Overall Australian unemployment and under-employment at 3.46 million in December – 13 months straight above 3 million

In December 2025, Australian ‘real’ unemployment increased by 41,000 to 1,669,000 (10.4% of the workforce, up 0.2%), and under-employment increased 78,000 to 1,787,000 (up 0.4% to 11.1%).

Roy Morgan estimates the overall workforce size (which adds together the employed and unemployed) at just above 16 million in December – 16,097,000 to be exact, up 130,000 on a month ago, and representing 69.2% of Australians aged 14+.

The increase in the workforce driven by increases in employment, up 89,000 to 14,428,000, and in unemployment, up 41,000 to 1,669,000. The rise in overall employment was driven by an increase in part-time employment, up 143,000 to 5,279,000 – a new record high part-time employment. In contrast, full-time employment was down 54,000 to 9,149,000. Overall employment represents 62% of Australians aged 14+.

Detailed Roy Morgan Employment Estimates in December:

- Australian workforce increased by 130,000 in December to just over 16 million:

In December the Australian workforce increased 130,000 to 16,097,000 driven by rising employment, up 89,000 to 14,428,000, and increasing unemployment, up 41,000 to 1,669,000.

- Overall employment increased in December driven by a jump in part-time employment:

Australian employment increased 89,000 to 14,428,000 driven by a jump in part-time employment, up 143,000 to 5,279,000, and equivalent to 36.6% of employed Australians. However, full-time employment dropped by 54,000 to 9,149,000, and equivalent to 63.4% of employed Australians.

- Unemployment increased by 0.2% to 10.4% in December:

1,669,000 Australians were unemployed (10.4% of the workforce, up 0.2%), up 41,000 from November. There were more people looking for full-time work, up 68,000 to 667,000, however, there were fewer people looking for part-time work, down 27,000 to 1,002,000.

- Under-employment was up in December; overall unemployment and under-employed at 21.5%:

In addition to the unemployed, a further 1.79 million Australians (11.1% of the workforce, up 0.4%) were under-employed, i.e. working part-time but looking for more work, up 78,000 from November. In total 3.46 million Australians (21.5% of the workforce) were either unemployed or under-employed in December.

- Comparisons with three years ago, during the early days of the Albanese Government (Dec. 2022), show a rapidly increasing population and workforce driving employment growth:

The Australian population aged 14+ in December 2025 was estimated at 23,261,000 (up 1,816,000 from December 2022 – more than double the pre-pandemic average growth of 840,000 over a three-year period). The workforce in December 2025 was 16,097,000 (up 1,145,000 from three years ago) – comprising 14,428,000 employed Australians (up 860,000) and 1,669,000 unemployed Australians (up 285,000).

The December Roy Morgan Unemployment estimates were obtained by surveying an Australia-wide cross section of people aged 14+. A person is classified as unemployed if they are looking for work, no matter when. The ‘real’ unemployment rate is presented as a percentage of the workforce (employed & unemployed).

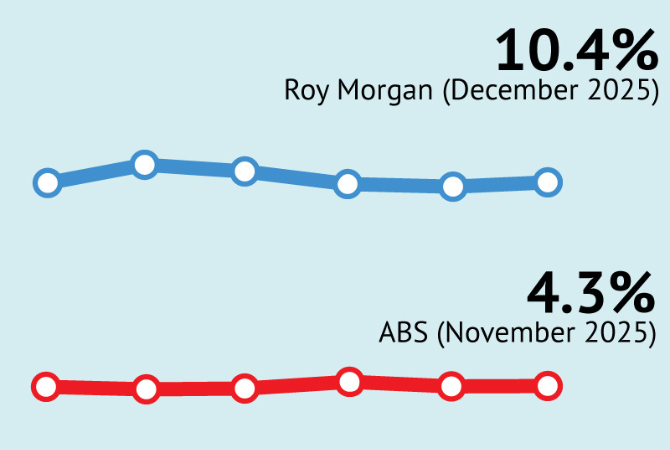

Roy Morgan Unemployment & Under-employment (2019-2025)

Source: Roy Morgan Single Source January 2019 – December 2025. Average monthly interviews 5,000.

Note: Roy Morgan unemployment estimates are actual data while the ABS estimates are seasonally adjusted.

Michele Levine, CEO Roy Morgan, says the latest Roy Morgan employment estimates for December show combined unemployment and under-employment continuing at a high level above 3 million for a 13th straight month:

“The latest Roy Morgan employment estimates for December show overall Australian unemployment and under-employment increasing 119,000 to 3,456,000 (21.5% of the workforce, up 0.6%). Concerningly, overall unemployment and under-employment have been above 3 million over a year.

“The increase in labour under-utilisation in December was driven by increases in both unemployment, up 41,000 to 1,669,000 (10.4% of the workforce, up 0.2%) and an even larger increase in under-employment, up 78,000 to 1,787,000 (11.1% of the workforce, up 0.4%).

“A look at the employment market over the last year shows a marginal increase to employment, up 152,000 to 14,428,000. However, only part-time employment is showing sustained increases, up by 326,000 to 5,279,000, while full-time employment dropped 174,000 to 9,149,000 from a year ago. Full-time employment has been consistently lower during 2025 than a year earlier.

“Both unemployment and under-employment have increased markedly from a year ago with unemployment up 127,000 to 1,669,000 (10.4% of the workforce, up 0.7%) and under-employment is up 111,000 to 1,787,000 (11.1% of the workforce, up 0.5%). This means overall unemployment and under-employment has increased significantly by 238,000 to 3,456,000 (21.5%, up 1.2%).

“The sluggish labour market – with no net full-time jobs created over the last year – shows the low level of productivity in the economy is stifling growth and leading to labour market stagnation.

“The latest ABS Inflation estimates for November 2025 showed official CPI at 3.4%, almost double the level in the 12 months to June 2025 (1.9%), but down slightly from the October 2025 high of 3.8%.

“The biggest driver of inflation in the Australian economy is public spending – from Federal and State Governments – which crowds out private investment and reduces economic productivity. The solution to low productivity in Australia is for the Federal and State Governments to cut public spending which will reduce inflationary pressures in the economy and allow the Reserve Bank to cut interest rates.

“In the United States, the Federal Reserve cut interest rates in September, October and December, and ‘across the ditch’ the Reserve Bank of New Zealand has cut interest rates nine times since August 2024 – including in both October 2025 (-0.5% to 2.5%), and November 2025 (-0.25% to 2.25%).

“In contrast, the Reserve Bank of Australia left interest rates on hold as inflation has accelerated.

“As the latest Roy Morgan employment and unemployment estimates show, the Australian economy needs the chance to grow and increase productivity that can be provided by a cut to Government spending, and lower interest rates throughout the economy. As long as the Albanese Government continues to increase public spending the economy will remain sluggish and over 3 million Australians will continue to be unemployed or under-employed.”

This Roy Morgan survey on Australia’s unemployment and ‘under-employed’* is based on weekly interviews of 993,449 Australians aged 14 and over between December 2008 and November 2025 and includes 7,079 telephone and online interviews in November 2025. *The ‘under-employed’ are those people who are in part-time work or freelancers who are looking for more work.

To learn more about Roy Morgan’s mortgage data, call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com. Please click on this link to the Roy Morgan Online Store.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |