Majority of mortgage holders who live alone or as single parents experience mortgage stress

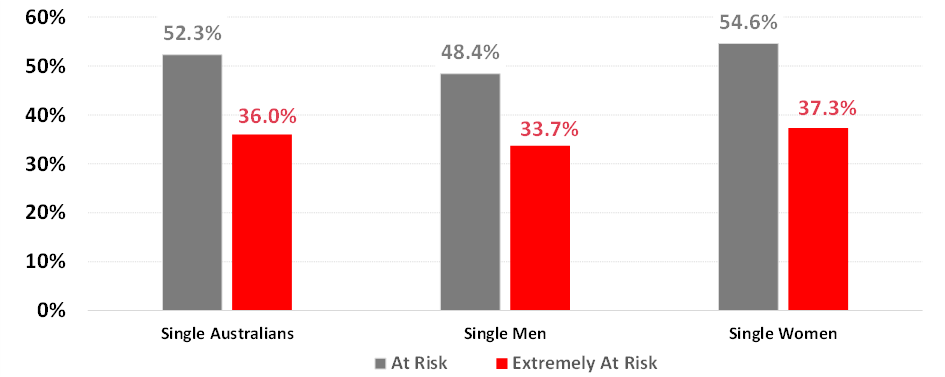

Roy Morgan’s Single Source research reveals that 52.3% of owner-occupier mortgage holders who are ‘single’ [1] are ‘At Risk’ [2] of mortgage stress and 36.0% are ‘Extremely at Risk’ [3]. Many more women than men are impacted.

An estimated 205,000 ‘single female’ mortgage holders were ‘At Risk’ of mortgage stress in the 12 months to June 2025 compared to 108,000 ‘single male’ mortgage holders. There were also more ‘single women’ ‘Extremely at Risk’ of mortgage stress, 137,000 compared to 74,000 ‘single male’ mortgage holders.

The substantially higher number of ‘single female’ mortgage holders at risk of mortgage stress is not only due to ‘single women’ being more likely to be at risk of mortgage stress, but also due to there being more ‘single women’ than ‘single men’ among mortgage holders. Nearly twice as many mortgage holders are ‘single women’ (6.8%) as ‘single men’ (4.1%).

Lower workforce participation as full-time workers contributes to higher ‘Extreme Risk’ of mortgage stress for ‘single women’. Only 59% of mortgage holding ‘single women’ work full-time compared to 71% of ‘single men’.

Chart 1: Mortgage Stress among ‘Single’ Owner Occupier Mortgage Holders by Gender

Source: Roy Morgan Single Source (Australia), July 2024 – June 2025, n=3,479

Base: Australians 14+ who are single (living alone or single parents) with an owner-occupied home loan.

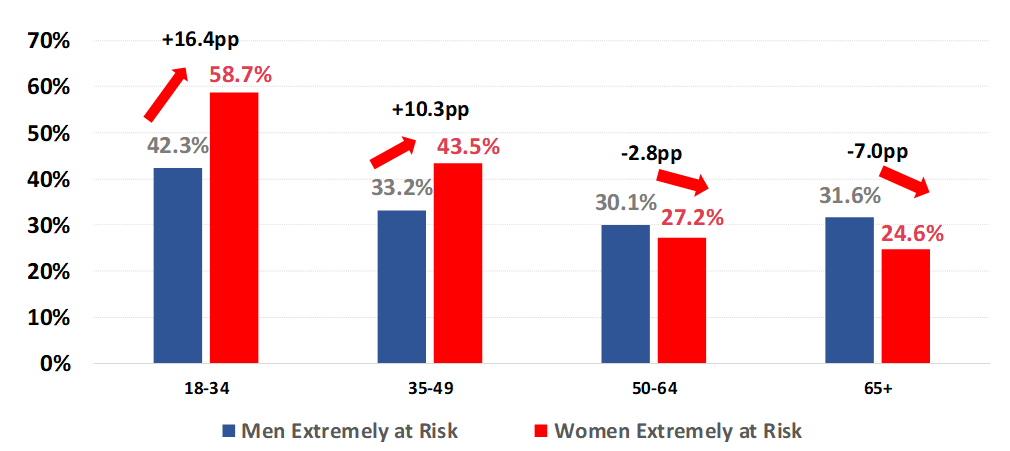

The gender difference is greatest among younger ‘singles’

While ‘single women’ are more likely to be at ‘Extreme Risk’ of mortgage stress than ‘single men’, the gap is greatest among those aged under 34, where the income gap between men and women is greater.

For example, the median personal income of women holding a mortgage (calculated across both workers and non-workers) is only 82% that of men among those aged 18-34 and 78% that of men among those aged 35-49, but 88% of mens’ among those aged 50 and over.

Chart 2: ‘Extreme’ Mortgage Stress among ‘Single’ Owner Occupier Mortgage Holders by Gender and Age

Source: Roy Morgan Single Source (Australia), July 2024 – June 2025, n=3,479

Base: Australians 14+ who are single (living alone or single parents) with an owner-occupied home loan.

Roy Morgan CEO, Michele Levine, commented on the concerning gender gap in mortgage stress between ‘single women’ and ‘single men’:

“The majority of mortgage holders who live alone or are ‘single parents’ experience mortgage stress.

“There are twice as many women living alone, or as ‘single parents’, with a mortgage than men, and these women are more likely to be either ‘At Risk’, or ‘Extremely At Risk’, of mortgage stress – across all age groups including 18-34, 35-49 and 50+.”

These latest findings come from the Roy Morgan Single Source survey, derived from in-depth interviews with over 60,000 Australians each year.

Related research findings

For further in-depth analysis, view the various Banking and Finance Currency Reports.

For comments or more information about Roy Morgan Small Business Research data please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

[1] ‘Singles’ are defined as those either ‘living alone’ or ‘single parents’.

[2] ‘At Risk’ is based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

[3] ‘Extremely at Risk’ is based on those paying more than a certain proportion of their after-tax household income into their home loan, based on the Standard Variable Rate set by the RBA and the amount now outstanding on their home loan.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |