Confidence in the Mining Industry soars in the second half of 2025 as critical and rare earth mineral deals signed with US

Business Confidence among all businesses operating in the Mining industry has soared in the last six months during discussions, and eventually the signing, of critical and rare earth mineral deals between the Australian and US Governments worth billions of dollars in October 2025.

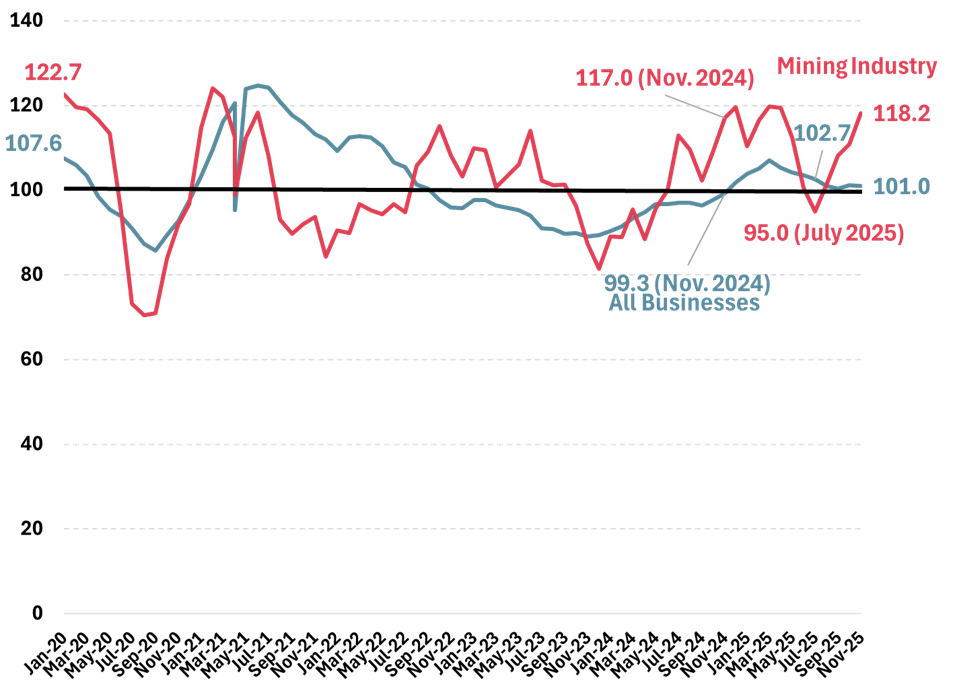

In the six months to November 2025, Business Confidence in the Mining industry increased to 118.2, up 23.2pts (+24.5%) since reaching a low of 95.0 in the six months to July 2025.

In contrast, overall, Roy Morgan Business Confidence during the same period since July 2025 has barely moved and declined by 1.7pts (-1.6%) to 101.0.

Looking back over the past year, Business Confidence within the Mining industry was at a similar level of 117.0 a year ago before plunging during the first half of 2025.

Longer-term confidence within the Mining industry has averaged 104.6 over the last six years, over 3pts above the overall average of Roy Morgan Business Confidence since January 2020 (101.5).

This Roy Morgan Business Confidence series is based on interviews with around 1,200 businesses each month to gauge their views on their company’s prospects as well as their assessment of the broader Australian economy.

Roy Morgan 6-Monthly Business Confidence – All Businesses vs. Mining Industry

Source: Roy Morgan Business Single Source, Aug 2019-Nov 2025. Average 6 monthly sample, n = 8,496.

Mining industry confidence driven up by businesses with under $5 million in revenue

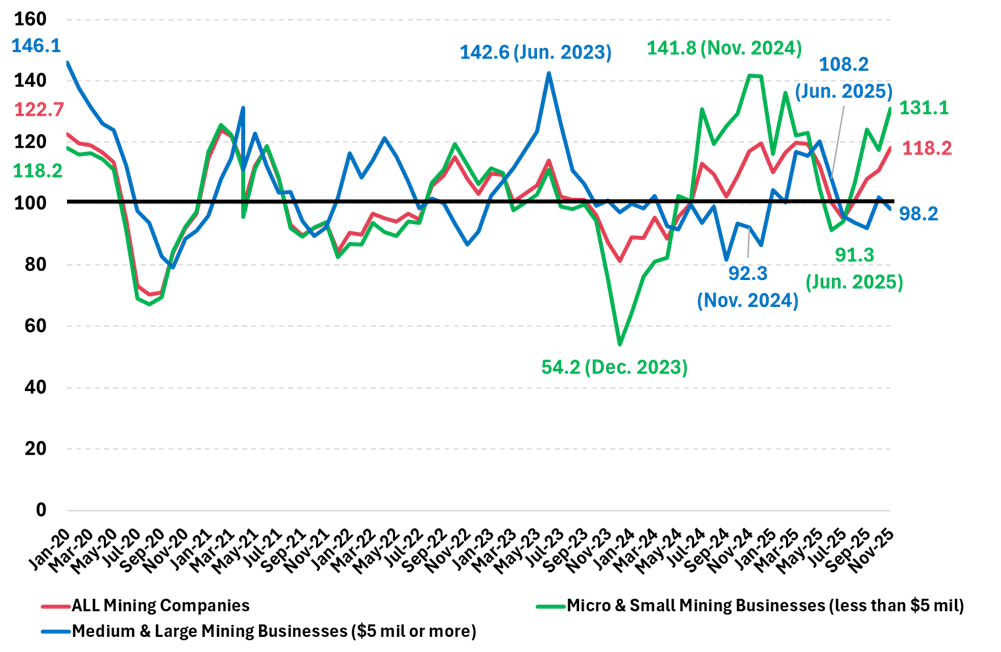

The mining industry is not just the major companies we all know about. Driving the boost to confidence in the mining industry in the last six months have been smaller players with less than $5 million in annual revenue. Business Confidence for this segment of the mining industry was at only 91.3 in the six months to June 2025 and has increased by 39.8pts (+43.5%) to 131.1.

In contrast, Business Confidence for larger mining businesses with annual revenue of $5 million or more has declined during this same period from 108.2 in the six months to June 2025, down by 10pts (-9.3%) to only 98.2.

Business Confidence in the Mining industry by size of annual revenue: 2019-2025

Source: Roy Morgan Business Single Source, Aug 2019-Nov 2025. Average 6 monthly sample in the mining industry, n = 162.

Confidence in the Mining Industry driven higher since mid-2025 by soaring confidence about the performance of the Australian economy over the next year and next five years:

- In the six months to November 2025, a slim majority of 53.1% (up 16.7ppts since July 2025) of mining businesses said their business is ‘better off’ financially than a year ago, while around a fifth, 21.5% (down 0.9ppts), said the business is ‘worse off’ – a net positive change of +17.6%;

- Mining businesses’ net views on their prospects for the next year have improved since mid-2025 with 60.4% (up 10.4ppts) expecting the business will be ‘better off’ financially this time next year, while a fifth, 20% (down 0.7ppts), expect the business will be ‘worse off’ – a net positive change of +11.1%;

- Confidence regarding the performance of the Australian economy over the next year has soared in since mid-2025 with 54.6% (up 17.6ppts) expecting ‘good times’ while 45.4% (down 17.3ppts) expect ‘bad times’ – a net positive change of +34.9%;

- Mining businesses’ views on the long-term future of the Australian economy over the next five years have improved more than any other indicator since mid-2025 – although the indicator is still in negative territory with 40.6% (up 25.8ppts) expecting ‘good times’ over the next five years compared to 59.2% (down 12.6ppts) expecting ‘bad times’ – a net positive change of +38.4%;

- A majority of mining businesses, 54.4% (up 17.1ppts) now say the next 12 months will be a a ‘good or bad time to invest in growing the business’while 25.7% (up 2.7ppts) say the next 12 months will be a ‘bad time to invest’ – a net positive change of +14.4%.

Michele Levine, CEO of Roy Morgan, says Business Confidence in the Mining industry has soared in the last six months as expectation grew about a critical minerals and rare earths deal between Australia and the United States which was eventually signed in mid-October 2025:

“Confidence in Australia’s mining industry has soared in recent months, increasing by 23.2pts (+24.5%) to 118.2 in the six months to November 2025, up from only 95.0 in the six months to July 2025. In contrast, broader Business Confidence has softened, down by 1.7pts (-1.6%) to 101.0 for the same period.

“Earlier in 2025, the uncertainty created by the Trump Administration’s tariff policies sent confidence in the mining industry – Australia’s largest export industry – plummeting. Mining industry confidence bottomed mid-year in the six months to July 2025 at 101.0.

“However, in mid-year discussions began about Australia and the United States signing an agreement related to the supply of critical and rare earth minerals. China dominates the current market for critical minerals and rare earths but due to tensions with the United States Government, the Trump Administration began to look for other sources of supply.

“These discussions eventually led to Prime Minister Anthony Albanese travelling to the United States and signing a multi-billion critical and rare earths minerals development deal with US President Donald Trump on October 20 with a vow for both governments to invest at least $1 Billion USD in the industry with a view of creating investments worth at least $8.5 Billion USD – and over the six months from October 2025.

“A closer analysis of the mining industry shows smaller mining businesses – those with less than $5 million in annual revenue – have driven the increase in confidence. Confidence among the smaller miners has soared by 39.8pts (+43.5%) to 131.1 in the six months to November 2025, up from only 91.3 in the six months to June 2025. Confidence among larger miners has gone in the opposite direction – down by 10pts to 98.2 during the same period.

“The two questions driving this increase relate to the Australian economy’s performance. Confidence about the performance of the Australian economy over the next year has improved by a net +34.9% since mid-2025, and confidence about the economy over the next five years has improved by a net +38.4%. Combined, these two questions alone account for almost 15pts of the increase of 23.2pts – over 60% of the increase.

“However, a look back at the history of Business Confidence in the mining industry does show wild swings in both directions, part of a ‘boom bust’ cycle that many associate with the industry.

“Looking forward, confidence in the industry will continue to rely on a strong pipeline of investment to service export markets worldwide. The new deal between Australia and the United States is meant to lead to billions of dollars of investment in the industry over the next few months, but until this funding is secured and invested there will remain a degree of uncertainty about just how much investment will in the end be made in these new ventures.”

The latest Roy Morgan Business Confidence results for the six months to November 2025 are based on 7,492 detailed interviews with a cross-section of Australian businesses from each State and Territory. Detailed findings are available to purchase on a monthly or annual subscription as part of the Roy Morgan Business Confidence Report.

For comments or more information please contact:

Michele Levine

CEO, Roy Morgan

Office: +61 (3) 9224 5215

Mobile: 0411 129 093

To learn more about Roy Morgan’s Business Confidence, Consumer Confidence and Inflation Expectations data call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |