% to 4.1%.

In clear second place is Victoria with 27.2% of mortgage holders classified as ‘At Risk’ and set to increase to 29.9% (up 2.7% points) following another RBA interest rate increase.

However, a potential RBA interest rate increase will hit hardest in Queensland and would mean 26.8% of mortgage holders ‘At Risk’ – an increase of 3.2% points.

Interestingly, it is mortgage holders in New South Wales that have the lowest level of mortgage stress at only 22.8% of mortgage holders. If the RBA decides to raise interest rates by +0.25% to 4.1% in March this will increase by 3% points to 25.8%, lower than every State except Western Australia (25.5%).

‘At Risk’ of Mortgage Stress – % of Owner-Occupied Mortgage-Holders by State & Forecast

Source: Roy Morgan Single Source (Australia), October – December 2025, n=3,278.

Base: Australians 14+ with owner occupied home loan.

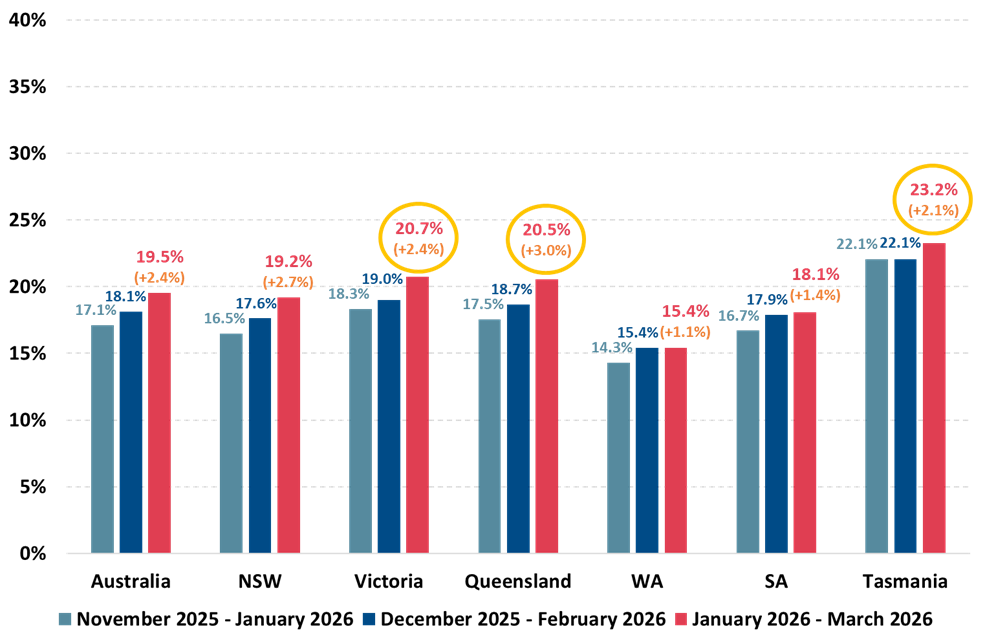

Mortgage Holders ‘Extremely At Risk’ of mortgage stress also highest in Victoria and Tasmania

A look at those mortgage holders that are ‘Extremely At Risk’ of mortgage stress shows a similar trend. Overall, 17.1% of mortgage holders are ‘Extremely At Risk’, and this will increase 2.4% points to 19.5% if the Reserve Bank increases interest rates by +0.25% to 4.1% in March – 947,000 mortgage holders.

Once again, Tasmanians are under the most mortgage stress – 22.1% of Tasmanian mortgage holders are ‘Extremely At Risk’, and this is set to increase 2.1% points to 23.2% of mortgage holders in March.

In second place is Victoria with 18.3% of mortgage holders classified as ‘Extremely At Risk’ and set to increase to 20.7% (up 2.4% points) following another RBA interest rate increase.

Queensland will be hit hardest by another RBA interest rate increase with those ‘Extremely At Risk’ rising from 17.5% currently, up by 3% points to 20.5% of mortgage holders.

Western Australia has clearly the lowest level of those ‘Extremely At Risk’ at only 14.3%. Another interest rate increase will see this rising by 1.1% points to 15.4% - even further below the national average.

‘Extremely At Risk’ of Mortgage Stress – % of Owner-Occupied Mortgage-Holders by State

Source: Roy Morgan Single Source (Australia), October – December 2025, n=3,278.

Base: Australians 14+ with owner occupied home loan.

How are mortgage holders considered ‘At Risk’ or ‘Extremely At Risk’ determined?

Roy Morgan considers the risk of ‘mortgage stress’ among mortgage holders in two ways:

Mortgage holders are considered ‘At Risk’[1] if their mortgage repayments are greater than a certain percentage of household income – depending on income and spending.

Mortgage holders are considered ‘Extremely at Risk’[2] if even the ‘interest only’ is over a certain proportion of household income.

Michele Levine, CEO Roy Morgan, says mortgage stress dropped to a three-year low in December, but the Reserve Bank’s decision to raise interest rates in early February, and the possibility of further interest rate increases to come, means mortgage stress is already on the way up again:

“The latest Roy Morgan data shows mortgage stress dropping to a three year low in December 2025 of 24.5% of mortgage holders – 1,187,000 ‘At Risk’ of mortgage stress. This is the lowest rate of mortgage stress for three years since December 2022 (23.9%, 1,100 mortgage holders).

“However, this respite has proven to be short-lived with the Reserve Bank already lifting interest rates in early February by +0.25% to 3.85%, and many economists believe there will be further interest rate increases to come.

“Roy Morgan has modelled the impact of the interest rate increase in February by +0.25% to 3.85%,, and a potential interest rate increase of +0.25% to 4.1% in March 2026. If there is another interest rate increase in March, the level of mortgage stress will increase to 27.2% (up 2.7% points) – and this rate rise will hit mortgage holders hardest in Victoria, Queensland, and Tasmania.

“Mortgage stress in Victoria would increase 2.7% points to 29.9%, in Queensland would be up 3.2% points to 26.8%, and would increase by 3.8% points to 32.6% in Tasmania – the largest jump in mortgage stress of any State, and clearly the highest level of mortgage stress.

“Interestingly, despite having the highest house prices in the nation, mortgage stress is currently lowest in New South Wales at only 22.8%. However, an increase to interest rates will see this rise by 3% points to 25.8% – over one-in-four mortgage holders in our largest State.

“A deeper analysis of the data within States shows a consistent trend with mortgage stress higher in the Capital Cities and set to be more heavily impacted by interest rate rises. This trend bears out with mortgage stress higher in Sydney than Country NSW, higher in Melbourne than Country Victoria, higher in Perth than Country WA, and higher in Adelaide than Country SA.

“However, there is a glaring exception to this trend with the situation reversed in Queensland – a State with a larger population outside the Capital City than within it. In Queensland, mortgage stress is significantly higher in areas outside Brisbane – which includes large regional areas such as the Gold Coast, Sunshine Coast, and North Queensland cities like Cairns and Townsville, than Brisbane.

“The forecasts for the impact on those mortgage holders ‘Extremely At Risk’ shows a similar trend with mortgage stress highest in Victoria, Queensland, and Tasmania. The number of mortgage holders ‘Extremely At Risk’ is lowest in Western Australia.

“The key takeout from these results is that further interest rate increases are set to be a painful experience for many Australians with almost one-in-four mortgage holders already classified as ‘At Risk’ (24.5%) of mortgage stress, and over one-in-six classified as ‘Extremely At Risk’ (17.1%).”

These are the latest findings from Roy Morgan’s Single Source Survey, based on in-depth interviews conducted with over 60,000 Australians each year including over 10,000 owner-occupied mortgage-holders.

[1] "At Risk" is based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

[2] "Extremely at Risk" is also based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the Standard Variable Rate set by the RBA and the amount now outstanding on their home loan.

To learn more about Roy Morgan’s mortgage data, call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com. Please click on this link to the Roy Morgan Online Store.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |