ANZ-Roy Morgan Consumer Confidence jumps 4.7pts to 84.0 in the lead-in to the Australia Day long weekend

ANZ-Roy Morgan Consumer Confidence jumps 4.7pts to 84.0, but is still 2pts lower than a year ago, January 20-25, 2025 (86.0), and 2.3pts below the 2025 weekly average of 86.3.

An analysis by State shows large increases in New South Wales and Queensland, a small increase in Western Australia, but down in Victoria, and virtually unchanged in South Australia.

Driving the weekly increase was a rise in confidence about the performance of the Australian economy going forward as well as views on personal finances compared to this time a year ago.

A fifth of Australians, 20% (up 3ppts), say their families are ‘better off’ financially than this time last year compared to a 39% (down 6ppts) that say their families are ‘worse off’ (the lowest figure for this indicator for nearly four years since May 2022).

However, views on personal finances over the next year were unchanged this week with 25% (unchanged) of respondents expecting their family will be ‘better off’ financially this time next year, while just over a third, 34% (unchanged), expect to be ‘worse off’.

Net sentiment regarding the economy over the next year improved significantly this week with 9% (up 3ppts) of Australians, expecting ‘good times’ for the Australian economy over the next twelve months compared to under a third, 30% (down 4ppts), that expect ‘bad times’.

Net views regarding the Australian economy in the longer-term improved this week with 9% (up 1ppt) of Australians expecting ‘good times’ for the economy over the next five years compared to over a quarter, 26% (down 2ppts), expecting ‘bad times’.

Net buying intentions also improved this week with 23% (up 3ppts) of respondents saying now is a ‘good time to buy’ major household items compared to 37% (down 1ppt) that say now is a ‘bad time to buy major household items’.

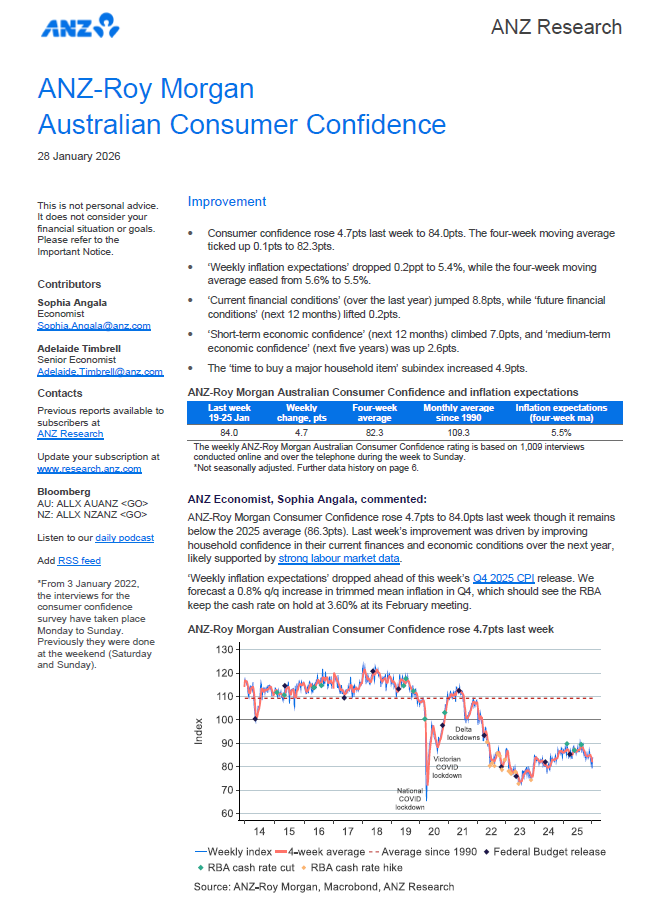

ANZ Economist, Sophia Angala, commented:

ANZ-Roy Morgan Consumer Confidence rose 4.7pts to 84.0pts last week though it remains below the 2025 average (86.3pts). Last week’s improvement was driven by improving household confidence in their current finances and economic conditions over the next year, likely supported by strong labour market data.

‘Weekly inflation expectations’ dropped ahead of this week’s Q4 2025 CPI release. We forecast a 0.8% q/q increase in trimmed mean inflation in Q4, which should see the RBA keep the cash rate on hold at 3.60% at its February meeting.

Check out the latest results for our weekly surveys on Business Confidence, Consumer Confidence, and Voting Intention as follows:

Roy Morgan Business Confidence Statistics

ANZ – Roy Morgan Consumer Confidence Statistics

Federal Voting – Government Confidence Rating

Related Research Reports

The latest Roy Morgan Consumer Confidence Monthly Report is available on the Roy Morgan Online Store. It provides demographic breakdowns for Age, Sex, State, Region (Capital Cities/ Country), Generations, Lifecycle, Socio-Economic Scale, Work Status, Occupation, Home Ownership, Voting Intention, Roy Morgan Value Segments and more

Consumer Confidence – Monthly Detailed Report in Australia.

Business Confidence – Monthly Detailed Report in Australia.

Consumer Banking Satisfaction - Monthly Report in Australia.

For comments or more information please contact:

Roy Morgan - Enquiries

Office: +61 (03) 9224 5309

askroymorgan@roymorgan.com

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |