In August Australian unemployment increased 0.8% to 11.1%, while under-employment was unchanged at 10.9%

In August 2025, Australian ‘real’ unemployment increased 132,000 to 1,776,000 (up 0.8% to 11.1% of the workforce) while under-employment was virtually unchanged at 1,742,000 (unchanged at 10.9%).

This is the first time over 1.7 million Australians have been unemployed and over 1.7 million Australians have been under-employed in the same month.

Roy Morgan estimates the overall workforce size (which adds together the employed and unemployed) at almost 16 million in August – 15,992,000 to be exact, up 62,000 on a month ago, and representing 69.2% of Australians aged 14+.

The workforce rise was driven by rising unemployment, up by 132,000. In contrast, overall employment fell 70,000 to 14,216,000 due to falling part-time employment, down 105,000 to 4,992,000. Full-time employment was up 35,000 to 9,224,000. Overall employment represents 61.5% of Australians aged 14+.

Detailed Roy Morgan Employment Estimates in August:

- Australian workforce increased by 62,000 in August to almost 16 million:

In August the Australian workforce increased 62,000 to 15,992,000 driven by an increase in unemployment, up 132,000 to 1,776,000 while employment fell by 70,000 to 14,216,000.

- Overall employment fell in August driven by a fall in part-time employment:

Australian employment dropped 70,000 to 14,216,000 driven by a drop in part-time employment, down 105,000 to 4,992,000. However, full-time employment increased 35,000 to 9,224,000.

- Unemployment increased 0.8% in August to 11.1%:

1,776,000 Australians were unemployed (11.1% of the workforce, up 0.8%), up 132,000 from July. The rise in unemployment was driven by more people looking for part-time work, up 152,000 to 1,101,000, although there were fewer people looking for full-time work, down 20,000 to 675,000.

- Under-employment unchanged in August; overall unemployment and under-employed at 22.0%:

In addition to the unemployed, a further 1.74 million Australians (10.9% of the workforce, unchanged) were under-employed, i.e. working part-time but looking for more work, up 5,000 from July. In total 3.52 million Australians (22.0% of the workforce) were either unemployed or under-employed in August.

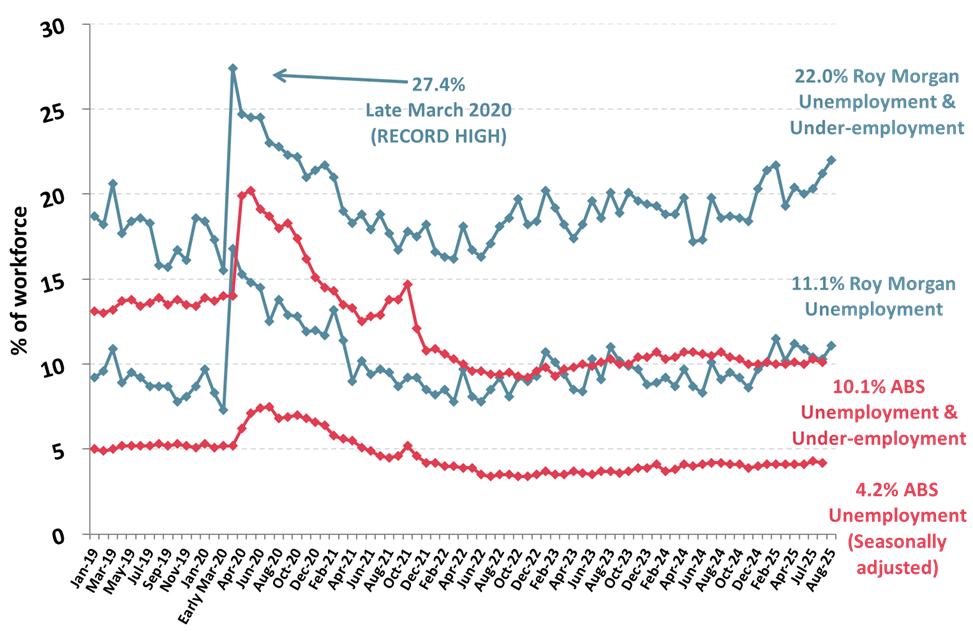

This is the first time since late March 2020 during the early days of the COVID-19 pandemic that overall unemployment and under-employment has exceeded 3.5 million and the highest rate of unemployment and under-employment since October 2020 (22.2% of the workforce).

- Comparisons with three years ago, during the early days of the Albanese Government (August 2022), show a rapidly increasing population and workforce driving employment growth:

The Australian population aged 14+ in August 2025 was estimated at 23,112,000 (up 1,753,000 from August 2022 – more than double the pre-pandemic average of 840,000 over an average three-year period since 1999). The workforce in August 2025 was 15,992,000 (up 1,142,000 from August 2022 compared to the pre-pandemic average growth of 689,000) – comprising 14,216,000 employed Australians (up 729,000) and 1,776,000 unemployed Australians (up 413,000) – so every indicator has increased rapidly.

The August Roy Morgan Unemployment estimates were obtained by surveying an Australia-wide cross section of people aged 14+. A person is classified as unemployed if they are looking for work, no matter when. The ‘real’ unemployment rate is presented as a percentage of the workforce (employed & unemployed).

Roy Morgan Unemployment & Under-employment (2019-2025)

Source: Roy Morgan Single Source January 2019 – August 2025. Average monthly interviews 5,000.

Note: Roy Morgan unemployment estimates are actual data while the ABS estimates are seasonally adjusted.

Michele Levine, CEO Roy Morgan, says the latest Roy Morgan employment estimates for August show a spike in unemployment and the highest level of overall unemployment and under-employment for over five years since the early days of the COVID-19 pandemic:

“The latest Roy Morgan employment estimates for August show overall Australian unemployment or under-employment increasing by 137,000 to 3,518,000 (22% of the workforce, up 0.8%) – the highest level since late March 2020 during the early days of the COVID-19 pandemic.

“Unemployment surged in August, up by 132,000 to 1,776,000 (11.1% of the workforce, up 0.8%) while under-employment was virtually unchanged at 1,742,000 (10.9%, unchanged). This is the first time ever that both indicators have been above 1.7 million in the same month.

“The increase in unemployment was driven by a large increase in part-time unemployment which surged by 152,000 to 1,101,000 and correlated to a sharp fall in part-time employment, which fell by 105,000 to 4,992,000 – dropping below 5 million for the first time since March.

“The movements in the Australian labour market in August show a continuing weakness with full-time employment down over 160,000 from the same month a year ago, although part-time employment has taken up some of the slack and is up over 90,000 compared to August 2024.

“Looking longer-term overall Australian unemployment and under-employment has been in excess of 3 million for nine straight months since late 2024. This is around double the latest ABS unemployment and under-employment estimate for June 2025 (10.1% of the workforce, 1,551,000).

“The continuing high level of unemployment and under-employment in the Australian labour force must be a key focus for the newly re-elected Albanese Government as it considers what policies to prioritise over the next few years.”

This Roy Morgan survey on Australia’s unemployment and ‘under-employed’* is based on weekly interviews of 974,479 Australians aged 14 and over between December 2008 and August 2025 and includes 7,077 telephone and online interviews in August 2025. *The ‘under-employed’ are those people who are in part-time work or freelancers who are looking for more work.

Contact Roy Morgan to learn more about Australia’s unemployed and under-employed; who and where they are, and the challenges they face as they search for employment opportunities.

Visit the Roy Morgan Online Store to purchase employment profiles, including for Australians who are employed, unemployed, under-employed, employed part-time, employed full-time, retired, studying and many more.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |