Super fund satisfaction rises to new record highs driven by record highs for Retail Funds and Industry Funds

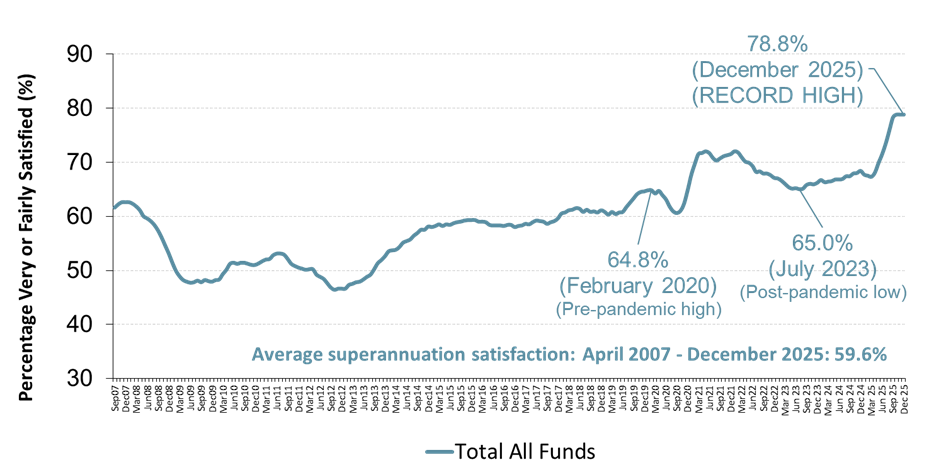

New data from Roy Morgan’s Superannuation Satisfaction Report shows an overall super fund satisfaction with financial performance rating of 78.8% in December 2025 – an increase of 10.4% points from a year ago and up 13.8% points from the post-pandemic low in July 2023 (65.0%).

Superannuation satisfaction has increased significantly since the post-pandemic low and has hit record highs in the last few months and is now 19.2% points above the long-term average of 59.6% since 2007.

Superannuation satisfaction ratings have consistently increased since July 2023, and this should be no surprise with the strong performance of the ASX200 over the last two-and-a-half years.

The ASX200 share index closed at a new record high of 9,094.7 in late October, an increase of 1,684.3 points (+22.7%) since closing at 7,410.4 on July 31, 2023. Since then, the ASX200 has moved in a band between 8,400 – 9,100, near this record high, and closed at 8,714.3 at the end of December 2025.

The period covered by these ratings is from July – December 2025 which followed interest rate cuts of +0.25% in February and May 2025, and an additional interest rate cut of +0.25% in August 2025 to 3.6%.

Customer Satisfaction with financial performance of superannuation funds: 2007-2025

Source: Roy Morgan Single Source Australia, April 2007 – December 2025, n=18,606 for every six-month period.

Base: Australians 14+ with work based or personal superannuation.

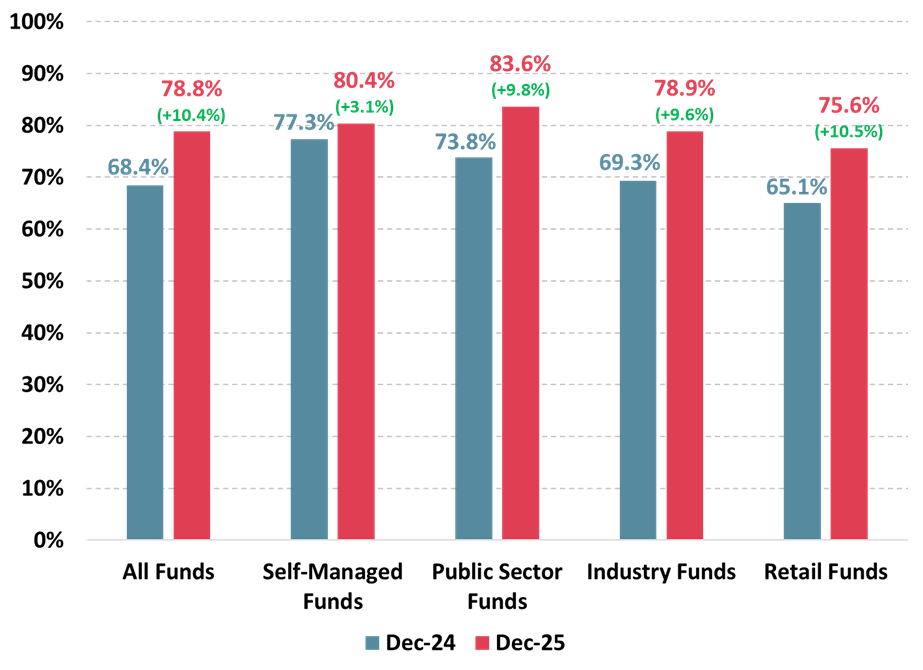

Customer satisfaction for Industry Funds and Retail Funds hits new record highs in late 2025

There has been significant improvement across all four different categories of super funds over the last year with the largest increase for Retail Funds, with customer satisfaction up a stunning 10.5% points to 75.6% - a new record high for this category. Customer satisfaction with Retail Funds has now been at record highs for the past eight months although it is still the lowest of the four categories.

There has also been a significant increase in customer satisfaction for Industry Funds from a year ago, up 9.6% points to 78.9% - a record high level of satisfaction in Industry Funds and 18.2% points higher than the average customer satisfaction for Industry Funds since 2007 of 60.7%.

In addition, customer satisfaction with Public Sector Funds is up 9.8% points from a year ago to 83.6%, and now clearly the highest of any of the four categories. Customer Satisfaction with Public Sector Funds increased above 80% for the first time in the last few months.

Although customer satisfaction with Self-Managed Funds is up 3.1% points from a year ago to 80.4%, this remains below the record high satisfaction for this category of 83.6% reached in December 2007 just before the onset of the Global Financial Crisis.

The report’s findings are from Roy Morgan Single Source, Australia’s most trusted consumer survey, compiled by in-depth interviews with over 60,000 Australians each year.

Satisfaction with financial performance of different type of super funds

Source: Roy Morgan Single Source Australia, July 2024 – Dec. 2024, n=23,016, July 2025 – Dec. 2025, n=18,606. Base: Australians 14+ with work based or personal superannuation.

Roy Morgan CEO Michele Levine says customer satisfaction with superannuation funds (78.8%) has reached record highs in recent months as the ASX200 stock index has hit several record highs and closed above the mark of 9,000 for the first time in the second half of 2025:

“Roy Morgan’s superannuation customer satisfaction ratings for the six months to December 2025 show overall satisfaction at a new record high of 78.8%, an increase of 10.4% points compared to a year ago, and up 13.8% points compared to the post-pandemic low of 65% reached in July 2023.

“The increase in customer satisfaction over the last two-and-a-half years has been powered by a record-setting ASX200. The stock index closed at a record high of 9,094.7 in late October, a large increase of 1,684.3 points (+22.7%) since closing at 7,410.4 on July 31, 2023.

“Overall customer satisfaction is now a large 19.2% points above the long-term average over the last 18 years of 59.6% and has been driven higher by significant increases in satisfaction for Retail Funds, Industry Funds and Public Sector Funds which are now all at, or near, record high levels.

“Customer satisfaction has increased for all four categories of superannuation. The largest increase is for Retail Funds, up 10.5% points to a new record high of 75.6%, closely followed by Industry Funds, up 9.6% points to a new record high of 78.9%.

“There has also been a significant improvement in customer satisfaction for Public Sector Funds, up 9.8% points to a near record high of 83.6%. Satisfaction with Self-Managed Funds is up 3.1% points to 80.4%, although still below the record high of 83.6% for that category.

“One factor likely to be driving the rapidly increasing satisfaction for Retail Funds over the last year compared to other categories is the higher investment exposure Retail Funds tend to have to equities. The strong share-market returns over the last year will have a bigger impact on the bottom line for Retail Funds than their industry peers.

“Several retail funds have performed exceptionally well over the last year including AMP (an impressive increase in customer satisfaction of 16% points since December 2024), MLC (+14.2% points), Colonial First State (+12.2% points), BT (+7.8% points) and OnePath (+6.3% points).

“Industry funds to stand out with large increases are led by Australian Retirement Trust (an impressive increase in customer satisfaction of 16.7% points since December 2024), HOSTPLUS (+15.2% points), HESTA (+14.5% points), CARE Super (+9.3% points), UniSuper (+8.5% points), AustralianSuper (+8.2% points) and REST Super (+6.7% points).

“Australian Retirement Trust is the superannuation fund with the highest customer satisfaction of any Industry Fund ahead of HOSTPLUS, UniSuper, HESTA and AustralianSuper. All five of these funds have customer satisfaction of over 80%.

“In late 2025 the Albanese Government finalised contentious proposed legislation changing the way superannuation is taxed – particularly impacting those on lower incomes as well as those with large superannuation balances of $3 million or more.

“For those on lower incomes, starting in July 2027, the ‘low-income super tax offset’ (LISTO) will increase from $500 to $810 with the eligibility threshold on annual incomes raised from $37,000 to $45,000. The increase in the LISTO is set to benefit over 3 million Australians on low incomes.

“The more contentious change has involved Australians with large superannuation balances of at least $3 million. The proposed legislation is set to double the annual superannuation tax from 15% to 30% for every dollar above $3 million, and to increase the superannuation tax from 15% to 40% for every dollar above $10 million in superannuation accounts.

“A key change to this proposed legislation means the threshold of these increased taxes will be indexed to inflation, and the proposed tax on unrealised capital gains has been dumped. These changes are set to impact fewer than 10,000 Australians with large superannuation balances.

“Roy Morgan has extensive data on Australia’s superannuation industry and the likely impacts of these legislative changes. In an increasingly complex and competitive industry, it is more important than ever before for superannuation funds to maintain a high level of customer satisfaction and market-leading investment returns.

‘These factors are even more critical as Australians face the prospect of rising interest rates during 2026 as the economy faces a renewed surge in inflation.”

For comments or more information about Roy Morgan’s superannuation data please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

Related research findings

For further in-depth analysis, view the Superannuation Satisfaction Report.

Roy Morgan Customer Satisfaction Awards

The Roy Morgan Customer Satisfaction Awards highlight the winners, but this is only the tip of the iceberg. Roy Morgan tracks customer satisfaction, engagement, loyalty, advocacy and NPS across a wide range of industries and brands. This data can be analysed by month for your brand, and importantly your competitive set.

Need to know what is driving your customer satisfaction?

Check out the new Roy Morgan Customer Satisfaction Dashboard at https://www.customersatisfactionawards.com.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |