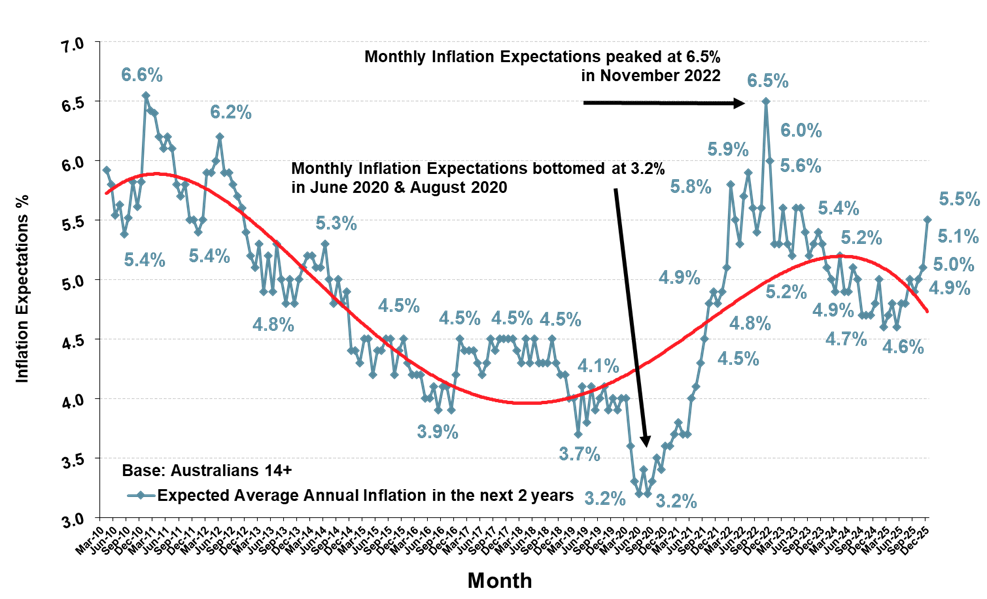

ANZ-Roy Morgan Inflation Expectations were at 5.6% in mid-January – up 0.1% points from the month of December

The weekly ANZ-Roy Morgan Inflation Expectations have remained high so far in 2026 and were at 5.6% for the week of January 12-18, 2026, up 0.1% points from the full month of December.

A look at monthly Inflation Expectations for December 2025 shows the measure at 5.5% for the month – up 0.4% points from the prior month of November, the highest monthly figure since July 2023.

Looking back over the last six months, since mid-July 2025, weekly Inflation Expectations have moved in a band of 4.7% - 5.6% and averaged 5.1%. In addition, the latest information on weekly Inflation Expectations is available to view each week in the Roy Morgan Weekly Update video on YouTube.

Monthly Inflation Expectations Index long-term trend – Expected Annual Inflation in next 2 years

Source: Roy Morgan Single Source: Interviewing an average of 4,900 Australians aged 14+ per month (April 2010 – Dec. 2025).

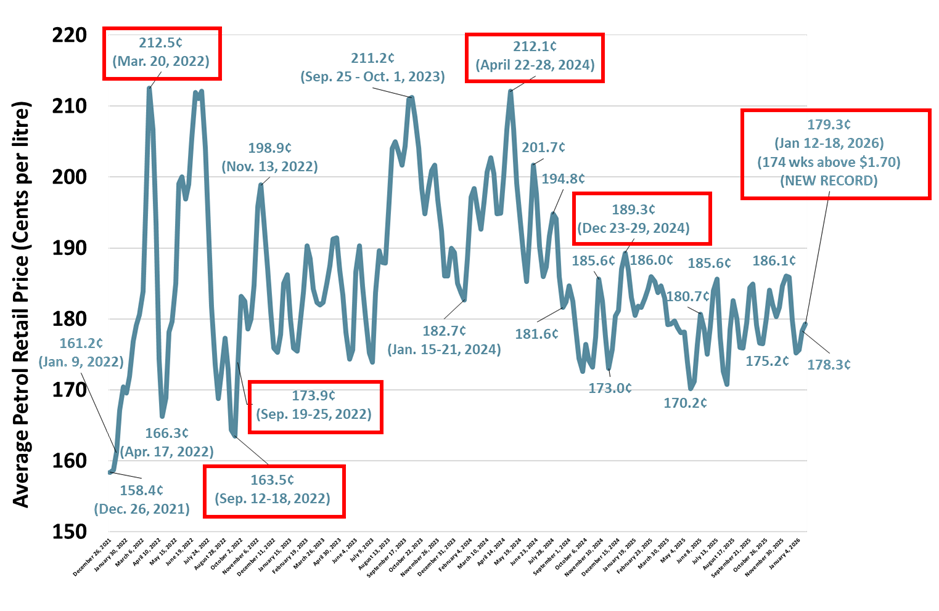

Average retail petrol prices were at $1.82 per litre in December, but have since dropped under $1.80

During December, average retail petrol prices were above $1.80 in November ($1.83) and December ($1.82) – the first consecutive months above this mark since March 2025. Average retail petrol prices started the month of December at $1.86 per litre – an 11-month high but have since dropped below $1.80 per litre in late December and for the first three weeks of January.

Looking longer-term, average retail petrol prices have now been at, or above, $1.70 per litre for a record 174 straight weeks, equivalent to over three years uninterrupted, since mid-September 2022.

During 2025 average retail petrol prices hit near three-year lows in May but then rebounded to $1.86 per litre in July. Since then, average retail petrol prices have moved largely in a 15-cent band between $1.71 and $1.86 and this volatility is reflected in the weekly Inflation Expectations of Australians which have moved in a band of 0.9% between 4.7-5.6% during the six months from July – January. On a weekly level, Inflation Expectations have increased 12 times, decreased six times, and been unchanged five times.

The reduction in petrol prices early in 2025 clearly lessened inflation pressures and was no doubt a factor for the Reserve Bank behind its decision to cut interest rates in February, May and August 2025. However, there has been renewed strength in petrol prices in the second half of 2025, and in turn inflationary pressures have re-accelerated across the economy during this period.

Australian average retail petrol prices (cents per litre) weekly: 2021 – 2026

Source: Australian Institute of Petroleum (AIP) weekly reports: https://www.aip.com.au/pricing/weekly-prices-reports.

The latest official ABS quarterly annual CPI estimate at 3.4% for the year to November 2025 is now above the Reserve Bank’s preferred target range of 2-3% over the course of the economic cycle. Office estimates of inflation have increased significantly by 1.5% in only five months since June 2025 (1.9%).

The increase in official estimates of inflation led to the Reserve Bank’s decision to leave interest rates unchanged for its last three meetings in October, November and December 2025. This is the first time since 2024 the Reserve Bank has left interest rates unchanged at three consecutive meetings.

The next ABS Monthly CPI estimate for December 2025 is due to be released next week on Wednesday.

Inflation Expectations were highest in Queensland and South Australia at 6% and above

A look at Monthly Inflation Expectations on a State-based level for December shows increases in all five mainland States, but a decline in the island State of Tasmania, down 0.9% to 5.1% - and now clearly the lowest Inflation Expectations of any State.

Inflation Expectations were driven higher by large increases in Queensland, up 0.6% to 6.2% - and now the highest of any State, up 1.4% to 6.0% in South Australia, and up 1.0% to 5.7% in Western Australia.

There were also increases in Victoria, up 0.2% to 5.3%, and in New South Wales, up 0.1% to 5.3%.

Inflation Expectations in Country Areas increased 0.3% points to 5.7% in December, and in Capital Cities increased significantly by 0.5% points to 5.5%.

Roy Morgan CEO Michele Levine says weekly Inflation Expectations increased to 5.6% in mid-January, up 0.1% from monthly figure of 5.5% for December:

“ANZ-Roy Morgan Inflation Expectations in Australia largely held steady in recent weeks and were at 5.6% in mid-January, up 0.1% points from the full month of December (5.5%). Inflation Expectations for the month of December had jumped 0.4% points to their highest since July 2023.

“These results show that Inflation Expectations may have peaked in December after a sharp run-up in the second half of 2025 and three consecutive monthly increases to end the year.

“The increase in Inflation Expectations in November, and December, is no surprise with inflationary pressures driven by energy prices a key factor. The average retail petrol price hit an 11-month high of $1.86 per litre in early December, although has dropped by almost 10 cents per litre since.

“The rise in Inflation Expectations, and average retail petrol prices, has been matched by a rapid increase of the official ABS Inflation from a low of 1.9% in June 2025, up to 2.8% in July 2025, and now 3.4% in November 2025.

“The sharp rise in inflationary pressures in the broader economy during the last few months of 2025 – increasing by 1.5% points since June – led to the Reserve Bank’s decision to leave interest rates unchanged at 3.6% at its last three-meetings in 2025.

“Looking forward, the moderating of Inflation Expectations in recent weeks suggests inflation pressures in the economy may be about to reduce, which will lessen pressure on the Reserve Bank (RBA) to consider interest rate increases in the next few months.

“The RBA’s first meeting on interest rates for the year is set for the first week of February.”

See below for a comprehensive list of RBA interest rate changes during the time-period charted above.

The data for the Inflation Expectations series is drawn from the Roy Morgan Single Source which has interviewed an average of around 5,300 Australians aged 14+ per month over the last decade from November 2015 – October 2025 and includes interviews with 5,099 Australians aged 14+ in October 2025.

For comments and information about Roy Morgan’s Inflation Expectations data, please contact:

Roy Morgan Enquiries

Office: +61 (3) 9224 5309

askroymorgan@roymorgan.com

About Roy Morgan

Roy Morgan is Australia’s largest independent Australian research company, with offices in each state, as well as in the U.S. and U.K. A full-service research organisation, Roy Morgan has over 80 years’ experience collecting objective, independent information on consumers.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |