Over one-in-three Australian credit card holders rely on credit to make ends meet

New research from Roy Morgan’s Single Source reveals a surprising financial reality for many Australians. While credit card holders are generally better off than the average Australian, more than one in three (36%) still leave part of their credit card debt unpaid each month.

Australian credit card holders have higher incomes than non-credit card holders. Their median annual personal income [1] is over $20,000 higher.

Nevertheless, more than one-third (36%) of credit card holders leave credit card debt unpaid at the end of each month. This equates to an estimated 2,440,000 Australians, or 11% of the Australian adult population.

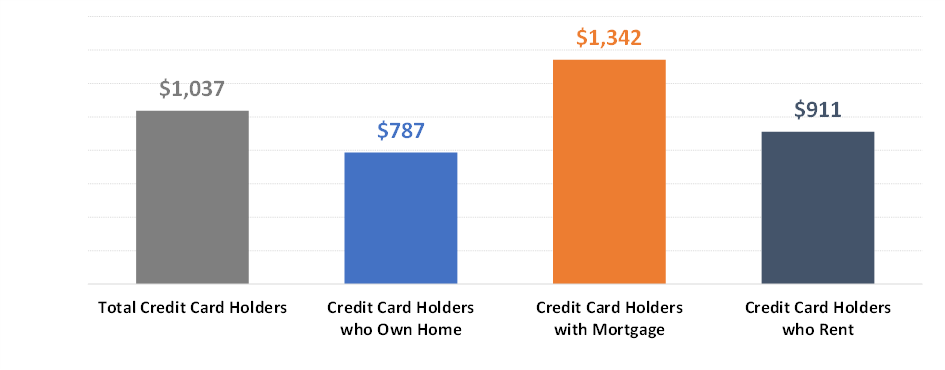

Among the 2.44 million Australians who don’t pay off their credit card each month, the median amount owed is $1,037. Those with greater ongoing living expenses tend to owe more (Chart 1 below), with more owed by mortgage payers ($1,342) and renters ($911) than by those owning their home outright ($787).

An estimated 423,000 Australians leave an unpaid credit card debt each month of over $5,000. This equates to 2% of the total Australian adult population, and 6% of Australian credit card holders.

Chart 1: Median Amount Owing on Credit Card each Month among those not paying off their Card

Source: Roy Morgan Single Source Australia, Sept. 2024 – Aug. 2025, n = 22,338.

Base: Australians 18+ who are credit card holders

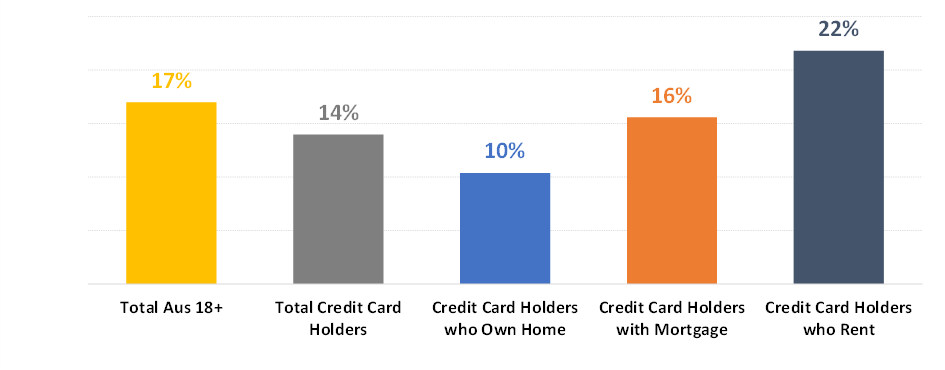

One-in-seven (14%) credit card holders access buy-now-pay-later services (BNPL)

Not only do credit card holders who have greater ongoing living expenses leave larger amounts unpaid on their credit card each month, but they are also more likely to have accessed buy-now-pay-later (BNPL) services (in an average four weeks). BNPL usage is higher among credit card holders that rent (22%) or pay a mortgage (16%) than among those who own their home outright (10%).

Chart 2: Australians using BNPL in the Last Four Weeks

Source: Roy Morgan Single Source Australia, Sept. 2024 – Aug. 2025, n = 63,438.

Base: Australians 18+

Roy Morgan General Manager of Financial Services, Suela Qemal, commented:

“While Australian credit card holders tend to be better off than other Australians, more than a third (36%) do not pay off their credit card balance each month. This equates to an estimated 2,440,000 Australians, or 11% of the Australian adult population,

“Among those not paying off their balance, the median amount owed is $1,037, though this rises among those with greater ongoing living expenses, with more owed by mortgage payers ($1,342) or renters ($911) than by those owning their home outright ($787). Disturbingly, an estimated 423,000 Australians leave unpaid credit card debt each month of over $5,000. This equates to 2% of the total Australian adult population, and 6% of credit card holders.

“The reliance on credit extends beyond credit cards. Recent buy-now-pay-later (BNPL) use is also more prevalent among credit card holders under greater financial pressure, with 22% of renters and 16% of mortgage payers using BNPL services (in an average four weeks), compared with 10% of mortgage-free homeowners.

“These patterns suggest that cost-of-living pressures, particularly the high expense of rent and mortgage repayments, are key drivers for why many Australians rely on credit to make ends meet.”

These latest findings come from the Roy Morgan Single Source survey, derived from in-depth interviews with over 60,000 Australians each year.

Related research findings

For further in-depth analysis, view the various Banking and Finance Currency Reports.

For comments or more information about Roy Morgan Small Business Research data please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

[1] Average across both workers and non-workers

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |