In July Australian unemployment was virtually unchanged at 10.3%, but under-employment surged to 10.9%

In July 2025, Australian ‘real’ unemployment was virtually unchanged at 1,644,000 (down 0.1% to 10.3% of the workforce). However, under-employment surged in July, increasing by 158,000 to 1,737,000 (up 1% to 10.9%).

This is the first time since January that under-employment is higher than unemployment, and the rise in under-employment was matched by a surge in part-time jobs – now at their highest number so far this year.

Roy Morgan estimates the overall workforce size (which adds together the employed and unemployed) at just over 15.9 million in July – 15,930,000 to be exact, up 43,000 on a month ago, and representing 69% of Australians aged 14+.

The rise in the workforce was driven by increasing employment, which increased 53,000 to 14,286,000 driven by rising part-time employment, up 75,000 to 5,097,000. In contrast, full-time employment softened marginally, down 22,000 to 9,189,000. Overall employment represents 61.9% of Australians aged 14+.

Detailed Roy Morgan Employment Estimates in July:

- Australian workforce increased by 43,000 in July to just over 15.9 million:

In July the Australian workforce increased 43,000 to 15,930,000 driven by an increase in employment, up 53,000 to 14,286,000 while unemployment dropped 10,000 to 1,644,000.

- Overall employment increased in July driven by a rise in part-time employment:

Australian employment increased 53,000 to 14,286,000 driven by an increase in part-time employment, up 75,000 to 5,097,000. However, full-time employment dropped 22,000 to 9,189,000.

- Unemployment was virtually unchanged in July at 10.3%:

1,644,000 Australians were unemployed (10.3% of the workforce, down 0.1%), down 10,000 from June. The small dip in unemployment was driven by fewer people looking for part-time work, down 157,000 to 949,000 which was offset by many more people looking for full-time work, up 147,000 to 695,000.

- Under-employment soars in July, driving overall unemployment and under-employed to 21.2%:

In addition to the unemployed, a further 1.74 million Australians (10.9% of the workforce, up 1%) were under-employed, i.e. working part-time but looking for more work, up 158,000 from June. In total 3.38 million Australians (21.2% of the workforce) were either unemployed or under-employed in July.

- Comparisons with three years ago, during the early days of the Albanese Government (July 2022), show a rapidly increasing population and workforce driving employment growth:

The Australian population aged 14+ in July 2025 was estimated at 23,083,000 (up 1,745,000 from July 2022 – more than double the pre-pandemic average of 840,000 over an average three-year period since 1999). The workforce in July 2025 was 15,930,000 (up 1,244,000 from July 2022 – almost double the pre-pandemic average three-year growth of 689,000) – comprising 14,286,000 employed Australians (up 846,000) and 1,644,000 unemployed Australians (up 398,000) – so every indicator has increased rapidly.

The July Roy Morgan Unemployment estimates were obtained by surveying an Australia-wide cross section of people aged 14+. A person is classified as unemployed if they are looking for work, no matter when. The ‘real’ unemployment rate is presented as a percentage of the workforce (employed & unemployed).

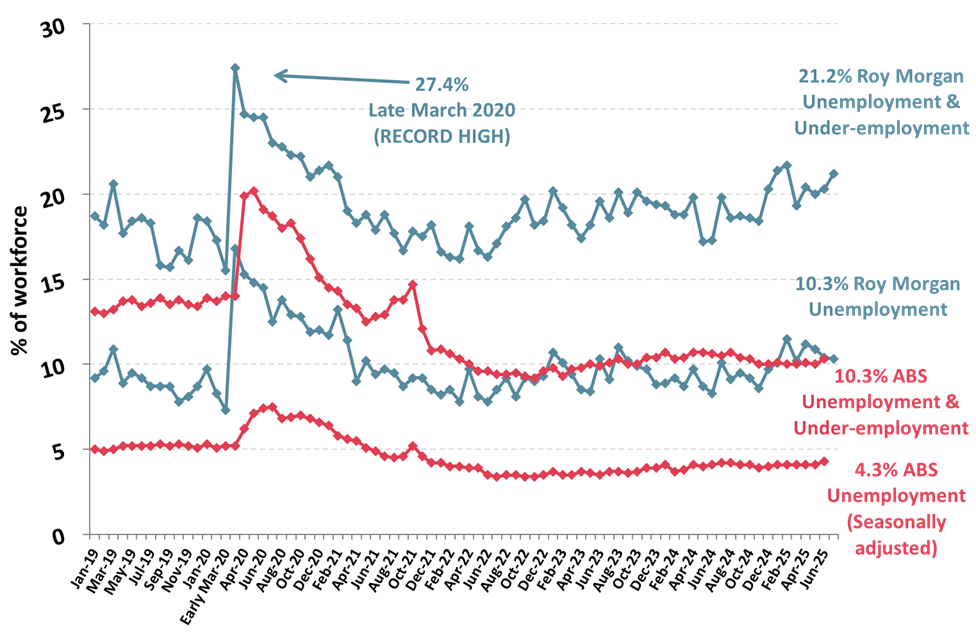

Roy Morgan Unemployment & Under-employment (2019-2025)

Source: Roy Morgan Single Source January 2019 – July 2025. Average monthly interviews 5,000.

Note: Roy Morgan unemployment estimates are actual data while the ABS estimates are seasonally adjusted.

Michele Levine, CEO Roy Morgan, says the latest Roy Morgan employment estimates for July show unemployment virtually unchanged but a surge in part-time employment has also led to a rise in under-employment – showing the importance of accurate labour statistics:

“The latest Roy Morgan employment estimates for July show overall Australian unemployment or under-employment increasing by 147,000 to 3,381,000 (21.2% of the workforce, up 0.9%). Although unemployment was virtually unchanged at 1,644,000 (10.3%, down 0.1%), there was a surge in under-employment, up 157,000 to 1,737,000 (10.9%, up 1%).

“The increase in under-employment was correlated to a surge in part-time employment, which increased by 75,000 to 5,097,000 – the highest level of part-time employment so far this year. In contrast, full-time employment was slightly down by 22,000 to 9,189,000 in July.

“The movements in the Australian labour market in July show a continuing weakness with full-time employment down over 200,000 from the same month a year ago, while part-time employment has taken up the slack and is up over 330,000 compared to July 2024.

“Looking longer-term overall Australian unemployment and under-employment has been in excess of 3 million for eight straight months since late 2024. This is around double the latest ABS unemployment and under-employment estimate for June 2025 (10.3% of the workforce, 1,581,000).

“However, the ‘ABS Potential Workers’ estimates for 2025 (released recently on July 29, 2025) show Potential workers (equivalent to an expanded definition of unemployment) at 1,650,200 (10.3%) and Under-employment (expanded definition) at 1,481,000 (9.3%) – a total of 3,131,500 (19.6%).

“A comparison of the monthly Roy Morgan unemployment and under-employment estimates and the ‘ABS Potential Workers’ estimates of unemployment and under-employment show the two series produce very similar results for Australia’s true level of labour under-utilisation – over 3 million.

“The accuracy of labour market statistics is also a big issue overseas. US President Donald Trump last week fired Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer after alleging the BLS – which produces the monthly US employment estimates – had ‘faked’ jobs numbers to assist his political opponents – including former US President Joe Biden and Presidential rival Kamala Harris.

“Trump’s allegation was that the BLS issued overly positive jobs numbers – showing strong employment growth – for the Biden Administration during the 2024 US Presidential Election which were later revised downwards after Trump won last year’s election.

“There is a massive discrepancy between the monthly ABS employment estimates for June – which shows overall unemployment and under-employment at 1,581,000 (10.3% of the workforce) and the annual ABS Potential Workers survey which estimates labour under-utilisation at 3,131,500 (19.6%).

“However, the annual ABS Potential Workers survey estimate of labour under-utilisation is a comparable figure to the latest Roy Morgan unemployment and under-employment estimate of 3,381,000 (21.2%) which supports the assertion that there are many more Australians looking for work, or looking for more work, than the monthly ABS unemployment series shows.

“The reasons for this discrepancy are due to the definitions used to define someone as unemployed or under-employed – which were first used in the late 1940s following the end of World War II.

“The fact is that the structure of the labour force has changed significantly over the last 80 years and the increasing casualisation of the workforce – which includes far higher levels of part-time employment than decades ago – means employment estimate models that were developed 80 years ago are clearly no longer ‘fit for purpose’ in the modern economy.”

This Roy Morgan survey on Australia’s unemployment and ‘under-employed’* is based on weekly interviews of 967,402 Australians aged 14 and over between December 2008 and July 2025 and includes 6,059 telephone and online interviews in July 2025. *The ‘under-employed’ are those people who are in part-time work or freelancers who are looking for more work.

Contact Roy Morgan to learn more about Australia’s unemployed and under-employed; who and where they are, and the challenges they face as they search for employment opportunities.

Visit the Roy Morgan Online Store to purchase employment profiles, including for Australians who are employed, unemployed, under-employed, employed part-time, employed full-time, retired, studying and many more.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |