Risk of mortgage stress drops to lowest since February 2023 after RBA cuts interest rates to 3.6% in August

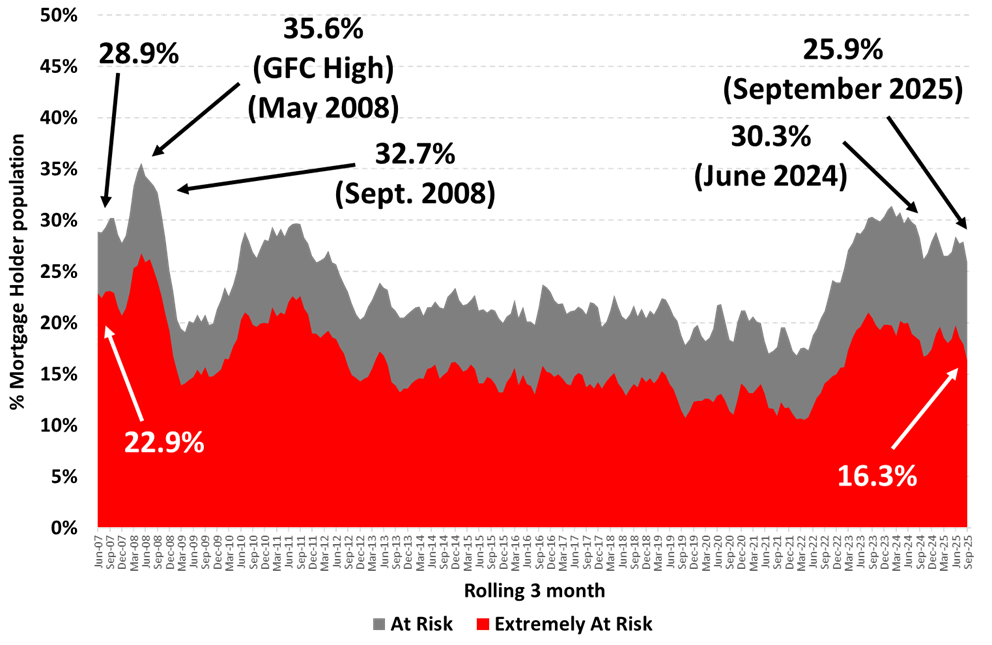

New research from Roy Morgan shows 25.9% of mortgage holders ‘At Risk’ of ‘mortgage stress’ in the three months to September 2025, down 2% points from August 2025.

This is the lowest share of mortgage holders ‘At Risk’ of ‘mortgage stress’ since February 2023 when the share first rose above one-in-four mortgage holders where it has stayed ever since.

The record high of 35.6% of mortgage holders in mortgage stress was reached in mid-2008.

554,000 more ‘At Risk’ of mortgage stress three years after interest rate increases began

The number of Australians ‘At Risk’ of mortgage stress has increased by 554,000 since May 2022 when the RBA began a cycle of interest rate increases which lifted official interest rates by a total of 4.25% from 0.1% to a high of 4.35% from November 2023 until February 2025.

The number of Australians considered ‘Extremely At Risk’, is now numbered at 858,000 (16.3% of mortgage holders) which is in line with the long-term average over the last two decades – also 16.3%.

Mortgage Stress – % of Owner-Occupied Mortgage-Holders

Source: Roy Morgan Single Source (Australia), average interviews per 3 month period April 2007 – Sep 2025, n=2,876. Base: Australians 14+ with owner occupied home loan.

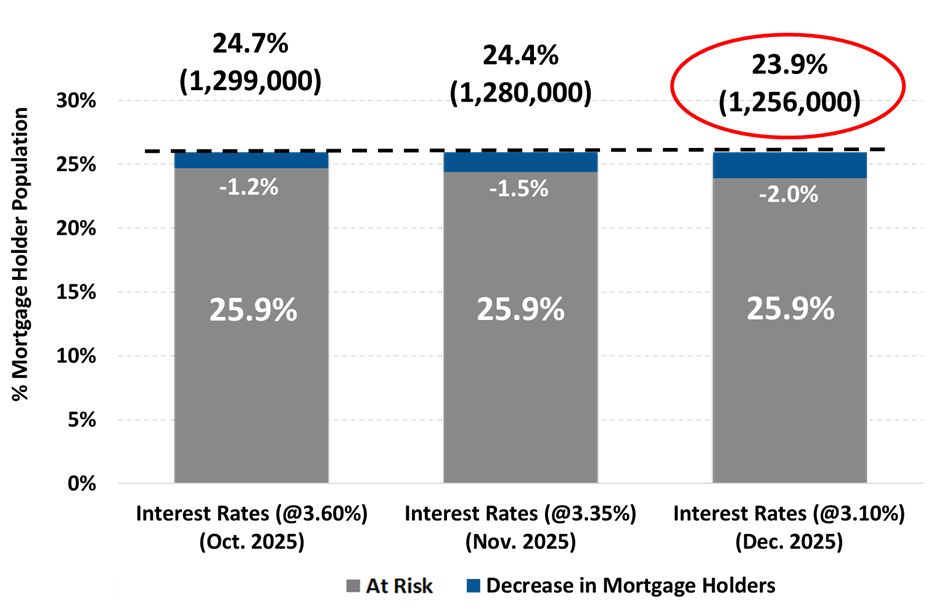

Mortgages ‘At Risk’ set to drop if the Reserve Bank cuts interest rates to 3.35% or even 3.1%

Due to the decline in inflation over the last year the Reserve Bank has cut interest rates in February, May and August by a total of 0.75% to 3.6%. Roy Morgan has modelled the impact of two additional RBA interest rate decreases in early November by +0.25% to 3.35% and in mid-December by another +0.25% to 3.1%.

In September, 25.9% of mortgage holders, 1,361,000, were considered ‘At Risk’. Looking forward, as the Reserve Bank’s latest interest rate cut flows through the economy, the share of mortgage holders ‘At Risk’ is forecast to decline in October by 1.2% points to 24.7% of mortgage holders (1,299,000, down 62,000).

If the Reserve Bank were to cut interest rates this week by 0.25% to 3.35% on the first Tuesday in November the share of mortgage holders ‘At Risk’ would drop to 24.4% in November 2025 – down 1.5% points from now and the lowest share for over two-and-a-half years since January 2023.

Looking further forward, if the Reserve Bank decides to cut interest rates by an additional 0.25% to 3.1% in mid-December, the share of mortgage holders ‘At Risk’ would drop to 23.9% (down 2% points from now) of mortgage holders (1,256,000, down 105,000 from now) by December.

Mortgage Risk projections based on interest rate cuts in November and December to 3.1%

Source: Roy Morgan Single Source (Australia), July – September 2025, n=3,389.

Base: Australians 14+ with owner occupied home loan.

How are mortgage holders considered ‘At Risk’ or ‘Extremely At Risk’ determined?

Roy Morgan considers the risk of ‘mortgage stress’ among mortgage holders in two ways:

Mortgage holders are considered ‘At Risk’[1] if their mortgage repayments are greater than a certain percentage of household income – depending on income and spending.

Mortgage holders are considered ‘Extremely at Risk’[2] if even the ‘interest only’ is over a certain proportion of household income.

Unemployment is the key factor which has the largest impact on income and mortgage stress

It is worth understanding that Roy Morgan uses a conservative forecasting model, essentially assuming all other factors apart from interest rates remain the same.

The latest Roy Morgan unemployment estimates show over one-in-five Australian workers are either unemployed or under-employed – 3,238,000 (20.1% of the workforce); (In September Australian unemployment was at 10.8% and under-employment was at 9.3%).

Although the Reserve Bank’s decision to cut interest rates in February, May and August have had a positive impact and helped marginally lower mortgage stress, the fact remains the greatest impact on an individual, or household’s, ability to pay the mortgage is not interest rates, it’s if they lose their job or main source of income.

Michele Levine, CEO Roy Morgan, says the Reserve Bank’s (RBA) interest rate cut in mid-August by 0.25% to 3.6% has led to a decrease in mortgage stress in September to the lowest in over two-and-a-half years since March 2023:

“The latest Roy Morgan data shows a significant reduction in mortgage stress following the Reserve Bank’s interest rate cut in mid-August. In September 2025 there were 1,361,000 Australians ‘At Risk’ of mortgage stress – equivalent to 25.9% of mortgage holders – down 2% points since August 2025.

“The RBA cut interest rates in February 2025, May 2025, and most recently in mid-August 2025, by a total of 0.75% to 3.6%. If the RBA cuts interest rates in early November, by a further 0.25% to 3.35%, the share of mortgage holders ‘At Risk’ will drop to 24.4% – the first time this share has dropped below one-in-four mortgage holders since January 2023.

“However, as we have previously highlighted, although the short-term impact of reducing interest rates is an immediate reduction in mortgage stress, there are counter-vailing factors that mean it can lead to further stress down the road.

“As general interest rates are lowered, new buyers entering the market are able to borrow more money for larger loans to buy the best house they can afford at that time, and this, in turn, leads to a subsequent increase in mortgage stress due to the larger size of the average loan.

“Finally, it is important to appreciate that interest rates are only one of the variables that determines whether a mortgage holder is considered ‘At Risk’ – the largest impact on whether a borrower falls into the ‘At Risk’ category is related to household income – which is directly related to employment.

“The employment market has been strong over the last three years (the latest Roy Morgan estimates show over 1 million new jobs created since May 2022) and this has provided support to household incomes which have helped to moderate levels of mortgage stress over the last year.”

[1] "At Risk" is based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

[2] "Extremely at Risk" is also based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the Standard Variable Rate set by the RBA and the amount now outstanding on their home loan.

These are the latest findings from Roy Morgan’s Single Source Survey, based on in-depth interviews conducted with over 60,000 Australians each year including over 10,000 owner-occupied mortgage-holders.

To learn more about Roy Morgan’s mortgage data, call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com. Please click on this link to the Roy Morgan Online Store.

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |