Trust in banking and finance industries – including all ‘big four’ banks – increases significantly over the last 12 months

A special Roy Morgan deep dive into trust and distrust in the banking and finance industry shows a remarkable recovery in levels of trust and a reduction in distrust for the industry over the last 12 months.

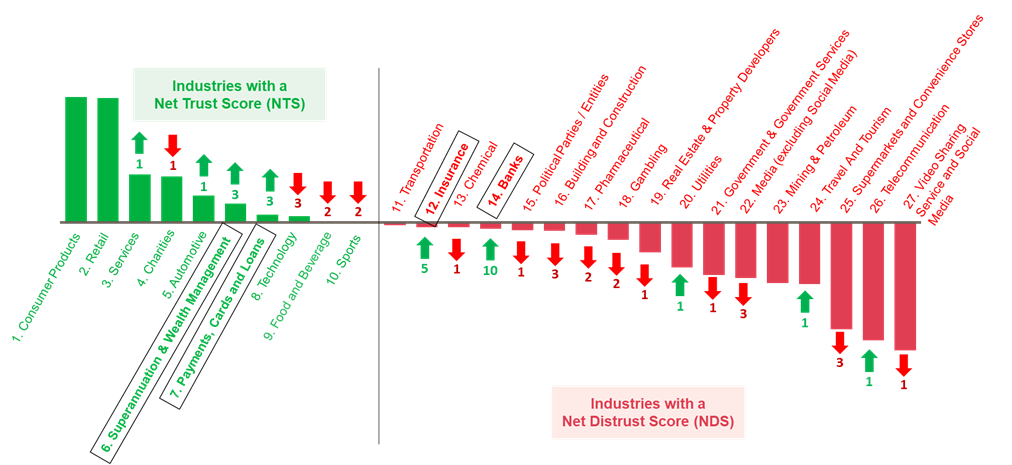

Roy Morgan measures trust and distrust across 27 industries and over 200 key Australian brands, on an ongoing basis, and compared to a year ago, trust has jumped and distrust has decreased across the banking and finance industries.

The Banking industry itself is now the 14th most trusted industry in Australia, up 10 spots from a year ago, lifted higher by rising trust and decreasing distrust in the big four banks.

In addition, the Insurance industry is up five spots and is now the 12th most trusted industry. The Payments, Cards & Loans industry is up three places to 7th and the Superannuation & Wealth Management industry is up three positions to 6th overall.

These four industries have improved more than any other sectors over the last 12 months.

View the webinar of Roy Morgan CEO Michele Levine’s full presentation of Australia’s Banking & Finance Landscape in late 2025 here:

Trust and distrust rankings of 27 Australian industries – 12 months to August 2025

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to Aug 2025.

Base: Australians 14+, Latest 12-month average n= 20,562. Arrows and numbers represent ranking moves since Aug 2024.

Big four banks closely track Roy Morgan’s Benchmark Recovery Rate

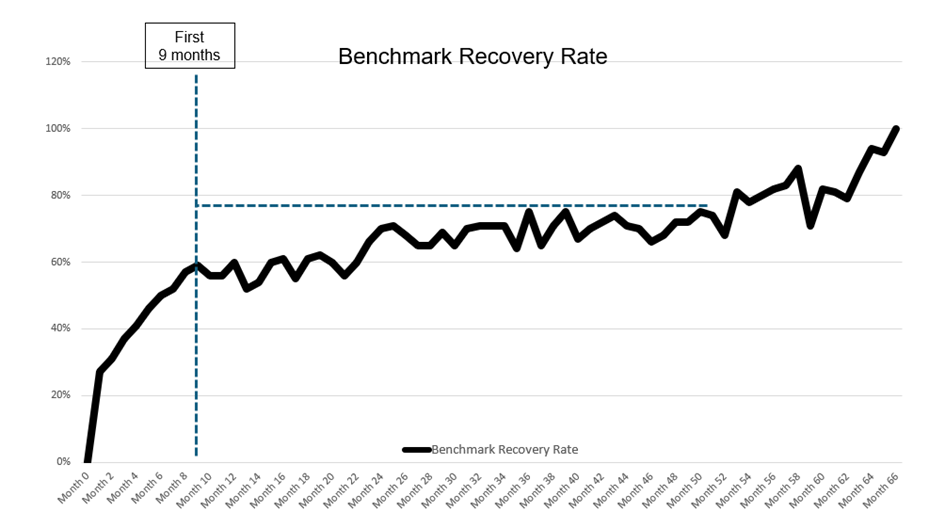

Roy Morgan has conducted detailed modelling of the recovery rates of 16 major brands impacted by dramatic distrust and/or trust events or scandals in Australia over the past seven years.

It is important to note that each brand’s journey to recovery is different and highly dependent on actions, additional setbacks that hinder or reverse brand recovery, and external factors such as emerging scandals for other brands that can shift awareness and recall.

Even for brands that actively address distrust and rebuild trust, recovery is often gradual, nonlinear, and volatile. This highlights that Net Distrust (where more Australians distrust a brand than the number of Australians who trust the same brand) does not fade quickly, and sustained and long-term efforts are crucial.

After 12 months, 92% of brands had not fully recovered, 75% had not recovered after 24 months, 50% had not recovered after 48 months, and after 5 years, 25% had still not recovered.

Averaging how long it took the 16 brands to recover, the chart below shows what the Benchmark Recovery Rate looks like over six years. What’s interesting is that if you haven’t achieved good recovery in the first 9 months, the next four years are a real slog.

Roy Morgan’s Benchmark Recovery Rate

Source: Roy Morgan Single Source (Australia). Risk Monitor. Commercial in confidence.

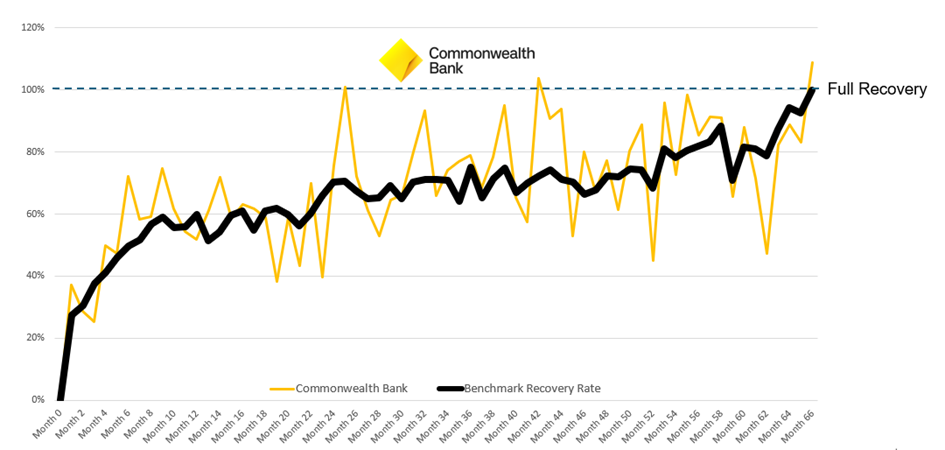

Roy Morgan has tracked the recovery in ‘Net Trust’ for each of the big four banks over the last six years since ‘The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry’ reported in early 2019.

The Royal Commission Report led to a significant decline in trust for all four of the big four banks – and many other firms in the industry.

The nation’s most trusted bank, The Commonwealth Bank, has generally followed the Benchmark Recovery Rate trajectory, though it has been relatively volatile.

It took 67 months (almost 6 years) to get back to a strong position; however, it does not yet qualify as a stable recovery – we’re looking for 6 months above the 100% ‘full recovery’ line.

Commonwealth Bank’s recovery has generally followed the Benchmark Recovery Rate

Source: Roy Morgan Single Source (Australia). Risk Monitor. Commercial in confidence.

Roy Morgan Risk Magnitude Scale

Our second innovation is an early warning system for brands. Using monthly scores, Roy Morgan’s Risk Lab devised a ‘Roy Morgan Risk Magnitude Scale’ which can be applied to brands we track ongoing via the Risk Monitor.

Clients receive alerts when distrust reaches predetermined danger levels – providing a key warning signal and the opportunity to proactively manage the distrust risk.

Roy Morgan generally only releases 12 monthly scores publicly – but we also track monthly scores, which we share with our clients.

Monthly scores provide timely tracking of trust, and more importantly distrust. They are essential in managing the risk of distrust, providing an early indication of where a brand’s trajectory is headed.

The Roy Morgan Risk Magnitude Scale has three tiers – Alert, High Alert, and Crisis.

After almost a year in the Crisis and High Alert zones following the Royal Commission, the Commonwealth Bank has steadily reduced distrust to its lowest level since 2018 and has now held above the Alert threshold for more than three years. This sustained stability has helped CBA reclaim leadership as Australia’s most trusted bank in 2025.

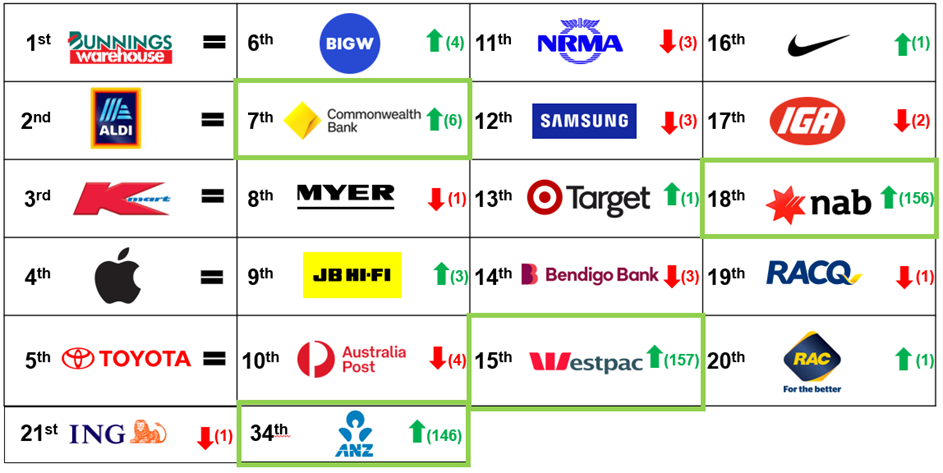

Big four banks soar up the rankings over the last 12 months – led by Commonwealth Bank and Westpac

A look at the key brands driving this resurgence shows the big four banks are ALL pulling their weight and have powered the recovery in trust ratings for the banking industry over the last 12 months.

The Commonwealth Bank – Roy Morgan’s recently awarded ‘Most Trusted Brand in Banking’ for 2025 – has increased six spots from a year ago to a highest ever ranking of 7th overall.

The biggest improvement of any brand – in terms of places gained compared to a year ago – is by Westpac which has soared a stunning 157 places to 15th position overall to be just behind the highly rated Bendigo Bank in 14th place overall.

Not to be outdone, the NAB has increased a similarly impressive 156 spots to enter the top 20 brands in 18th overall, replacing ING which slipped one spot to be just outside the top 20 in 21st spot.

The third biggest improver is the ANZ which sprinted up the rankings, rising an impressive 146 spots to be in 34th place overall and is set to enter the top 20 brands in the near future.

Top 20 Most Trusted Brands – August 2025 (with noteworthy banks outside top 20 included)

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to Aug 2025.

Base: Australians 14+, Latest 12-month average n= 20,562. Arrows and numbers represent ranking moves since Aug 2024.

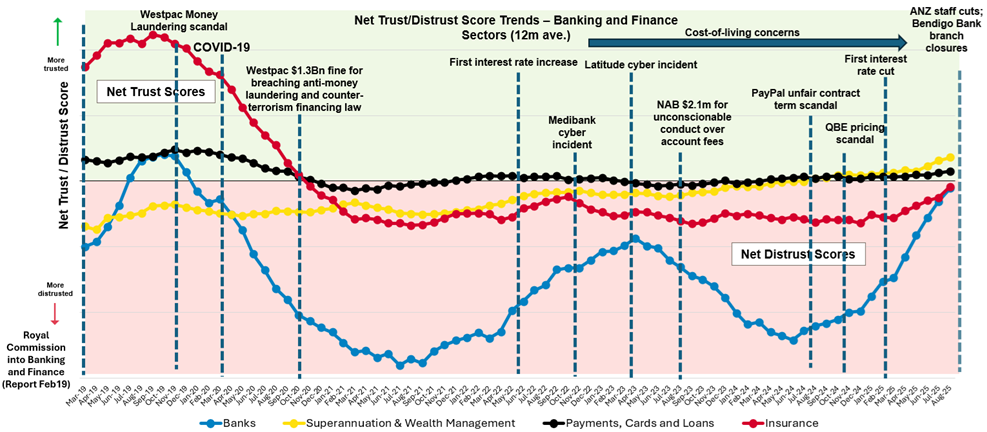

Net Trust improves for all banking and finance industries over the last 12 months

The Banking industry has enjoyed a strong improvement in ‘Net Trust’ since hitting a mult-year low in mid-2024. Importantly, the improvement in ‘Net Trust’ for the Banking industry began more than six months before the Reserve Bank’s first interest rate cut of the current cycle in February 2025 – indicating there is more to this improvement than lower interest rates and reduced loan payments.

