Bunnings is Australia’s most trusted brand, banking industry moves into ‘Net Trust’ and Temu is most distrusted online retailer

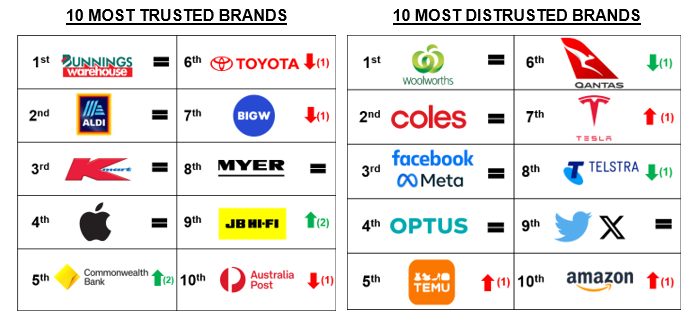

Bunnings is the most trusted brand in the 12 months to September 2025 – an eighth consecutive quarterly victory for the ubiquitous hardware retailer stretching back to late 2023.

For the fourth straight quarter the top four places are unchanged with discount supermarket Aldi in second, discount department store Kmart.in third, and technology and consumer products giant Apple in fourth.

Banks improve their trust rankings – now with five of the top 20 most trusted brands

At the top of the latest trust rankings the big movers are banks – four of the five brands in the top 20 that moved up in the latest quarterly results are banks – and the banking industry as a whole moved into Net Trust territory as eighth most trusted industry – up a stunning 10 places from the 12 months to June 2025.

The individual brand trust rankings show banking giant the Commonwealth Bank has improved again, up two spots and into the top five for the first time in fifth place. Also moving up were Westpac, up five places to 14th overall, NAB, up one spot to 19th, and ING, returning to the top 20 in 20th place. Bendigo Bank retains its high ranking, little changed in 15th place overall.

There were small downward movements throughout the rest of the top 20 most trusted brands with Toyota slipping one spot to be out of the top five in sixth place, Big W, down one spot to seventh, Australia Post, dropping one place to tenth, NRMA, down one position to drop out of the top 10 in 11th, IGA, down one place to 16th, Nike, down one position to 17th, and RACQ, down one spot to 18th.

Although not in the top 20 most trusted brands, the biggest movers to improve their Net Trust rankings were insurer GIO, up 27 spots to enter the top 100 in 98th, Priceline Pharmacy, up 23 places to 75th, and conglomerate Wesfarmers which improved by 21 positions to enter the top 50 in 47th.

View the latest Roy Morgan Trust & Distrust September 2025 Quarterly Update Webinar.

Figure 1: Australia’s 10 most trusted and 10 most distrusted brands in Sep. 2025. Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to Sep. 2025. Base: Australians 14+, n=19,779. Arrows with numbers show ranking change since June 2025.

Distrusted Brands – Temu, Tesla, Amazon, Shein and McDonalds deteriorate in the rankings

The supermarket giants Woolworths and Coles are again Australia’s two most distrusted brands for a fourth straight quarter, however there are a range of brands – led by several online retailers – that are facing a rapidly increasing level of distrust.

As highlighted in the special quarterly trust webinar – online retailer Temu was the most distrusted brand in the country for the month of September, however, even in the full trust rankings covering the 12 months to September 2025, Temu has deteriorated one place to the 5th most distrusted brand overall.

Two other online retailers worsened during the quarter, with Amazon, down one place to tenth most distrusted brand, and Shein, deteriorating by one spot to 11th most distrusted brand overall.

Also sliding during the quarter are Tesla, deteriorating one place to seventh most distrusted, ubiquitous fast food outlet McDonald’s, worsening by two places to 16th most distrusted, discount airline Jetstar, which lost three ranking places to be the country’s 18th most distrusted, and oil major Shell, which deteriorated one place to be the 19th most distrusted brand.

There were several distrusted companies to improve their rankings including airline Qantas which improved one spot to 6th, Telstra, improving one place to 8th, and the biggest increase was for News Corp, improving two places to 12th, Rio Tinto, improving one spot to 17th and oil major BP, improving one spot to 20th.

Temu now clearly the most distrusted online retailer with Shein continuing to slide

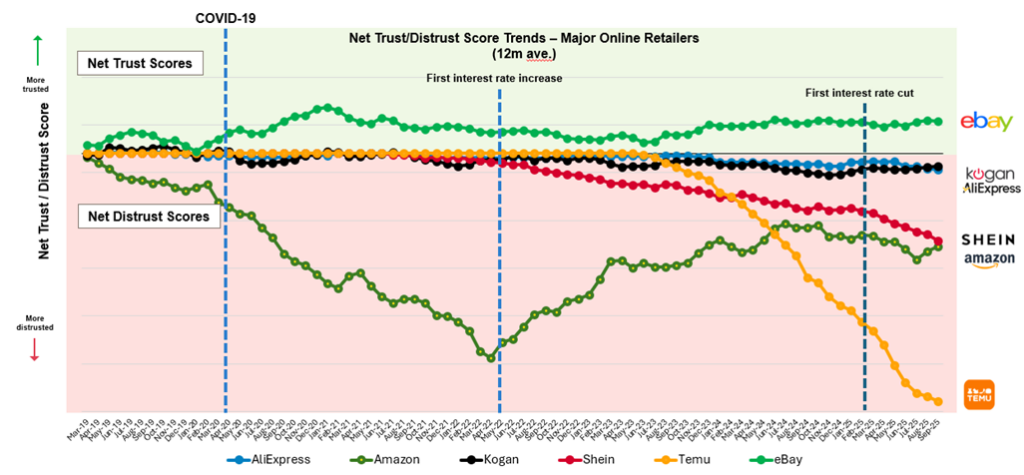

The recent reputational deterioration of online marketplaces is concentrated around Temu and Shein, both of which are trending down. Amazon is also deeply distrusted – although has improved significantly from early 2022. AliExpress and Kogan are more distrusted than trusted, and only eBay enjoys net trust.

Net Trust/Distrust Score Trends – Major Online Retailers (12 month average)

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12 month average to September 2025.

Base: Australians 14+, Latest 12 month average n=19,779.

What is driving growing distrust in online marketplaces like Temu and Shein?

Interestingly, it appears that when it comes to the Chinese marketplace platforms, Temu and Shein, “the more people buy from them, the faster their distrust grows.” But what’s behind all this distrust in the online marketplace channel?

Unethical attitudes and behaviour are a top reason for distrusting online marketplaces with Temu and Amazon performing poorly on this measure, followed by Shein. In contrast, AliExpress and Kogan remain comparatively low on unethical metrics, but they’re both on the rise. Unethical conduct has become the defining fault line for online marketplaces: brands without clear, credible ethical safeguards are now on a predictable trajectory towards higher distrust.

For Amazon, profit-driven distrust surged during COVID and has never recovered. Australians have normalised the idea that the dominant global marketplaces (Amazon, Temu and Shein) are more interested in shareholder profit than customers. In contrast, AliExpress and Kogan remain low and fairly flat on this measure.

Unsurprisingly, as consumers increasingly perceive the online marketplace brands as offering the lowest prices, perceptions of unaffordability have dropped. This is particularly so for Amazon. In contrast, Temu and Shein are lifting from a low base, but their levels are still modest. Price pain persists amid the cost-of-living crisis, but it’s no longer the dominant story. For most brands, distrust is shifting away from “too expensive” towards concerns about ethical behaviour and profit triumphalism.

The rise and rise of Temu is turbocharging its own distrust

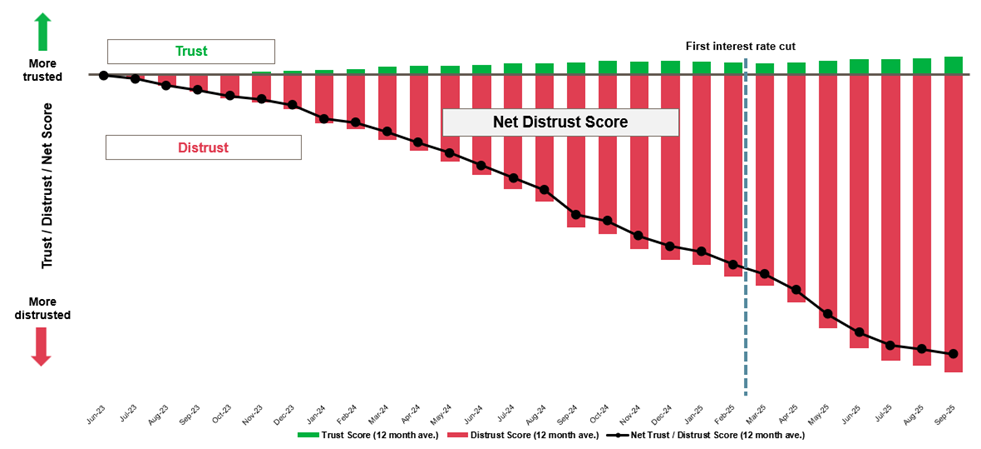

Temu’s Net Distrust has worsened every month since we started tracking it in 2023 and in the single month of September, Temu became the most distrusted brand of all in Australia. As more Australians trial the platform, distrust is accelerating rather than stabilising, a sign real-world experience is feeding the decline.

The biggest drivers of Temu’s distrust are poor quality, a lack of ethics, dishonesty, a lack of data privacy, and overall unreliability. Poor quality and low standards are accelerating fastest, but every negative driver is reinforcing the overall surge in distrust.

Temu Net Distrust Score Trend – 12-month average

Source: Roy Morgan Single Source (Australia). Risk Monitor, 12-month average to September 2025.

Base: Australians 14+, Latest 12-month average n=19,779. Latest 12-month average for Temu n = 570

According to Roy Morgan CEO Michele Levine, although Bunnings remains untouched as Australia’s most trusted brand in the 12 months to September, there has been plenty of movement underneath with bank trust increasing, while distrust in online retailers like Temu and Shein is on the rise:

“Bunnings has topped the rankings as Australia’s most trusted brand for an eighth consecutive quarter, and there’s some familiar faces at the top with Aldi, Kmart and Apple filling places second to fourth – as they have for a fourth straight quarter.

“However, there have been big moves from other major brands – especially the big banks. Commonwealth Bank has increased two spots to fifth overall – its highest ever ranking, Westpac is up five spots to 14th, NAB has improved one place to 19th, and ING is back in the top 20 – up two spots.

“The improving trust in Australia’s banks is reflected in the broader overall industry rankings with the Banking industry rising an impressive 10 places in the last quarter to be eighth overall – up from 18th only three months ago. This is by far the biggest increase of any industry, with the second-best performance by the closely related Insurance Industry, up three rankings to 13th overall.

“Perhaps even more consequential is what’s happening at the other end of the rankings among Australia’s most distrusted brands. Although the big supermarkets Woolworths and Coles are again Australia’s two most distrusted brands – it is online retailers such as Temu, Amazon and Shein that are falling down the rankings – and especially Chinese-based online retailer Temu.

“Since Roy Morgan began measuring Temu in mid-2023, the brand has been on a steady downward trajectory that shows no signs of ending anytime soon – and is now Australia’s fifth most distrusted brand overall in the 12 months to September 2025. In fact, in the single month of September – Temu was the most distrusted brand of all.

“As more Australians trial the platform, distrust is accelerating rather than stabilising, a sign real-world experience is feeding the decline. The biggest drivers of Temu’s distrust are poor quality, a lack of ethics, dishonesty, a lack of data privacy, and overall unreliability. Poor quality and low standards are accelerating fastest, but every negative driver is reinforcing the overall surge in distrust.”

Subscribe to Roy Morgan’s YouTube channel to ensure you don’t miss our next webinar on trust and distrust: https://www.youtube.com/c/roymorganaus.

Comprehensive Trust and Distrust Insights Reports are available in Roy Morgan’s online store, including the Retail (excluding Online) Trust and Distrust Insights Report here, the Online Retail Trust and Distrust Insights Report here, the Department & Discount Department Store Trust and Distrust Insights Report here, and the Supermarkets Trust and Distrust Insights Report here. The Roy Morgan Most Trusted Brand Awards Report 2025 with rankings of over 230 brands and analysis by industry is now available for purchase here. The latest Trust and Distrust Webinar Report with insights into trust and distrust across various industries is available here.

The Roy Morgan Risk Monitor surveys approximately 1,500-2,000 Australians every month (over 20,000 per year) to measure levels of trust and distrust of around 1,000 brands across 27 industries. Respondents are asked which brands they trust, and why, and which brands they distrust, and why. The survey is designed to be open-ended, context-free, and unprompted. Roy Morgan Risk Monitor data is available in a variety of formats, from snapshot overviews to detailed tracking of individual brands and competitors. Industry Trust and Brand Health Surveys are also conducted (e.g. Private Health Insurance, Agribusiness, Banking, Travel and Tourism, Telco, Utilities, Insurance, etc.) for deep insights into brand health, perceptions of, and customer experience (CX) with brands.

To learn more call (+61) (3) 9224 5309 or email askroymorgan@roymorgan.com.

About Roy Morgan

Roy Morgan is the source of the most comprehensive data on Australians’ behaviour and attitudes, surveying over 1,000 people weekly in a continuous cycle that has been running for two decades. The company has more than 80 years’ experience collecting objective, independent information.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |