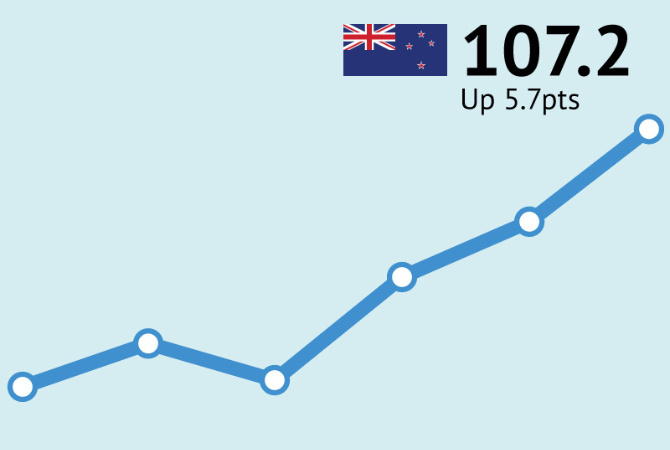

ANZ-Roy Morgan New Zealand Consumer Confidence – Feeling positive – up 5.7pts to 107.2 in January

- ANZ-Roy Morgan New Zealand Consumer Confidence lifted from 101.5 to 107.2 in January, the highest level since August 2021.

- The proportion of households thinking it’s a good time to buy a major household item (the best retail indicator) rose 2 points to +1 – the first time it's been net positive in nearly four years.

- Inflation expectations were steady at 4.6%

Turning to the detail (see charts on page 4 of the linked PDF):

- The future conditions index made up of forward-looking questions lifted from 108.9 to 113.5, the highest level since May 2021. The current conditions index rose very sharply from 90.4 to 97.7, the highest since December 2021.

- Net perceptions of current personal financial situations (better or worse off than last year) rose 12 points from -18% to -6% with 31% of New Zealanders (up 5% points) saying they are 'better off' financially than this time a year ago compared to 36% (down a large 8% points) saying they are 'worse off' financially. The results on this question confirm that the rise in confidence is based on the experience here and now rather than hopes.

- On the hope front, a net 29% of respondents expect to be better off this time next year, up 7 points to the highest level since April 2021. This is driven by almost half, 47% (up 4% points) of respondents who expect to be 'better off' financially this time next year compared to only 18% (down 3% points) who expect to be 'worse off'.

- In further good news, a net 1% think it’s a good time to buy a major household item, back in the black finally! This positive result is driven by 41% (up 2% points) of New Zealanders saying it's a 'good time to buy' major household items compared to 40% (unchanged) that say it's a 'bad time to buy' major household items. This is the first positive result for this index for four-and-a-half years since August 2021.

- Perceptions regarding the economic outlook over the next 12 months lifted 5 points to -1%. The 5-year-ahead measure rose 1 point to +12%.

- House price inflation expectations eased from 4.0% to 3.7%, giving up last month’s gains. Wellington continues to drag the chain (2.5%).

- Two-year-ahead CPI inflation expectations were unchanged at 4.6%. In the recent Q4 CPI data food price inflation was 4.3% y/y and household energy 12.2% y/y, so it's entirely understandable that expectations are higher than the current official CPI rate of inflation (3.1%).

Figure 2 in the linked PDF shows the net percentage of consumers saying it’s a good time to buy a major item split by whether the respondent has a mortgage or not (the latter group being a mix of those who have paid a mortgage off, and renters). Mortgage holders remain more cautious, and their enthusiasm increased by less in January. This will be a key series to watch to help gauge whether the turnaround in the direction of interest rates is biting.

Margin of Error

The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate.

| Sample Size | Percentage Estimate |

| 40% – 60% | 25% or 75% | 10% or 90% | 5% or 95% | |

| 1,000 | ±3.0 | ±2.7 | ±1.9 | ±1.3 |

| 5,000 | ±1.4 | ±1.2 | ±0.8 | ±0.6 |

| 7,500 | ±1.1 | ±1.0 | ±0.7 | ±0.5 |

| 10,000 | ±1.0 | ±0.9 | ±0.6 | ±0.4 |

| 20,000 | ±0.7 | ±0.6 | ±0.4 | ±0.3 |

| 50,000 | ±0.4 | ±0.4 | ±0.3 | ±0.2 |