Net Trust and Distrust for the Banking & Finance Industries: Banks, Insurance, Superannuation & Wealth Management, and Payments, Cards & Loans

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to Aug 2025.

Base: Australians 14+, Latest 12-month average n= 20,562. Arrows and numbers represent ranking moves since Aug 2024.

The industries encompassing ‘Superannuation and Wealth Management’ as well as ‘Payments, Cards, & Loans’ have improved more gradually, and over a longer time period. Both industries were in ‘Net Distrust’ territory 18 months ago, in February 2024, but have since steadily moved into ‘Net Trust’.

Also improving its ‘Net Trust’ scores – although still marginally in negative territory overall – is the Insurance industry. The recovery for the Insurance industry has been concentrated in 2025 after its ‘Net Distrust’ reached its 2024 low at the tail end of the year – in December 2024.

Considered as a group, the signs are good with all sectors reaching their highest levels in over four years.

Good service, customer relationships and reliability drive increasing trust in banking industry

There are several key themes that emerge as fostering a healthy, and improving, level of trust in the banking sector. Strong customer relationships are a key factor driving renewed trust and some of the stand-out comments from Australians over the last year include:

- “Has been solid and dependable as my major bank, without charging excess fees, and has shown commitment to communities.”

- “Have banked with them for over 50 years with no problem.”

- “Because in the past months I have been staying here, my bank is secure, their services are prompt and very reliable and I had used their buy now pay later scheme to pay for my grocery errands when I need to prioritize tuition fee first or other related necessities - $100 and up and I had the chance to pay it in 4 instalments, and they have assisted me well.”

A strong focus on delivering for customers is an important factor for Australians giving banks a higher level of trust over the last year as illustrated by these comments on why people trust banks:

- “They don’t take unnecessary charges from you. Great assistance when travelling overseas.”

- “They look after our farmers and rural community. They care about people from all walks of life.”

- “They have proven themselves trustworthy – they keep their promises and provide good service.”

Reliability and dependability are major reasons given by many Australians for why they trust their bank, and this was mentioned by many Australians in their comments:

- “Has been solid and dependable as my major bank, without charging excess fees, and have shown commitment to communities.”

- “They seem to provide a consistent pattern of behaviour which balances their interests and those of their customers.”

- “Because I have an account with them, they’re awesome, and seem to care about me personally.”

Distrust of banks is centred on being profit-driven, having unaffordable fees and poor service

On the flipside, there are several themes that emerge as driving distrust in the banking sector, led by a perception from many Australians that the banks are primarily motivated by increasing their profits at the expense of their own customers at times:

- “They care more about money than consumer health and safety.”

- “They overcharge on fees and rates and make outrageous profits.”

- “One of the big 4 banks, which I personally feel are all the same. To ensure they are profiting off everyday citizens' banking.”

A key theme mentioned by many Australians that drives distrust in the banking sector is the view that they’re not sufficiently customer focused:

- “Poor customer service. Fees to use tap and go and refusing cash withdrawals. Interest rates. Profit margin vs customer care.”

- “Profits are before people and the environment. Encouraging a gap between the rich and the poor. Influencing the government.”

- “The fees associated with everyday banking. The excessive Interest incurred on loans, lack of helpful staff members, and slow service just do not feel like the customer is valued. No incentives for long-term customers.”

There were many Australians that felt banks are charging too much and are making many services unaffordable with their excessive fees and high interest rates on their key products:

- “Interest rates are too high on credit cards and loans. They don't look after their customers they’re just interested in making more money.”

- “I distrust all banks that charge exorbitant interest rates on credit cards and then offer little interest on term deposits and penalise people for accessing their term deposits early.”

- “Australian banks have the highest profits of any others in the world. They lock home buyers in and force builders to give fixed-priced contracts for borrowers, and the building industry is going through huge price increases, forcing builders into bankruptcy, and the banks still win, are under pressure to make huge profits, etc.”

Roy Morgan CEO Michele Levine says the stunning rise in ‘Net Trust’ for the Banking industry over the last year has been driven by both rising trust, and declining distrust, with the improved performance of the ‘big four banks’ a decisive factor in driving the Banking industry up the rankings:

“The Banking industry has experienced the most rapid rise in ‘Net Trust’ over the last year of any industry – rising 10 places to be the 14th most trusted industry overall in August 2025.

“Importantly, other finance industries have also improved in “Net Trust’ including the Insurance industry, up five spots to 12th most trusted industry overall, Payments, Cards & Loans, up three positions to seventh, and Superannuation & Wealth Management, up three places to sixth.

“The rise in ‘Net Trust’ across these four related industries is despite overall distrust in brands and industries in Australia remaining near record highs over the past year. Overall levels of trust in brands and industries have increased marginally compared to 12 months ago.

“The ‘big four banks’ are leading the charge with Australia’s ‘Most Trusted Bank Brand’ – the Commonwealth Bank – rising six spots to an all-time high ranking of seventh most trusted brand overall. Following close behind are Westpac, up 157 spots to 15th, NAB, up 156 places to 18th, and ANZ, up 146 positions to 34th most trusted brand overall – these are the three most impressive increases of any brands over the last year.

“The rapid recovery in trust for the big four banks over the last year is clear when their Net Trust scores are compared to Roy Morgan’s Benchmark Recovery Rate which models how quickly brands recover to their best monthly score after suffering their worst monthly score.

“The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry reported in early 2019 and led to a significant decline in trust for all four of the big four banks – and many other firms in the industry.

“Since the conclusion of the Royal Commission, the recovery in Net Trust for the banks has closely tracked the Benchmark Recovery Rate over the last six years. All four banks have now recovered fully to be above their previous ‘Net Trust’ level in 2019. Most impressively, the NAB has consistently increased their Net Trust above the Benchmark Recovery Rate under the stewardship of CEO Ross McEwan (Dec. 2019 – April 2024) and current CEO Andrew Irvine (incumbent).

“Crucially, all four big banks have now clearly exited the ‘Alert’ stage on Roy Morgan’s Risk Magnitude Scale after languishing in the Alert/ High Alert/ Crisis stages in the year’s following the Banking and Finance Royal Commission.

“To learn more about Roy Morgan’s Benchmark Recovery Rate and Risk Magnitude Scale and how these new products based on extensive in-depth survey data into trust and distrust can be utilised to improve your brand health, contact Roy Morgan.”

View the webinar of Roy Morgan CEO Michele Levine’s full presentation of Australia’s Banking & Finance Landscape in late 2025 here:

Banking and Finance Trust & Distrust Insights Reports can be purchased here:

Since early 2018, Roy Morgan’s ongoing Risk Monitor has collected insights into companies and sectors Australians trust and distrust, and importantly reasons for these feelings.

The unique unprompted and open-ended methodology provides the opportunity for Australians to nominate any companies they trust or distrust in any sector. Each year around many Australians nominate companies in this sector, along with the reasons for each nomination in their own words – providing valuable quantitative and qualitative insights.

This report summarised analysis of insights into Australians’ perceptions of companies and the sector in general, including:

- Where the sector ranks on Net Trust/Distrust Score amongst 27 sectors.

- Net Trust/Distrust Scores and rankings of key companies.

- Breakdown of Trust and Distrust Scores for key companies.

- Thematic analysis of reasons Australians trust and distrust key companies.

- Actual example verbatim comments from reasons Australians trust and distrust key companies – in the actual words used by Australians.

- Analysis of impact of any scandals or major reputation events on scores and reasons for trust and distrust.

- Trend analysis from 2018 and demographic analysis.

- A PDF report of around 40 pages including Executive Summary, charts, tables and commentary summarising key findings.

Latest Roy Morgan Risk Report (June 2025) available here.

For comments or more information please contact:

Roy Morgan Enquiries

Office: +61 (03) 9224 5309

askroymorgan@roymorgan.com

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years of experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |